A Double Net Lease requires tenants to pay property taxes and insurance while the landlord covers maintenance expenses, offering a balanced risk distribution. In contrast, a Triple Net Lease shifts most operating costs, including maintenance, utilities, and repairs, entirely to the tenant, resulting in lower landlord responsibilities. Investors favor Triple Net Leases for their predictable income streams and reduced management duties, whereas Double Net Leases offer a middle ground for both parties.

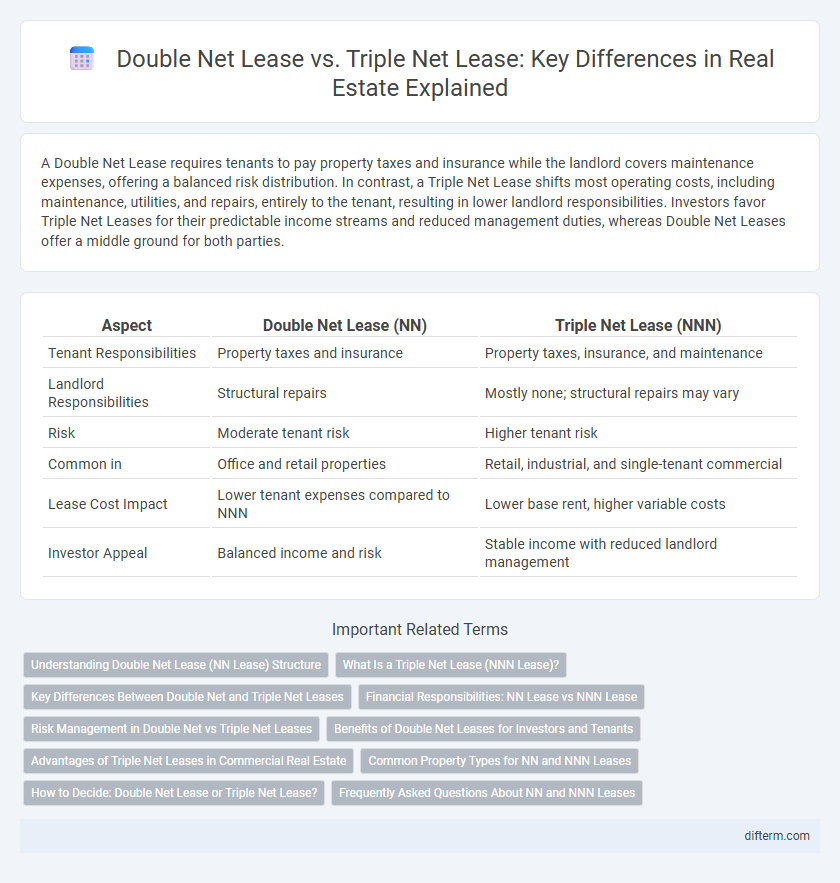

Table of Comparison

| Aspect | Double Net Lease (NN) | Triple Net Lease (NNN) |

|---|---|---|

| Tenant Responsibilities | Property taxes and insurance | Property taxes, insurance, and maintenance |

| Landlord Responsibilities | Structural repairs | Mostly none; structural repairs may vary |

| Risk | Moderate tenant risk | Higher tenant risk |

| Common in | Office and retail properties | Retail, industrial, and single-tenant commercial |

| Lease Cost Impact | Lower tenant expenses compared to NNN | Lower base rent, higher variable costs |

| Investor Appeal | Balanced income and risk | Stable income with reduced landlord management |

Understanding Double Net Lease (NN Lease) Structure

A Double Net Lease (NN Lease) requires the tenant to pay property taxes and insurance premiums in addition to the base rent while the landlord remains responsible for maintenance and structural repairs. This lease structure balances financial responsibilities, offering landlords predictable income and tenants more control over operational expenses compared to a Triple Net Lease, which shifts nearly all costs to the tenant. Understanding these distinctions helps investors and tenants tailor lease agreements to their financial and management preferences in commercial real estate.

What Is a Triple Net Lease (NNN Lease)?

A Triple Net Lease (NNN lease) requires the tenant to pay not only rent but also property taxes, insurance, and maintenance expenses, making it a popular choice in commercial real estate investments. This lease structure shifts most operational costs and financial responsibilities from the landlord to the tenant, providing landlords with a predictable income stream and reduced management burdens. Investors prefer NNN leases for their stability, long-term tenant commitments, and lower investment risk compared to other lease types.

Key Differences Between Double Net and Triple Net Leases

Double net leases (NN) require tenants to pay property taxes and insurance premiums, while the landlord covers structural maintenance. Triple net leases (NNN) assign tenants responsibility for property taxes, insurance, and all maintenance costs, including structural repairs. The primary distinction lies in the extent of tenant obligations, with triple net leases transferring more financial risks and operational duties from landlord to tenant.

Financial Responsibilities: NN Lease vs NNN Lease

In a Double Net (NN) lease, tenants are responsible for property taxes and insurance premiums, while landlords handle maintenance and structural repairs, reducing tenant financial obligations compared to a Triple Net (NNN) lease. Triple Net leases require tenants to cover property taxes, insurance, and all maintenance costs, including repairs and management, transferring nearly all financial responsibilities from the landlord to the tenant. This increased financial exposure in NNN leases often results in lower base rents, whereas NN leases balance cost-sharing between tenant and landlord.

Risk Management in Double Net vs Triple Net Leases

Double Net Leases (NN) limit tenant responsibilities to property taxes and insurance, reducing risk exposure for landlords compared to Triple Net Leases (NNN), where tenants assume maintenance and repair costs as well. This risk distribution in Double Net Leases provides landlords with more predictable expenses and fewer unexpected liabilities, while tenants benefit from some operational control with capped financial obligations. Triple Net Leases transfer most property-related risks to tenants, increasing their operational burden but offering landlords a more hands-off investment with stable net income.

Benefits of Double Net Leases for Investors and Tenants

Double net leases offer investors reduced risk by requiring tenants to cover property taxes and insurance, while landlords retain responsibility for maintenance, enhancing investment predictability. Tenants benefit from lower overall expenses and increased control over property conditions, fostering better long-term occupancy and satisfaction. This lease structure balances financial responsibility, making it appealing for both parties in commercial real estate agreements.

Advantages of Triple Net Leases in Commercial Real Estate

Triple net leases (NNN) transfer property expenses such as taxes, insurance, and maintenance to the tenant, reducing financial risk for landlords and providing predictable income streams. This lease structure enhances cash flow stability, making it highly attractive for investors seeking low management responsibilities. Commercial real estate investors benefit from triple net leases through long-term, stable returns and minimized landlord operational burdens.

Common Property Types for NN and NNN Leases

Double net leases (NN) are commonly used in retail properties, office buildings, and industrial spaces where tenants cover property taxes and insurance while landlords handle maintenance costs. Triple net leases (NNN) prevail in single-tenant retail locations, medical offices, and standalone commercial buildings, shifting most expenses, including maintenance and repairs, to the tenant. Investors often prefer NNN leases for their predictability and lower management responsibilities associated with these property types.

How to Decide: Double Net Lease or Triple Net Lease?

Choosing between a Double Net Lease and a Triple Net Lease depends on the tenant's and landlord's willingness to share property expenses such as taxes, insurance, and maintenance. Double Net Leases require tenants to cover property taxes and insurance, while landlords handle maintenance costs, making them ideal for tenants seeking fewer responsibilities. Triple Net Leases transfer all three expenses to the tenant, offering landlords reduced risk and consistent net income but demanding tenants manage all property-related costs.

Frequently Asked Questions About NN and NNN Leases

Double Net Lease (NN) requires tenants to pay property taxes and insurance, while the landlord covers maintenance costs; Triple Net Lease (NNN) passes property taxes, insurance, and maintenance expenses to the tenant, offering landlords reduced management responsibilities. NN leases are common in retail and office spaces, appealing to investors seeking moderate risk, whereas NNN leases attract investors favoring predictable income with minimal involvement. Lease terms, tenant creditworthiness, and property type significantly influence whether an NN or NNN lease is suitable for a specific investment.

Double Net Lease vs Triple Net Lease Infographic

difterm.com

difterm.com