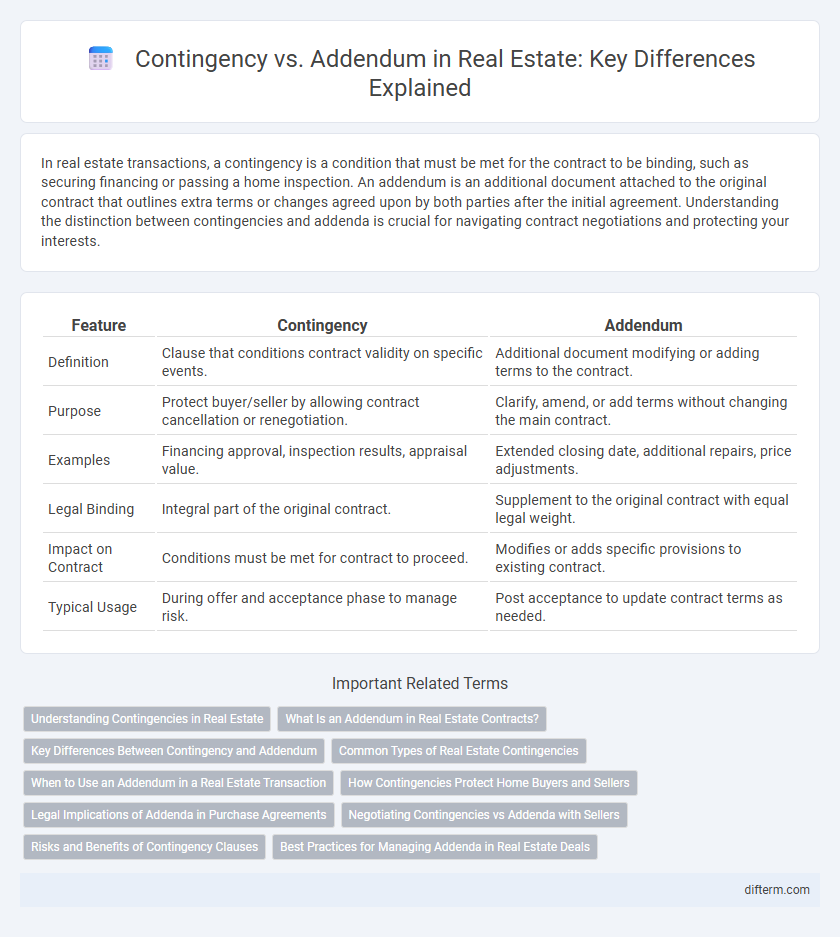

In real estate transactions, a contingency is a condition that must be met for the contract to be binding, such as securing financing or passing a home inspection. An addendum is an additional document attached to the original contract that outlines extra terms or changes agreed upon by both parties after the initial agreement. Understanding the distinction between contingencies and addenda is crucial for navigating contract negotiations and protecting your interests.

Table of Comparison

| Feature | Contingency | Addendum |

|---|---|---|

| Definition | Clause that conditions contract validity on specific events. | Additional document modifying or adding terms to the contract. |

| Purpose | Protect buyer/seller by allowing contract cancellation or renegotiation. | Clarify, amend, or add terms without changing the main contract. |

| Examples | Financing approval, inspection results, appraisal value. | Extended closing date, additional repairs, price adjustments. |

| Legal Binding | Integral part of the original contract. | Supplement to the original contract with equal legal weight. |

| Impact on Contract | Conditions must be met for contract to proceed. | Modifies or adds specific provisions to existing contract. |

| Typical Usage | During offer and acceptance phase to manage risk. | Post acceptance to update contract terms as needed. |

Understanding Contingencies in Real Estate

Contingencies in real estate contracts are specific conditions that must be met for the transaction to proceed, such as financing approval, home inspection, or appraisal results. These clauses protect buyers and sellers by allowing contract termination or renegotiation if the contingencies are not satisfied. Understanding contingencies is crucial to managing risk and ensuring a smooth property transaction.

What Is an Addendum in Real Estate Contracts?

An addendum in real estate contracts is a legally binding document that modifies, adds, or removes terms and conditions of the original purchase agreement without canceling it. It serves to clarify details or include additional provisions agreed upon by both buyer and seller, such as repair requests, changes in closing dates, or financing terms. Unlike contingencies, which are conditions that must be met for the contract to proceed, addendums directly alter the existing contract terms and become part of the final agreement.

Key Differences Between Contingency and Addendum

Contingencies in real estate contracts are conditions that must be met for the sale to proceed, such as financing approval or home inspections, while addendums are additional documents appended to the original contract to modify or clarify terms. Contingencies provide buyers and sellers protection by allowing contract termination or renegotiation if certain criteria are unmet, whereas addendums legally alter contract details without nullifying the original agreement. Understanding these distinctions ensures clearer negotiation and risk management in property transactions.

Common Types of Real Estate Contingencies

Common types of real estate contingencies include financing contingencies, inspection contingencies, and appraisal contingencies, each protecting buyers by allowing contract termination under specific conditions. Financing contingencies ensure the buyer secures a mortgage, while inspection contingencies permit withdrawal if property inspections reveal significant issues. Appraisal contingencies safeguard buyers by confirming the property's value meets or exceeds the purchase price, preventing overpayment.

When to Use an Addendum in a Real Estate Transaction

An addendum in a real estate transaction is used to modify or add conditions to the original purchase agreement without changing the core terms. It is essential when parties agree to include new provisions such as inspection results, financing changes, or repair requests after signing the initial contract. Using an addendum ensures both buyer and seller formally acknowledge and consent to these adjustments, protecting their legal interests.

How Contingencies Protect Home Buyers and Sellers

Contingencies provide crucial protection for home buyers and sellers by allowing contract termination or renegotiation if specific conditions, such as financing approval or home inspections, are not met. These clauses ensure that buyers are not obligated to complete the purchase under unfavorable circumstances while offering sellers a clear timeline to address potential issues. Unlike addendums, which modify existing contract terms, contingencies serve as safeguards that manage risk throughout the transaction process.

Legal Implications of Addenda in Purchase Agreements

Addenda in real estate purchase agreements serve to modify or add specific terms to the original contract, creating legally binding obligations that must be adhered to by all parties involved. Unlike contingencies, which allow conditions to be met or waived for the contract to proceed, addenda permanently alter the rights and duties established in the agreement, potentially impacting issues like closing dates, financing terms, or property disclosures. Failure to comply with the stipulations outlined in an addendum can lead to legal disputes, contract termination, or financial penalties for breach of contract.

Negotiating Contingencies vs Addenda with Sellers

Negotiating contingencies involves securing specific conditions that must be met for the real estate transaction to proceed, often including home inspections, financing approval, or appraisal results, which protect the buyer's interests. Addenda are supplementary documents added to the original purchase agreement to clarify or modify terms without altering the main contract, such as extending closing dates or including personal property. Sellers often prefer fewer contingencies to reduce uncertainty, while carefully crafted addenda can facilitate smoother negotiations by addressing unique buyer and seller needs without risking the deal's validity.

Risks and Benefits of Contingency Clauses

Contingency clauses in real estate contracts provide buyers protection by allowing contract termination if specific conditions, such as financing approval or home inspections, are unmet, reducing the risk of financial loss. These clauses offer flexibility and safeguard buyers from unforeseen issues, but they may weaken a buyer's offer appeal compared to all-cash or non-contingent bids. While addendums modify contract terms without the conditional safeguards of contingencies, understanding the risks and benefits of contingency clauses helps both buyers and sellers manage transaction uncertainties effectively.

Best Practices for Managing Addenda in Real Estate Deals

Managing addenda in real estate deals requires clear documentation of all modifications to the original contract, ensuring each addendum is dated, signed, and referenced properly. Best practices include maintaining organized records, communicating changes promptly to all parties, and verifying that contingencies outlined in addenda align with the primary agreement terms. Employing standardized templates and legal review can reduce disputes and protect all stakeholders throughout the transaction process.

contingency vs addendum Infographic

difterm.com

difterm.com