Net operating income (NOI) in real estate reflects the revenue generated from a property after operating expenses are deducted, providing a clearer picture of profitability than gross rental income. Gross rental income represents the total income from all rental units before any expenses, making it less accurate for assessing true financial performance. Investors rely on NOI to evaluate the cash flow potential and efficiency of a property, guiding smarter investment decisions.

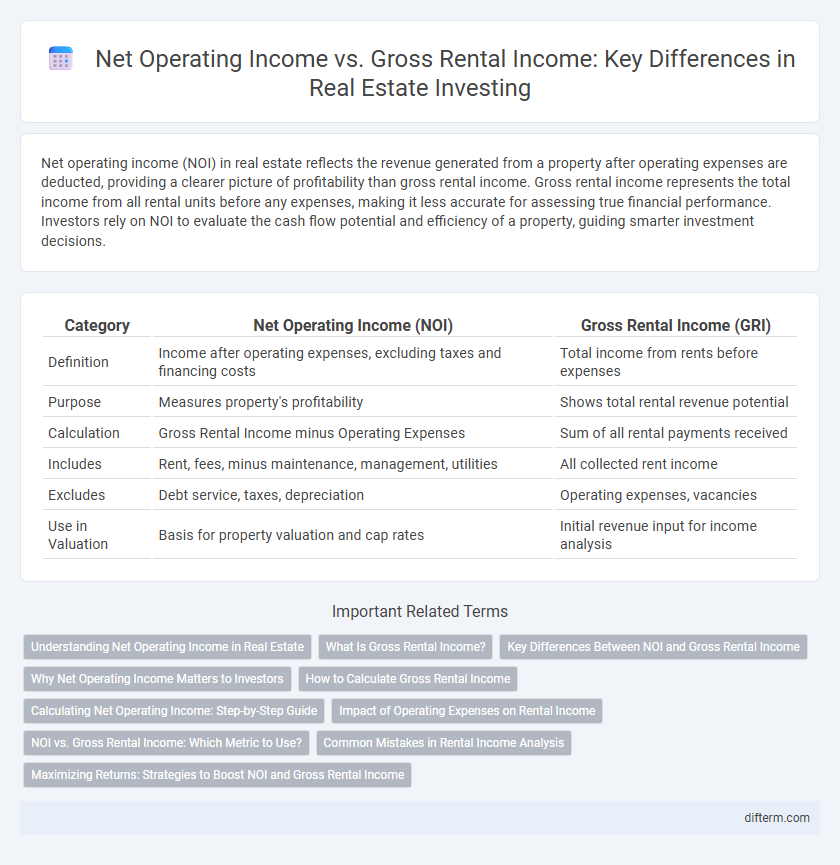

Table of Comparison

| Category | Net Operating Income (NOI) | Gross Rental Income (GRI) |

|---|---|---|

| Definition | Income after operating expenses, excluding taxes and financing costs | Total income from rents before expenses |

| Purpose | Measures property's profitability | Shows total rental revenue potential |

| Calculation | Gross Rental Income minus Operating Expenses | Sum of all rental payments received |

| Includes | Rent, fees, minus maintenance, management, utilities | All collected rent income |

| Excludes | Debt service, taxes, depreciation | Operating expenses, vacancies |

| Use in Valuation | Basis for property valuation and cap rates | Initial revenue input for income analysis |

Understanding Net Operating Income in Real Estate

Net Operating Income (NOI) in real estate represents the total revenue generated from a property minus all operating expenses, excluding mortgage payments, depreciation, and income taxes. It provides a clear measure of a property's profitability by focusing strictly on income and direct costs associated with property management and maintenance. NOI is crucial for investors to assess the property's financial health and compare its performance against other investment opportunities.

What Is Gross Rental Income?

Gross rental income is the total revenue generated from leasing out real estate properties before any operating expenses or deductions are applied. It encompasses all rental payments received from tenants, including base rent and any additional fees like parking or laundry charges. Understanding gross rental income is essential for assessing the property's revenue potential and calculating net operating income.

Key Differences Between NOI and Gross Rental Income

Net operating income (NOI) represents the total revenue from a property minus all operating expenses, excluding financing costs and taxes, providing a clearer picture of a property's profitability. Gross rental income is the total income generated from rent before deducting any expenses, serving as the starting point for further financial analysis. Understanding these distinctions helps investors evaluate cash flow, property performance, and investment potential more accurately.

Why Net Operating Income Matters to Investors

Net Operating Income (NOI) provides a clearer financial picture by subtracting operating expenses from gross rental income, revealing the actual profitability of a real estate investment. Investors rely on NOI to evaluate property performance, determine cash flow potential, and compare investment opportunities accurately. Understanding NOI helps investors make informed decisions on property valuation, financing, and long-term profitability.

How to Calculate Gross Rental Income

Gross rental income is calculated by multiplying the total number of rentable units by the monthly rent charged per unit, then annualizing that figure by multiplying by 12 months. It represents the total revenue generated from rental properties before deducting any operating expenses or vacancies. Accurately calculating gross rental income is essential for assessing property performance and estimating net operating income in real estate investments.

Calculating Net Operating Income: Step-by-Step Guide

Calculating Net Operating Income (NOI) begins with determining the Gross Rental Income, which includes total rent collected from tenants before expenses. Next, subtract operating expenses such as property management fees, maintenance costs, property taxes, and insurance from the Gross Rental Income. The resulting figure, Net Operating Income, reflects the property's profitability by measuring income generated after essential operational costs are deducted but before financing and tax expenses.

Impact of Operating Expenses on Rental Income

Net operating income (NOI) is directly affected by operating expenses, which include property management fees, maintenance costs, and property taxes, reducing the gross rental income. While gross rental income represents total revenue from rental properties before expenses, NOI reflects the actual profitability by subtracting these operating costs. Understanding the impact of operating expenses is essential for accurately assessing investment returns and managing rental property performance.

NOI vs. Gross Rental Income: Which Metric to Use?

Net Operating Income (NOI) provides a more accurate measure of a property's profitability by accounting for operating expenses, while Gross Rental Income represents the total revenue generated before any deductions. Investors prioritize NOI for evaluating cash flow and overall financial health, as it reflects the actual income available after costs like maintenance, property taxes, and management fees. Choosing NOI over Gross Rental Income allows for better comparison across properties and more informed investment decisions in real estate.

Common Mistakes in Rental Income Analysis

Confusing net operating income (NOI) with gross rental income is a common mistake that can lead to overestimating a property's profitability. Gross rental income represents total earnings from rent before expenses, whereas NOI accounts for operating costs like maintenance, property management, and vacancies. Failing to deduct these expenses from gross income often results in inaccurate rental income analysis and misguided investment decisions.

Maximizing Returns: Strategies to Boost NOI and Gross Rental Income

Maximizing net operating income (NOI) and gross rental income involves strategically increasing rental rates and minimizing operational expenses to enhance overall property profitability. Key strategies include implementing dynamic pricing models based on market demand, reducing vacancy rates through targeted marketing, and optimizing maintenance schedules to lower costs without compromising tenant satisfaction. Leveraging data analytics to identify underperforming assets and negotiating vendor contracts effectively can further boost NOI while maintaining high rental income levels.

net operating income vs gross rental income Infographic

difterm.com

difterm.com