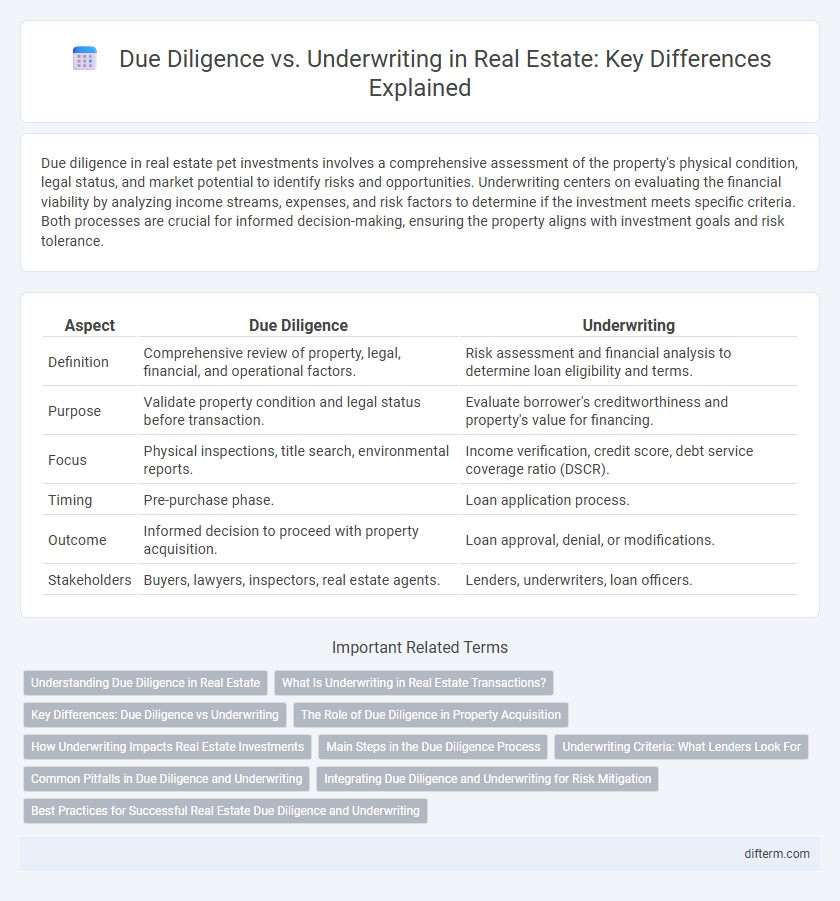

Due diligence in real estate pet investments involves a comprehensive assessment of the property's physical condition, legal status, and market potential to identify risks and opportunities. Underwriting centers on evaluating the financial viability by analyzing income streams, expenses, and risk factors to determine if the investment meets specific criteria. Both processes are crucial for informed decision-making, ensuring the property aligns with investment goals and risk tolerance.

Table of Comparison

| Aspect | Due Diligence | Underwriting |

|---|---|---|

| Definition | Comprehensive review of property, legal, financial, and operational factors. | Risk assessment and financial analysis to determine loan eligibility and terms. |

| Purpose | Validate property condition and legal status before transaction. | Evaluate borrower's creditworthiness and property's value for financing. |

| Focus | Physical inspections, title search, environmental reports. | Income verification, credit score, debt service coverage ratio (DSCR). |

| Timing | Pre-purchase phase. | Loan application process. |

| Outcome | Informed decision to proceed with property acquisition. | Loan approval, denial, or modifications. |

| Stakeholders | Buyers, lawyers, inspectors, real estate agents. | Lenders, underwriters, loan officers. |

Understanding Due Diligence in Real Estate

Due diligence in real estate involves a comprehensive investigation of property conditions, title status, zoning laws, and financial records to identify potential risks before closing a deal. It ensures buyers verify structural integrity, environmental reports, and market value, reducing unforeseen liabilities. Underwriting primarily assesses the financial viability and risk of a real estate investment through credit analysis and cash flow projections, complementing the detailed property inspection performed during due diligence.

What Is Underwriting in Real Estate Transactions?

Underwriting in real estate transactions involves a detailed risk assessment process where underwriters evaluate property value, market conditions, borrower financials, and legal factors to determine loan eligibility and terms. This process ensures the lender's investment is secure by verifying income, creditworthiness, property appraisal, and title status. Unlike due diligence, which encompasses a broader investigation by buyers or investors, underwriting specifically focuses on loan approval criteria and risk mitigation for lenders.

Key Differences: Due Diligence vs Underwriting

Due diligence in real estate involves a comprehensive investigation of a property's legal, physical, and financial condition to identify potential risks before transaction completion. Underwriting focuses on assessing the financial viability and risk profile of the investment, including credit analysis and cash flow projections, to determine loan approval and terms. Key differences lie in due diligence emphasizing risk identification through detailed property inspection and documentation review, while underwriting centers on financial evaluation and risk mitigation for lenders and investors.

The Role of Due Diligence in Property Acquisition

Due diligence in property acquisition involves a thorough investigation of legal, financial, and physical aspects to ensure the property's value and identify potential risks before closing. It encompasses title verification, environmental assessments, zoning compliance, and financial audits, providing a comprehensive risk analysis. This process is distinct from underwriting, which primarily focuses on evaluating loan risk and financial viability from the lender's perspective.

How Underwriting Impacts Real Estate Investments

Underwriting in real estate involves a comprehensive evaluation of financial risks and property values to determine investment viability, directly impacting borrowing decisions and potential returns. Accurate underwriting ensures that investors assess true asset performance, market conditions, and cash flow projections, minimizing the risk of overvaluation. This process differs from due diligence, which focuses more on legal, physical, and environmental assessments, making underwriting critical for financial structuring and investment success.

Main Steps in the Due Diligence Process

Due diligence in real estate involves comprehensive verification of property details, such as title examination, environmental assessments, and financial audits, to identify risks and confirm asset value. Key steps include reviewing legal documents, inspecting physical conditions, assessing zoning compliance, and evaluating market conditions to ensure the investment aligns with strategic goals. Unlike underwriting, which focuses on risk and loan approval, due diligence provides a thorough validation before finalizing the transaction.

Underwriting Criteria: What Lenders Look For

Underwriting criteria in real estate focus on evaluating the borrower's creditworthiness, property value, and loan-to-value ratio to assess risk and determine loan approval. Lenders analyze financial documents, including income statements, credit reports, and debt levels, alongside property appraisal and market conditions to ensure investment viability. Comprehensive underwriting ensures that the loan terms align with both the borrower's capacity and the asset's projected performance.

Common Pitfalls in Due Diligence and Underwriting

Common pitfalls in real estate due diligence include overlooking property liens, misjudging zoning restrictions, and failing to verify environmental risks, which can lead to costly surprises post-acquisition. In underwriting, common errors involve inaccurate income projections, underestimating repair costs, and neglecting market volatility, resulting in flawed financial assessments and increased investment risk. Rigorous cross-checking of legal documents, market data, and physical property conditions is essential to mitigate these risks and ensure sound investment decisions.

Integrating Due Diligence and Underwriting for Risk Mitigation

Integrating due diligence and underwriting enhances risk mitigation by combining thorough property inspections, financial analysis, and market research to identify potential threats and validate investment assumptions. This holistic approach ensures comprehensive evaluation of legal, environmental, and financial factors, reducing uncertainty in real estate transactions. Leveraging data from both processes optimizes decision-making, resulting in more accurate risk assessments and improved asset protection.

Best Practices for Successful Real Estate Due Diligence and Underwriting

Successful real estate due diligence involves thorough property inspections, title verification, and financial analysis to identify risks and validate investment assumptions. Underwriting best practices require careful evaluation of market conditions, borrower creditworthiness, and accurate cash flow projections to ensure proper risk assessment. Combining detailed due diligence with diligent underwriting enhances decision-making and mitigates potential losses in real estate investments.

due diligence vs underwriting Infographic

difterm.com

difterm.com