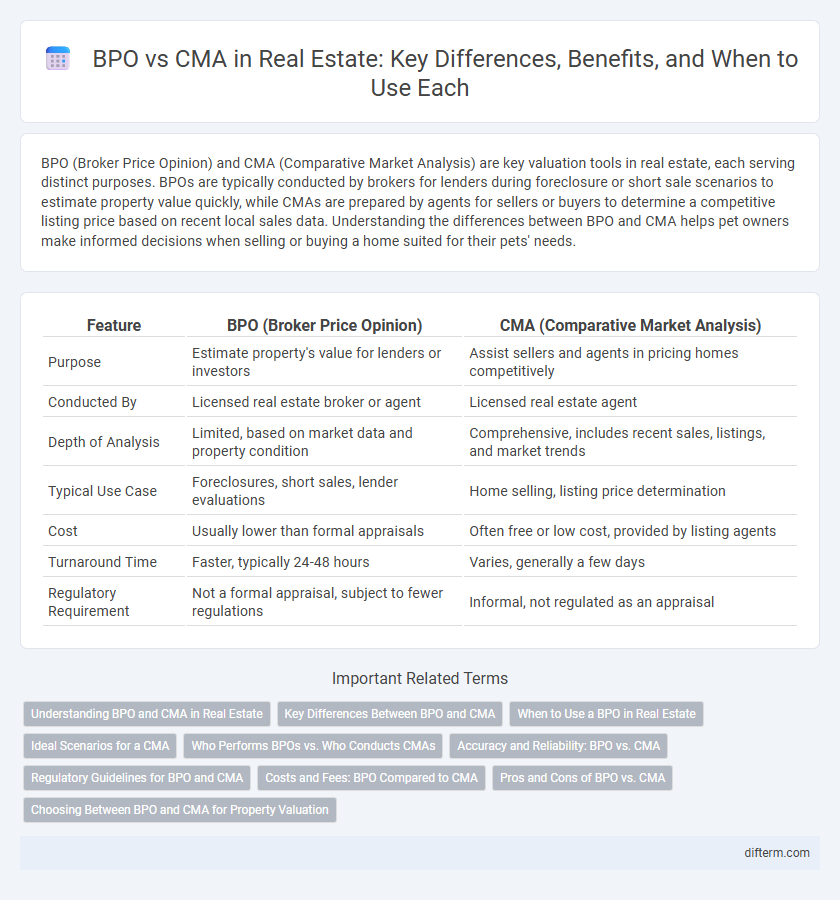

BPO (Broker Price Opinion) and CMA (Comparative Market Analysis) are key valuation tools in real estate, each serving distinct purposes. BPOs are typically conducted by brokers for lenders during foreclosure or short sale scenarios to estimate property value quickly, while CMAs are prepared by agents for sellers or buyers to determine a competitive listing price based on recent local sales data. Understanding the differences between BPO and CMA helps pet owners make informed decisions when selling or buying a home suited for their pets' needs.

Table of Comparison

| Feature | BPO (Broker Price Opinion) | CMA (Comparative Market Analysis) |

|---|---|---|

| Purpose | Estimate property's value for lenders or investors | Assist sellers and agents in pricing homes competitively |

| Conducted By | Licensed real estate broker or agent | Licensed real estate agent |

| Depth of Analysis | Limited, based on market data and property condition | Comprehensive, includes recent sales, listings, and market trends |

| Typical Use Case | Foreclosures, short sales, lender evaluations | Home selling, listing price determination |

| Cost | Usually lower than formal appraisals | Often free or low cost, provided by listing agents |

| Turnaround Time | Faster, typically 24-48 hours | Varies, generally a few days |

| Regulatory Requirement | Not a formal appraisal, subject to fewer regulations | Informal, not regulated as an appraisal |

Understanding BPO and CMA in Real Estate

Broker Price Opinions (BPO) and Comparative Market Analyses (CMA) are essential tools in real estate valuation, each serving distinct purposes. BPOs are typically requested by lenders or banks to estimate property value quickly for foreclosure or portfolio management, relying on recent sales, current listings, and property condition. CMAs, prepared by real estate agents, provide a detailed market comparison based on similar properties recently sold or listed, helping sellers set competitive prices and buyers make informed offers.

Key Differences Between BPO and CMA

BPO (Broker Price Opinion) and CMA (Comparative Market Analysis) both estimate property value but differ in scope and origin; BPO is typically prepared by licensed brokers or agents for lending purposes, often involving a more detailed inspection and market data analysis. CMA is commonly created by real estate agents to advise sellers on pricing by comparing similar recently sold properties in the neighborhood, focusing on current market trends and local sales data. BPOs tend to be more standardized and formal for financial institutions, whereas CMAs offer customized, agent-driven insights for client negotiations.

When to Use a BPO in Real Estate

A Broker Price Opinion (BPO) is ideal for determining property value quickly in situations such as short sales, foreclosures, or when a full appraisal is cost-prohibitive. BPOs provide real estate professionals with a detailed market analysis based on comparable sales and local market trends, helping lenders and investors make informed decisions. Use a BPO when needing a cost-effective, timely alternative to a Comparative Market Analysis (CMA) or formal appraisal for estimating property value.

Ideal Scenarios for a CMA

A Comparative Market Analysis (CMA) is ideal for homeowners seeking a precise property valuation based on recent sales of similar homes in the neighborhood, helping determine a competitive listing price. Real estate agents typically use CMAs during the initial stages of selling to tailor marketing strategies and attract serious buyers. CMAs provide detailed insights into market trends and property attributes, making them essential for sellers aiming for an accurate, agent-guided price estimate rather than a broader, broker price opinion (BPO).

Who Performs BPOs vs. Who Conducts CMAs

BPOs (Broker Price Opinions) are typically performed by licensed real estate brokers or agents with access to extensive market databases, enabling them to provide an estimated property value for lenders, banks, or financial institutions. CMAs (Comparative Market Analyses) are conducted exclusively by real estate agents or brokers representing sellers, utilizing recent sales data of similar properties in the local market to advise clients on competitive listing prices. While BPOs serve a broader institutional purpose, CMAs focus on assisting individual clients in setting accurate market prices for buying or selling properties.

Accuracy and Reliability: BPO vs. CMA

Broker Price Opinions (BPOs) offer a quicker, cost-effective property value estimate but typically lack the detailed market analysis found in Comparative Market Analyses (CMAs), which provide more accurate and reliable valuations through comprehensive data on recent sales, property conditions, and market trends. CMAs employ in-depth research and professional expertise to assess a property's worth precisely, making them the preferred method for real estate agents and sellers aiming for accuracy. While BPOs serve well for preliminary valuations, CMAs ensure higher reliability crucial for final pricing decisions in real estate transactions.

Regulatory Guidelines for BPO and CMA

Regulatory guidelines for Broker Price Opinions (BPOs) require strict adherence to industry standards to ensure accuracy and compliance with state laws, often involving limitations on who can perform BPOs and their intended use. Comparative Market Analyses (CMAs) must follow protocols established by real estate boards and licensing authorities, emphasizing transparency and thorough market data evaluation to support fair pricing strategies. Both BPOs and CMAs are subject to oversight from entities like the Real Estate Commission, which enforces ethical practices and prevents misleading representations in property valuation.

Costs and Fees: BPO Compared to CMA

Broker Price Opinions (BPOs) typically cost less than Comparative Market Analyses (CMAs), making them a budget-friendly option for lenders and real estate professionals seeking quick property valuations. BPO fees generally range from $50 to $150, whereas CMAs, often prepared by licensed real estate agents, can exceed $200 depending on the level of detail and market complexity. The lower cost of BPOs reflects their less comprehensive nature compared to CMAs, which consider more nuanced market data and provide a detailed pricing strategy.

Pros and Cons of BPO vs. CMA

Broker Price Opinions (BPO) offer a fast and cost-effective property valuation conducted by licensed brokers, providing an estimated market value useful for lenders and investors, yet may lack the detailed analysis found in Comparative Market Analysis (CMA). CMA delivers a comprehensive evaluation based on recent sales data and market trends, tailored by real estate agents to assist sellers in pricing homes competitively, though it often requires more time and expertise to prepare. Choosing between BPO and CMA depends on the need for speed and cost-efficiency versus accuracy and detailed market insights in property valuation.

Choosing Between BPO and CMA for Property Valuation

When choosing between a Broker Price Opinion (BPO) and a Comparative Market Analysis (CMA) for property valuation, it's crucial to consider the purpose and accuracy requirements of the assessment. BPOs, conducted by licensed brokers, provide an estimated property value often used by lenders and investors for quick decision-making, while CMAs, prepared by real estate agents, offer a detailed market-based evaluation to assist sellers in pricing homes competitively. Understanding that BPOs are typically less comprehensive than CMAs helps clients select the right method based on their need for depth and precision in valuation.

BPO vs CMA Infographic

difterm.com

difterm.com