Portfolio lenders hold loans on their own balance sheets, allowing for more flexible underwriting standards and personalized loan terms tailored to unique real estate investments, including those with pets. Correspondent lenders, however, originate and fund loans which are then sold to larger investors, often adhering to stricter guidelines and less customization. Understanding the differences helps real estate investors choose the best financing option for properties accommodating pets, ensuring smoother approval and better loan conditions.

Table of Comparison

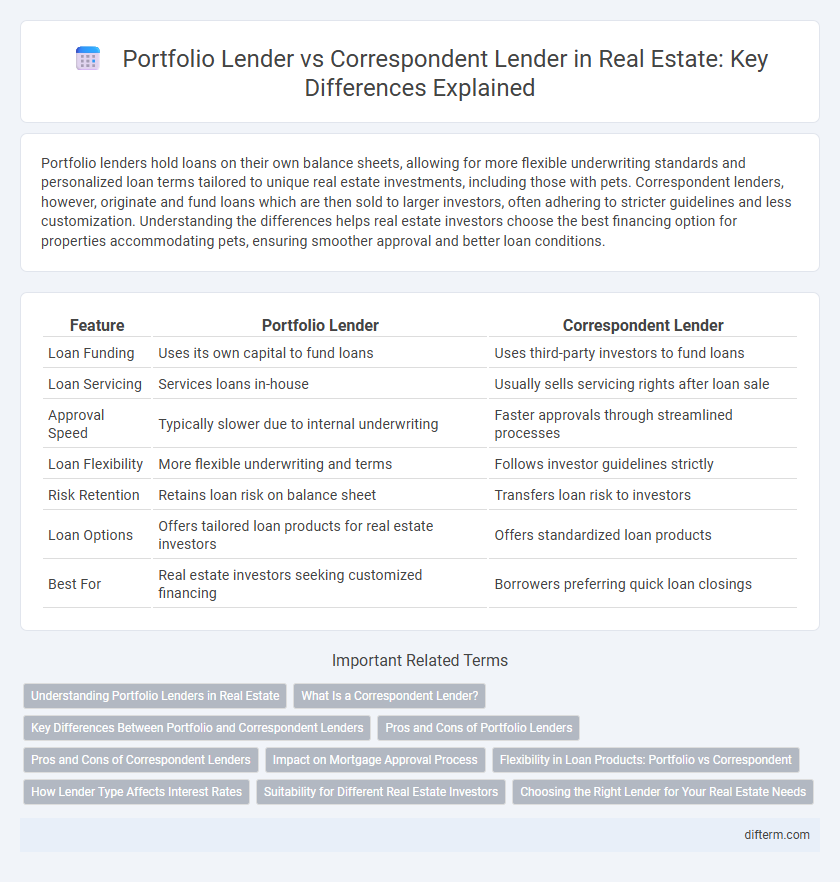

| Feature | Portfolio Lender | Correspondent Lender |

|---|---|---|

| Loan Funding | Uses its own capital to fund loans | Uses third-party investors to fund loans |

| Loan Servicing | Services loans in-house | Usually sells servicing rights after loan sale |

| Approval Speed | Typically slower due to internal underwriting | Faster approvals through streamlined processes |

| Loan Flexibility | More flexible underwriting and terms | Follows investor guidelines strictly |

| Risk Retention | Retains loan risk on balance sheet | Transfers loan risk to investors |

| Loan Options | Offers tailored loan products for real estate investors | Offers standardized loan products |

| Best For | Real estate investors seeking customized financing | Borrowers preferring quick loan closings |

Understanding Portfolio Lenders in Real Estate

Portfolio lenders in real estate retain loans on their own balance sheets, enabling more flexible underwriting criteria and faster loan approval compared to correspondent lenders. These lenders often tailor mortgage solutions to unique borrower profiles and complex property types that conventional lenders may reject. Their ability to manage risk internally allows investors and developers to access customized financing options crucial for diverse real estate portfolios.

What Is a Correspondent Lender?

A correspondent lender is a financial institution that originates and funds mortgage loans using its own resources before selling them to larger investors or secondary markets. Unlike portfolio lenders who retain loans on their books, correspondent lenders primarily act as middlemen, facilitating quicker loan processing and broader access to funding. These lenders maintain control over underwriting and closing processes, ensuring streamlined service and faster turnaround for borrowers.

Key Differences Between Portfolio and Correspondent Lenders

Portfolio lenders retain and service loans within their own financial institutions, allowing for greater flexibility in underwriting and customized loan terms tailored to borrower needs. Correspondent lenders originate loans and then sell them to larger investors or banks, which requires adherence to standardized guidelines and limits their ability to modify loan conditions. The key differences lie in portfolio lenders' risk retention and loan servicing control versus correspondent lenders' reliance on secondary markets for loan liquidity and compliance.

Pros and Cons of Portfolio Lenders

Portfolio lenders retain loan servicing and ownership, allowing flexible underwriting criteria and faster loan approvals compared to correspondent lenders who sell loans to investors. This flexibility benefits borrowers with unique financial profiles but may lead to higher interest rates and limited product offerings. Portfolio lenders face increased risk exposure, which can affect their lending capacity during economic downturns.

Pros and Cons of Correspondent Lenders

Correspondent lenders offer faster loan processing and more personalized service by funding loans with their own capital before selling them to investors, providing borrowers with quicker approvals and flexible underwriting. However, their loan options and pricing may be limited compared to larger portfolio lenders, and borrowers might face higher interest rates or fewer concessions. Correspondent lenders can struggle to maintain consistent funding, potentially causing delays or uncertainty in closing timelines.

Impact on Mortgage Approval Process

Portfolio lenders hold and service loans in-house, allowing for more flexible underwriting criteria and faster mortgage approval processes compared to correspondent lenders. Correspondent lenders originate loans but sell them to investors, which can introduce additional layers of approval and potentially longer processing times due to investor-specific requirements. Borrowers working with portfolio lenders often benefit from personalized service and more adaptable terms, affecting the speed and ease of securing mortgage approval.

Flexibility in Loan Products: Portfolio vs Correspondent

Portfolio lenders offer greater flexibility in loan products by retaining loans on their own balance sheets, allowing customized terms and underwriting standards that cater to unique borrower needs. Correspondent lenders, in contrast, originate loans that conform to investor guidelines for resale, which limits their ability to deviate from standard loan products and underwriting criteria. This fundamental difference impacts the variety of financing options and adaptability available to real estate investors and homebuyers.

How Lender Type Affects Interest Rates

Portfolio lenders often offer more flexible interest rates since they keep loans in-house and can tailor terms based on borrower risk profiles. Correspondent lenders typically provide rates aligned with secondary market standards, potentially resulting in more competitive but less negotiable interest rates. Understanding these distinctions helps borrowers optimize financing costs in real estate transactions.

Suitability for Different Real Estate Investors

Portfolio lenders provide tailored loan options by holding and managing loans in-house, making them ideal for real estate investors with unique needs or complex property types. Correspondent lenders originate loans that are quickly sold on the secondary market, offering faster processing suitable for investors seeking standard financing and quicker closings. Understanding these distinctions helps investors select financing aligned with their investment strategy and property portfolio size.

Choosing the Right Lender for Your Real Estate Needs

Portfolio lenders retain loans in-house, offering flexible underwriting and faster processing for unique or complex real estate transactions. Correspondent lenders originate loans but sell them to larger investors, providing access to competitive rates and a broader range of loan products. Selecting the right lender depends on your property type, financing timeline, and need for customized loan solutions.

portfolio lender vs correspondent lender Infographic

difterm.com

difterm.com