Hard money loans offer faster approval and less stringent credit requirements, making them ideal for real estate investors needing quick financing. Conventional loans typically have lower interest rates and longer repayment terms, benefiting buyers with strong credit and stable income. Choosing between the two depends on the borrower's financial situation and investment timeline.

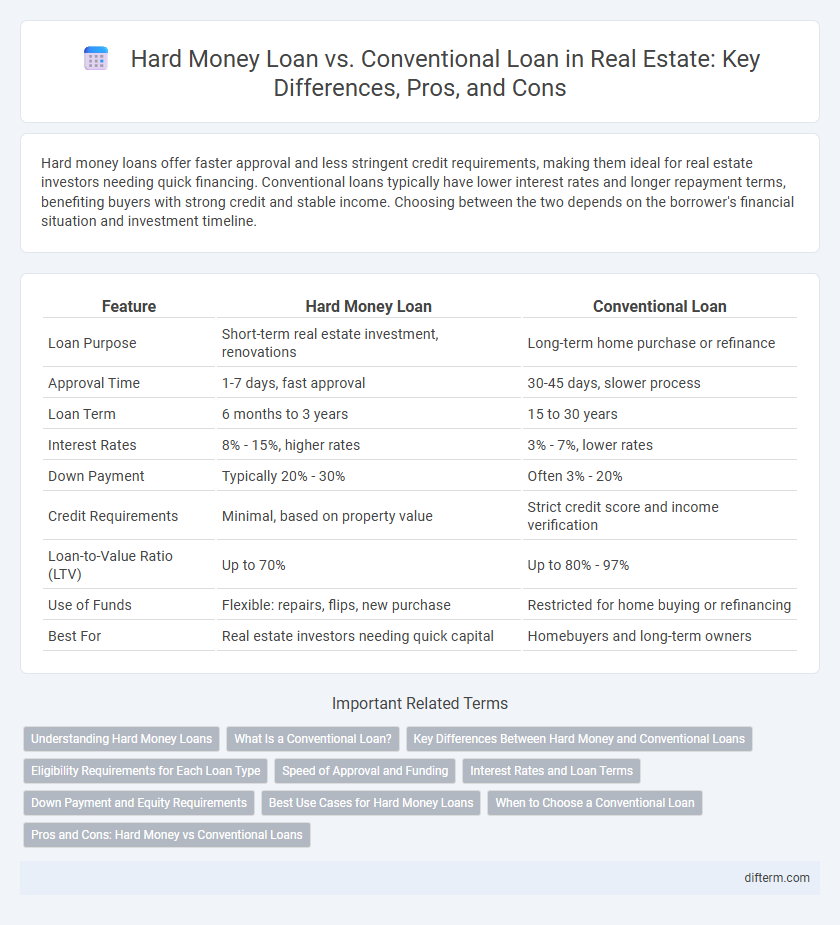

Table of Comparison

| Feature | Hard Money Loan | Conventional Loan |

|---|---|---|

| Loan Purpose | Short-term real estate investment, renovations | Long-term home purchase or refinance |

| Approval Time | 1-7 days, fast approval | 30-45 days, slower process |

| Loan Term | 6 months to 3 years | 15 to 30 years |

| Interest Rates | 8% - 15%, higher rates | 3% - 7%, lower rates |

| Down Payment | Typically 20% - 30% | Often 3% - 20% |

| Credit Requirements | Minimal, based on property value | Strict credit score and income verification |

| Loan-to-Value Ratio (LTV) | Up to 70% | Up to 80% - 97% |

| Use of Funds | Flexible: repairs, flips, new purchase | Restricted for home buying or refinancing |

| Best For | Real estate investors needing quick capital | Homebuyers and long-term owners |

Understanding Hard Money Loans

Hard money loans are short-term, asset-based financing options primarily used in real estate investing where the loan approval relies on the property's value rather than the borrower's creditworthiness. These loans typically feature higher interest rates and faster approval times compared to conventional loans, making them ideal for investors needing quick capital for property flips or renovations. Understanding hard money loans involves recognizing their flexibility, higher risk, and suitability for non-traditional borrowers or projects that conventional lenders may reject.

What Is a Conventional Loan?

A conventional loan is a mortgage that is not insured or guaranteed by the federal government, typically offered by private lenders such as banks or credit unions. These loans usually require higher credit scores, lower debt-to-income ratios, and more substantial down payments compared to hard money loans. Borrowers often choose conventional loans for long-term financing due to their lower interest rates and more favorable terms.

Key Differences Between Hard Money and Conventional Loans

Hard money loans are short-term, asset-based financing options primarily offered by private investors or companies, focusing on the property's value rather than the borrower's creditworthiness. Conventional loans, provided by banks or mortgage lenders, rely heavily on the borrower's credit score, income, and financial history with longer approval times and lower interest rates. Key differences include loan speed, approval criteria, interest rates, and terms, with hard money loans suited for quick funding and risky projects, while conventional loans fit traditional, long-term home purchases.

Eligibility Requirements for Each Loan Type

Hard money loans typically require less stringent eligibility criteria, focusing primarily on the value of the property rather than the borrower's credit score or income. Conventional loans demand higher credit scores, steady income verification, and lower debt-to-income ratios, reflecting stricter underwriting standards. Borrowers with poor credit or unconventional income sources often find hard money loans more accessible, while conventional loans favor long-term financial stability and strong credit histories.

Speed of Approval and Funding

Hard money loans offer significantly faster approval and funding times, often within days, by focusing on the property's value rather than the borrower's creditworthiness. Conventional loans typically require extensive documentation and underwriting, leading to approval timelines of 30 to 45 days or more. Investors needing quick capital for real estate deals frequently prefer hard money loans due to their expedited processing and immediate access to funds.

Interest Rates and Loan Terms

Hard money loans typically feature higher interest rates ranging from 8% to 15%, compared to conventional loans which average between 3% and 7%. Loan terms for hard money loans are generally shorter, often 6 to 24 months, whereas conventional loans offer longer terms, usually 15 to 30 years. The elevated rates and brief terms of hard money loans reflect their focus on quick access and higher risk, contrasting with the stability and affordability of conventional financing.

Down Payment and Equity Requirements

Hard money loans typically require a higher down payment, often between 20% to 30%, focusing on the property's current value rather than borrower creditworthiness. Conventional loans generally demand a lower down payment, typically ranging from 5% to 20%, based on borrower credit and income history. Equity requirements for hard money loans emphasize immediate collateral value, whereas conventional loans rely on long-term equity buildup through consistent payments.

Best Use Cases for Hard Money Loans

Hard money loans are ideal for real estate investors needing fast financing for fix-and-flip projects, land purchases, or when conventional loans are inaccessible due to poor credit or unique property conditions. These loans offer flexible underwriting and quicker approval times, making them suitable for short-term investments requiring rapid cash flow. Hard money lending is particularly beneficial in competitive markets where speed and less stringent qualifications outweigh the higher interest rates compared to conventional loans.

When to Choose a Conventional Loan

Choose a conventional loan for real estate purchases when you have a strong credit score, stable income, and a longer timeframe to close, as these loans offer lower interest rates and flexible repayment terms. Conventional loans are ideal for buyers seeking competitive financing on primary residences or investment properties with minimal upfront costs. This option is preferred when extensive documentation and credit verification support a favorable loan-to-value ratio, ensuring better affordability and financial stability.

Pros and Cons: Hard Money vs Conventional Loans

Hard money loans offer faster approval and flexible terms ideal for real estate investors needing quick funding, but they come with higher interest rates and shorter repayment periods compared to conventional loans. Conventional loans provide lower interest rates and longer repayment terms, benefiting buyers with strong credit and stable income, yet they require extensive documentation and have rigid approval criteria. Evaluating the purpose, financial situation, and timeline helps determine whether hard money or conventional loans best suit your real estate investment needs.

Hard Money Loan vs Conventional Loan Infographic

difterm.com

difterm.com