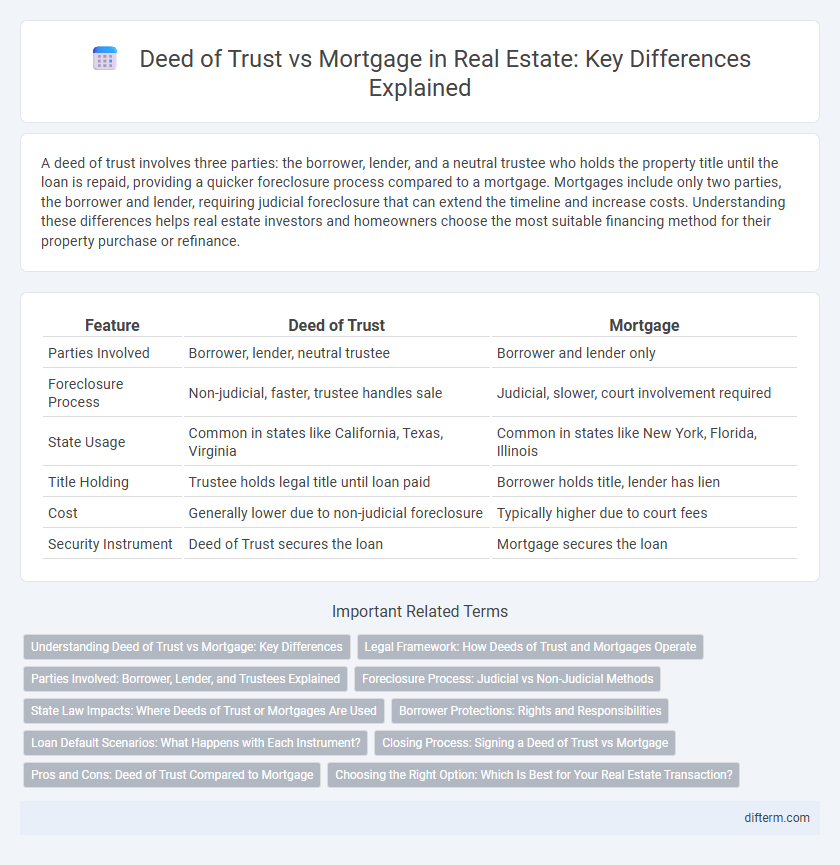

A deed of trust involves three parties: the borrower, lender, and a neutral trustee who holds the property title until the loan is repaid, providing a quicker foreclosure process compared to a mortgage. Mortgages include only two parties, the borrower and lender, requiring judicial foreclosure that can extend the timeline and increase costs. Understanding these differences helps real estate investors and homeowners choose the most suitable financing method for their property purchase or refinance.

Table of Comparison

| Feature | Deed of Trust | Mortgage |

|---|---|---|

| Parties Involved | Borrower, lender, neutral trustee | Borrower and lender only |

| Foreclosure Process | Non-judicial, faster, trustee handles sale | Judicial, slower, court involvement required |

| State Usage | Common in states like California, Texas, Virginia | Common in states like New York, Florida, Illinois |

| Title Holding | Trustee holds legal title until loan paid | Borrower holds title, lender has lien |

| Cost | Generally lower due to non-judicial foreclosure | Typically higher due to court fees |

| Security Instrument | Deed of Trust secures the loan | Mortgage secures the loan |

Understanding Deed of Trust vs Mortgage: Key Differences

A deed of trust involves three parties: the borrower, lender, and a neutral trustee who holds the property title until the loan is repaid, while a mortgage is a two-party agreement directly between borrower and lender. Deed of trust allows for non-judicial foreclosure, enabling quicker property seizure if the borrower defaults, whereas mortgages typically require a lengthy judicial foreclosure process. Understanding these distinctions is crucial for real estate investors and homebuyers as they affect foreclosure speed, costs, and title handling in property financing.

Legal Framework: How Deeds of Trust and Mortgages Operate

Deeds of trust and mortgages function under distinct legal frameworks that affect the property transfer process and foreclosure procedures. A deed of trust involves a trustee holding the property title until the loan is repaid, enabling a non-judicial foreclosure process. Mortgages create a lien on the property, requiring judicial foreclosure, which can be more time-consuming and costly compared to deeds of trust.

Parties Involved: Borrower, Lender, and Trustees Explained

A deed of trust involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee) who holds the property title until the loan is repaid. In contrast, a mortgage typically includes only two parties: the borrower and the lender, with the lender holding a lien on the property. The trustee's role in a deed of trust facilitates a non-judicial foreclosure process, while mortgages often require judicial foreclosure.

Foreclosure Process: Judicial vs Non-Judicial Methods

A deed of trust commonly enables a non-judicial foreclosure process, allowing lenders to bypass court involvement and expedite property repossession through a trustee's sale. Mortgages typically require a judicial foreclosure, necessitating a court proceeding to authorize the sale of the property, which can prolong the timeline. Understanding these differences is crucial for homeowners and investors evaluating foreclosure risks and timelines in various states.

State Law Impacts: Where Deeds of Trust or Mortgages Are Used

Deeds of trust are predominantly used in states like California, Texas, and Virginia, where state laws favor non-judicial foreclosure processes that expedite lender recovery. Mortgages are more common in states such as New York and Florida, which require judicial foreclosure procedures governed by stricter state court oversight. Understanding state-specific regulations is critical for borrowers and lenders to navigate foreclosure timelines, costs, and legal protections effectively.

Borrower Protections: Rights and Responsibilities

A deed of trust transfers legal title to a third-party trustee, offering the borrower quicker foreclosure procedures but fewer redemption rights compared to a mortgage. Mortgages grant the borrower more extensive protections, including longer foreclosure timelines and statutory redemption periods that allow borrowers to reclaim their property after default. Both instruments require borrowers to uphold obligations like timely payments and property maintenance, but mortgages generally provide enhanced legal safeguards during default scenarios.

Loan Default Scenarios: What Happens with Each Instrument?

In loan default scenarios, a deed of trust allows the lender to initiate a non-judicial foreclosure process, often resulting in a faster resolution compared to a mortgage's judicial foreclosure, which requires court involvement and can be lengthier. Mortgages require court approval to foreclose, potentially leading to prolonged foreclosure timelines and higher legal costs. Deeds of trust typically provide lenders with more efficient property repossession, reducing financial risk and enhancing loan recovery prospects.

Closing Process: Signing a Deed of Trust vs Mortgage

During the closing process, signing a deed of trust involves three parties: the borrower, the lender, and a neutral trustee who holds the property title as security. In contrast, signing a mortgage typically involves only two parties: the borrower and the lender, with the borrower retaining the legal title while the lender holds a lien. The deed of trust often facilitates a faster foreclosure process compared to the mortgage, impacting the risk and timeline for both lenders and borrowers.

Pros and Cons: Deed of Trust Compared to Mortgage

A deed of trust offers faster foreclosure processes and typically lower costs, making it advantageous in states favoring non-judicial foreclosures, while a mortgage requires judicial foreclosure, which can be lengthier and more expensive. However, mortgages often provide stronger borrower protections and are more widely recognized across states, potentially benefiting borrowers in complex legal situations. The choice between a deed of trust and a mortgage depends on state laws, foreclosure preferences, and the balance between speed and borrower rights.

Choosing the Right Option: Which Is Best for Your Real Estate Transaction?

Choosing between a deed of trust and a mortgage depends on state laws and desired foreclosure processes; a deed of trust involves a neutral third-party trustee, facilitating a faster non-judicial foreclosure, while a mortgage requires judicial foreclosure, potentially prolonging the process. Buyers in states favoring rapid foreclosure often prefer deeds of trust to secure the lender's interest efficiently, whereas mortgages offer borrower protections and are more common in states with stringent foreclosure requirements. Evaluating these factors alongside local regulations helps determine the best instrument for a smooth and secure real estate transaction.

deed of trust vs mortgage Infographic

difterm.com

difterm.com