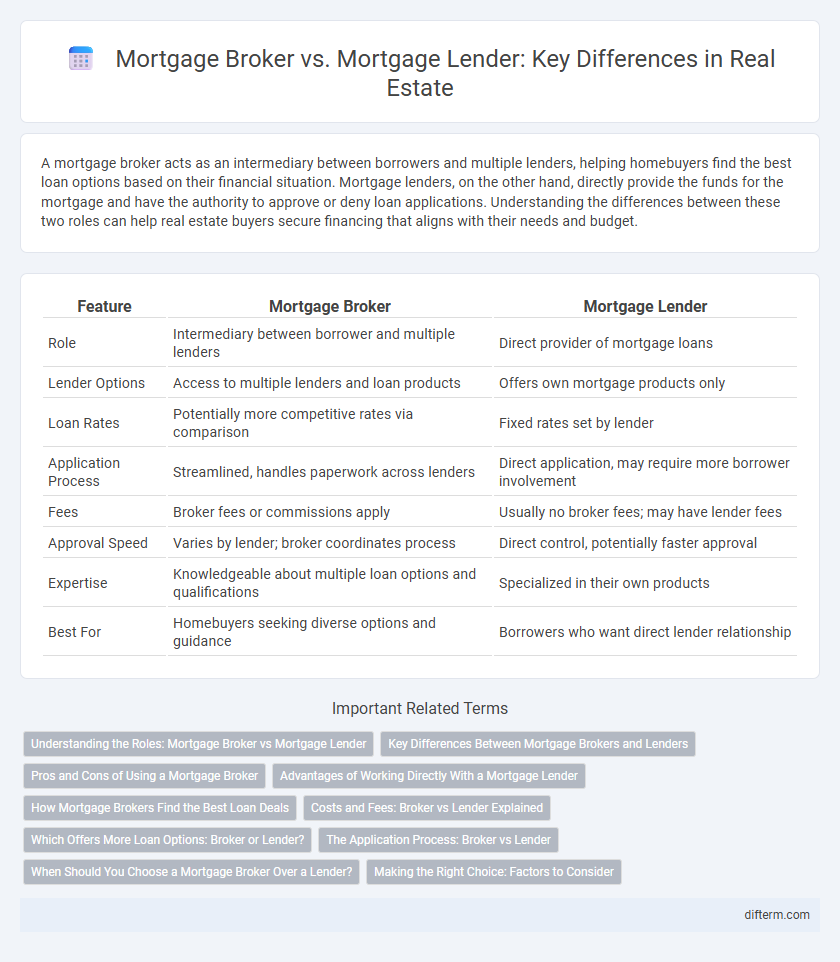

A mortgage broker acts as an intermediary between borrowers and multiple lenders, helping homebuyers find the best loan options based on their financial situation. Mortgage lenders, on the other hand, directly provide the funds for the mortgage and have the authority to approve or deny loan applications. Understanding the differences between these two roles can help real estate buyers secure financing that aligns with their needs and budget.

Table of Comparison

| Feature | Mortgage Broker | Mortgage Lender |

|---|---|---|

| Role | Intermediary between borrower and multiple lenders | Direct provider of mortgage loans |

| Lender Options | Access to multiple lenders and loan products | Offers own mortgage products only |

| Loan Rates | Potentially more competitive rates via comparison | Fixed rates set by lender |

| Application Process | Streamlined, handles paperwork across lenders | Direct application, may require more borrower involvement |

| Fees | Broker fees or commissions apply | Usually no broker fees; may have lender fees |

| Approval Speed | Varies by lender; broker coordinates process | Direct control, potentially faster approval |

| Expertise | Knowledgeable about multiple loan options and qualifications | Specialized in their own products |

| Best For | Homebuyers seeking diverse options and guidance | Borrowers who want direct lender relationship |

Understanding the Roles: Mortgage Broker vs Mortgage Lender

A mortgage broker acts as an intermediary between borrowers and multiple lenders, helping clients find the best loan options tailored to their financial situations. Mortgage lenders, on the other hand, provide funds directly to borrowers and typically manage the loan process from application to closing. Understanding the distinct functions of brokers versus lenders is essential for making informed decisions in real estate financing.

Key Differences Between Mortgage Brokers and Lenders

Mortgage brokers act as intermediaries connecting borrowers with multiple lenders to find the best mortgage rates and terms, while mortgage lenders provide the actual loan funds directly to the borrower. Brokers offer a wider range of options and personalized service, but may charge fees or earn commissions from lenders, whereas lenders have stricter eligibility criteria and control over loan approval. Understanding these distinctions helps homebuyers choose the most efficient path for securing financing tailored to their credit profile and financial goals.

Pros and Cons of Using a Mortgage Broker

Using a mortgage broker offers access to a wide range of loan products from multiple lenders, increasing the chances of securing competitive rates and personalized service tailored to individual financial situations. However, mortgage brokers may charge higher fees compared to direct lenders, and the process can take longer due to additional layers of communication and approval. Borrowers benefit from expert guidance and simplified comparisons but should weigh potential extra costs and timing against the convenience provided.

Advantages of Working Directly With a Mortgage Lender

Working directly with a mortgage lender often results in faster loan approval processes due to streamlined communication and reduced intermediaries. Mortgage lenders provide more competitive interest rates and exclusive loan programs that may not be available through brokers. Clients benefit from direct access to in-house underwriting and personalized customer service, enhancing overall transparency and efficiency in securing home financing.

How Mortgage Brokers Find the Best Loan Deals

Mortgage brokers leverage extensive networks of multiple lenders to access a diverse range of loan products, enabling them to match borrowers with the most competitive interest rates and terms. They analyze borrower profiles and financial situations to negotiate tailored mortgage options that traditional lenders might not offer directly. By comparing various lenders' offerings, mortgage brokers optimize loan conditions, potentially saving clients thousands over the life of their mortgage.

Costs and Fees: Broker vs Lender Explained

Mortgage brokers typically charge fees that vary based on the loan size and complexity, often including origination fees and lender fees passed through to the borrower, while mortgage lenders usually have more transparent, standardized fee structures tied directly to the loan product. Borrowers may find mortgage brokers offer competitive rates by shopping multiple lenders, potentially lowering overall costs, whereas lenders might provide lower upfront fees but less flexibility in terms and pricing. Understanding the fee breakdown--application fees, appraisal costs, and closing fees--is crucial for comparing total mortgage expenses between brokers and direct lenders.

Which Offers More Loan Options: Broker or Lender?

Mortgage brokers provide access to a wide range of loan options by working with multiple lenders, increasing the chances of finding tailored mortgage products that fit diverse financial situations. Mortgage lenders offer loans directly from their institution, limiting options to their specific portfolio and underwriting criteria. Borrowers seeking more variety and competitive rates typically benefit more from the broker's extensive network of lenders.

The Application Process: Broker vs Lender

Mortgage brokers streamline the application process by collecting necessary documentation and submitting it to multiple lenders, increasing the likelihood of loan approval and competitive rates. Mortgage lenders handle the application internally, assessing borrower creditworthiness and underwriting the loan, which may result in faster decision-making but fewer loan options. Understanding these distinctions helps borrowers choose the most efficient path for securing home financing tailored to their unique financial profiles.

When Should You Choose a Mortgage Broker Over a Lender?

Choosing a mortgage broker over a lender is ideal when seeking access to a wider range of loan products and competitive interest rates from multiple lenders. Mortgage brokers offer personalized guidance, especially beneficial for borrowers with unique financial situations or less-than-perfect credit. Homebuyers prioritizing convenience and tailored mortgage solutions typically benefit more from working with a mortgage broker than directly with a single lender.

Making the Right Choice: Factors to Consider

Choosing between a mortgage broker and a mortgage lender hinges on factors such as loan variety, rates, and personalized service. Mortgage brokers offer access to multiple lenders, potentially securing better rates and customized loan options for diverse credit profiles. Direct mortgage lenders provide streamlined processes and quicker approvals, ideal for borrowers prioritizing speed and specific loan products.

mortgage broker vs mortgage lender Infographic

difterm.com

difterm.com