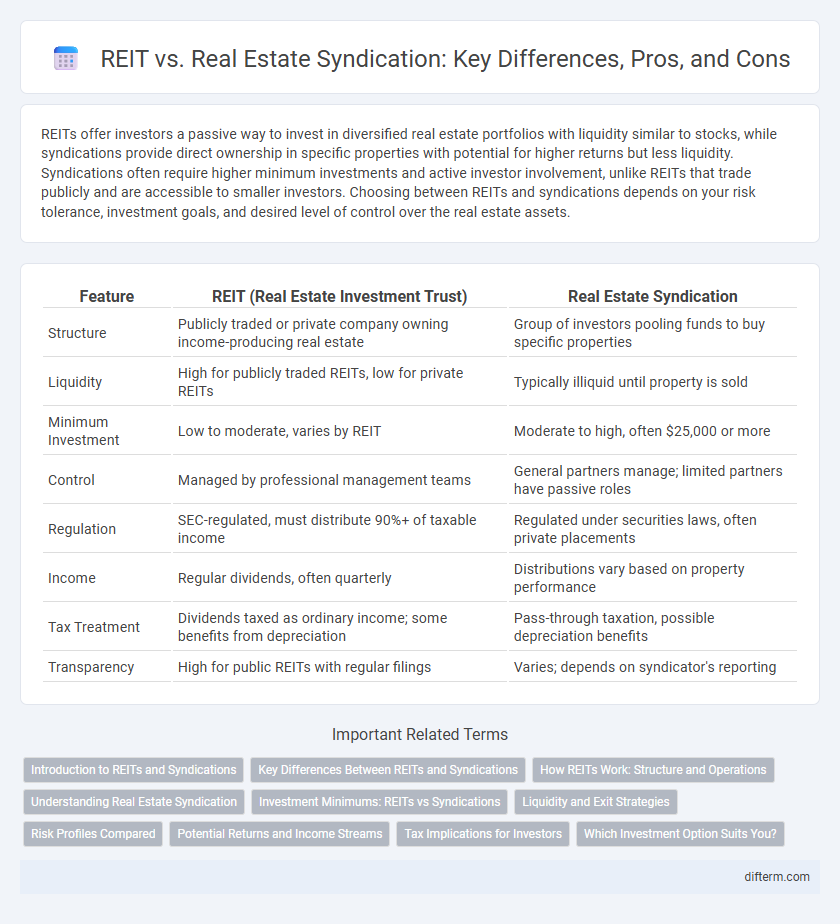

REITs offer investors a passive way to invest in diversified real estate portfolios with liquidity similar to stocks, while syndications provide direct ownership in specific properties with potential for higher returns but less liquidity. Syndications often require higher minimum investments and active investor involvement, unlike REITs that trade publicly and are accessible to smaller investors. Choosing between REITs and syndications depends on your risk tolerance, investment goals, and desired level of control over the real estate assets.

Table of Comparison

| Feature | REIT (Real Estate Investment Trust) | Real Estate Syndication |

|---|---|---|

| Structure | Publicly traded or private company owning income-producing real estate | Group of investors pooling funds to buy specific properties |

| Liquidity | High for publicly traded REITs, low for private REITs | Typically illiquid until property is sold |

| Minimum Investment | Low to moderate, varies by REIT | Moderate to high, often $25,000 or more |

| Control | Managed by professional management teams | General partners manage; limited partners have passive roles |

| Regulation | SEC-regulated, must distribute 90%+ of taxable income | Regulated under securities laws, often private placements |

| Income | Regular dividends, often quarterly | Distributions vary based on property performance |

| Tax Treatment | Dividends taxed as ordinary income; some benefits from depreciation | Pass-through taxation, possible depreciation benefits |

| Transparency | High for public REITs with regular filings | Varies; depends on syndicator's reporting |

Introduction to REITs and Syndications

REITs (Real Estate Investment Trusts) are companies that own, operate, or finance income-producing real estate, offering investors liquidity and diversification through publicly traded shares. Syndications involve pooled investments where multiple investors collectively fund private real estate projects, typically managed by a syndicator or sponsor. REITs provide easier access and regulatory oversight, while syndications offer potential for higher returns through direct property ownership and active management.

Key Differences Between REITs and Syndications

REITs (Real Estate Investment Trusts) offer liquidity through publicly traded shares, while syndications involve direct ownership with less liquidity. REITs are regulated by the SEC and provide passive income with mandated dividend distributions, whereas syndications typically require active investor involvement and offer customized control over property management. Tax treatment differs as REITs pass income through without corporate tax, whereas syndication investors may benefit from depreciation deductions and direct tax advantages.

How REITs Work: Structure and Operations

Real Estate Investment Trusts (REITs) operate by pooling capital from multiple investors to purchase, manage, and generate income from a diversified portfolio of income-producing real estate assets. Structured as publicly traded or private entities, REITs must adhere to specific regulatory requirements, including distributing at least 90% of taxable income as dividends to shareholders. These entities generate revenue primarily through leasing commercial properties, collecting rent, and managing property-related assets, offering investors liquidity and passive income without the need for direct property management.

Understanding Real Estate Syndication

Real estate syndication involves pooling funds from multiple investors to purchase large properties, allowing individuals to access high-value commercial assets with relatively small capital contributions. Unlike REITs, which trade on public exchanges and offer liquidity through shares, syndications are private investments with limited liquidity but often provide more direct control and potential for higher returns. Understanding the structure, roles of the sponsor and investors, and legal framework is crucial for evaluating the risks and benefits of syndication in real estate portfolios.

Investment Minimums: REITs vs Syndications

REITs typically have lower investment minimums, often starting around $500 to $1,000, making them accessible to a broad range of investors. Syndications usually require higher minimum investments, commonly ranging from $25,000 to $50,000, reflecting their private offering status and targeted accredited investors. These minimum thresholds impact liquidity and investor eligibility, influencing portfolio diversification strategies in real estate investment.

Liquidity and Exit Strategies

REITs offer higher liquidity compared to syndications, allowing investors to buy and sell shares on public exchanges with ease. Syndications typically require longer holding periods, with exit strategies dependent on property sales or refinancing events. Investors seeking flexibility benefit from REITs' tradable nature, while those targeting potentially higher returns accept syndications' less liquid, longer-term commitments.

Risk Profiles Compared

REITs offer lower risk due to regulated structures, liquidity, and professional management, making them suitable for conservative investors seeking steady income through publicly traded real estate assets. Syndications carry higher risk with less liquidity and depend heavily on sponsor expertise and market conditions, appealing to investors willing to accept volatility for potentially higher returns. Understanding risk profiles helps investors align their real estate strategy with risk tolerance and investment goals.

Potential Returns and Income Streams

REITs typically offer stable income streams through dividends derived from a diversified portfolio of income-producing properties, providing predictable cash flow with moderate potential returns. Syndications, on the other hand, often involve direct property ownership with higher risk but the potential for greater capital appreciation and variable income depending on property performance and management. Investors seeking consistent income might favor REITs, while those pursuing higher returns and tax advantages may prefer syndications.

Tax Implications for Investors

REITs offer investors pass-through taxation, meaning income is taxed at the individual shareholder level, avoiding corporate tax but often resulting in higher ordinary income tax rates. Syndications provide depreciation and other deductions that can offset taxable income, allowing investors to defer taxes and potentially reduce their tax liability. Understanding the specific tax classifications and distributions of each structure is crucial for optimizing after-tax returns in real estate investments.

Which Investment Option Suits You?

REITs offer liquidity, professional management, and diversified real estate portfolios, making them ideal for investors seeking hands-off, easily tradable assets. Syndications provide direct ownership, targeted property types, and potential tax benefits, appealing to investors willing to engage more actively and assume higher risks for potentially greater returns. Assess your investment goals, risk tolerance, and desired level of involvement to determine whether the flexibility of REITs or the control of syndications better suits your real estate investment strategy.

REIT vs Syndication Infographic

difterm.com

difterm.com