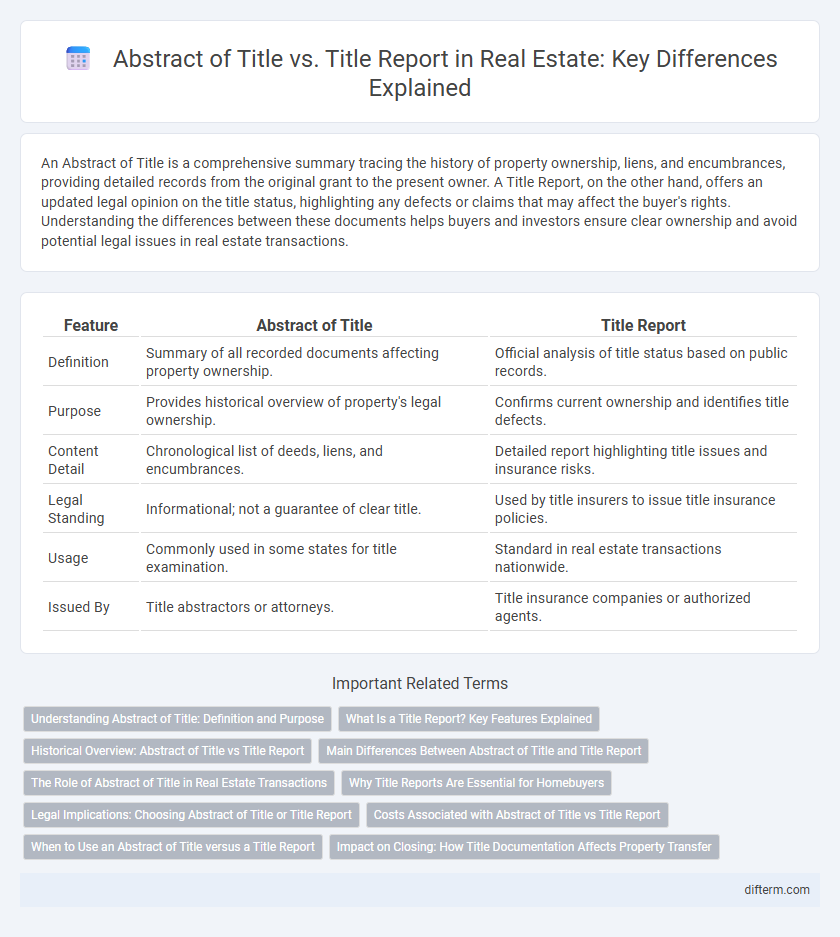

An Abstract of Title is a comprehensive summary tracing the history of property ownership, liens, and encumbrances, providing detailed records from the original grant to the present owner. A Title Report, on the other hand, offers an updated legal opinion on the title status, highlighting any defects or claims that may affect the buyer's rights. Understanding the differences between these documents helps buyers and investors ensure clear ownership and avoid potential legal issues in real estate transactions.

Table of Comparison

| Feature | Abstract of Title | Title Report |

|---|---|---|

| Definition | Summary of all recorded documents affecting property ownership. | Official analysis of title status based on public records. |

| Purpose | Provides historical overview of property's legal ownership. | Confirms current ownership and identifies title defects. |

| Content Detail | Chronological list of deeds, liens, and encumbrances. | Detailed report highlighting title issues and insurance risks. |

| Legal Standing | Informational; not a guarantee of clear title. | Used by title insurers to issue title insurance policies. |

| Usage | Commonly used in some states for title examination. | Standard in real estate transactions nationwide. |

| Issued By | Title abstractors or attorneys. | Title insurance companies or authorized agents. |

Understanding Abstract of Title: Definition and Purpose

An Abstract of Title is a comprehensive summary of all recorded documents affecting a property's ownership, including deeds, mortgages, liens, and legal actions, providing a historical account to establish clear ownership. This document serves as a vital tool for buyers, sellers, and attorneys to verify the chain of title and identify any encumbrances or defects that could impact the transaction. Understanding the Abstract of Title ensures informed decision-making and helps safeguard against potential title disputes during real estate transactions.

What Is a Title Report? Key Features Explained

A title report is a detailed document outlining the current ownership, liens, encumbrances, and legal status of a property, essential for real estate transactions. It provides critical information such as easements, restrictions, and outstanding mortgages, helping buyers and lenders assess risks associated with the property's title. Unlike an abstract of title, which is a historical summary of all recorded documents, the title report offers a current snapshot of title status prepared by a title company.

Historical Overview: Abstract of Title vs Title Report

An Abstract of Title provides a condensed summary of the property's entire recorded history, including all transfers, liens, and encumbrances, typically compiled from public records and legal documents. A Title Report, however, is a more current document prepared by a title company or attorney that details the present condition of the title, highlighting any defects or issues affecting ownership rights. Historically, Abstracts served as the primary tool for verifying ownership before modern title insurance practices introduced standardized Title Reports for risk assessment and transaction security.

Main Differences Between Abstract of Title and Title Report

An Abstract of Title provides a comprehensive summary of all recorded documents, liens, and legal actions affecting a property's ownership history, typically covering every transaction from the original grant to the present. A Title Report, often prepared by a title company, focuses on current ownership, potential title defects, and encumbrances that could impact a real estate transaction, offering a snapshot of the property's status as of the report date. The main differences lie in the Abstract offering a detailed chronological history, while the Title Report emphasizes current title issues and risks relevant to buyers and lenders.

The Role of Abstract of Title in Real Estate Transactions

An Abstract of Title provides a detailed chronological summary of all recorded documents, liens, and legal proceedings affecting a property's title, crucial for verifying ownership and identifying encumbrances. This comprehensive historical record supports buyers and lenders in assessing potential risks and ensuring clear title transfer during real estate transactions. Unlike a title report, which highlights current title status and defects, the abstract offers an in-depth foundation for title insurance and legal due diligence.

Why Title Reports Are Essential for Homebuyers

Title reports provide homebuyers with a detailed examination of a property's legal ownership and any existing liens, encumbrances, or claims, ensuring clear title transfer. Unlike abstracts of title, which compile historical documents, title reports interpret the data to verify the property's marketability and uncover potential legal issues. This critical insight protects buyers from future disputes and financial loss, making title reports essential in the real estate purchasing process.

Legal Implications: Choosing Abstract of Title or Title Report

An Abstract of Title provides a comprehensive historical summary of all recorded documents affecting a property's ownership and liens, offering a detailed legal foundation for title verification. A Title Report is a condensed document generated by a title company highlighting current ownership, liens, encumbrances, and defects, often used to facilitate title insurance issuance. Selecting between an Abstract of Title and a Title Report impacts legal risk exposure, as the Abstract offers thorough historical insight while the Title Report provides a more immediate snapshot tailored to closing and insurance needs.

Costs Associated with Abstract of Title vs Title Report

Costs associated with an abstract of title typically involve fees for compiling a comprehensive historical record of property ownership, which can be extensive and detailed, leading to higher charges. Title reports, however, usually incur lower costs as they provide a summarized evaluation of the property's current title status without the exhaustive historical documentation. Understanding these cost differences is essential for buyers and investors when deciding between thorough title verification methods in real estate transactions.

When to Use an Abstract of Title versus a Title Report

An Abstract of Title provides a comprehensive historical summary of property ownership and related legal documents, making it ideal for in-depth due diligence on complex or older properties. A Title Report is a more concise document, often used for straightforward transactions to quickly verify current ownership and any liens or encumbrances. Choose an Abstract of Title for thorough historical research and a Title Report for streamlined verification in typical real estate closings.

Impact on Closing: How Title Documentation Affects Property Transfer

The Abstract of Title provides a comprehensive historical summary of all recorded documents affecting ownership, helping identify potential liens or encumbrances before closing. A Title Report offers a current status on title defects and is essential for securing title insurance, directly influencing the risk assessment during property transfer. Clear and accurate title documentation ensures a smoother closing process by minimizing surprises that could delay or derail the transaction.

Abstract of Title vs Title Report Infographic

difterm.com

difterm.com