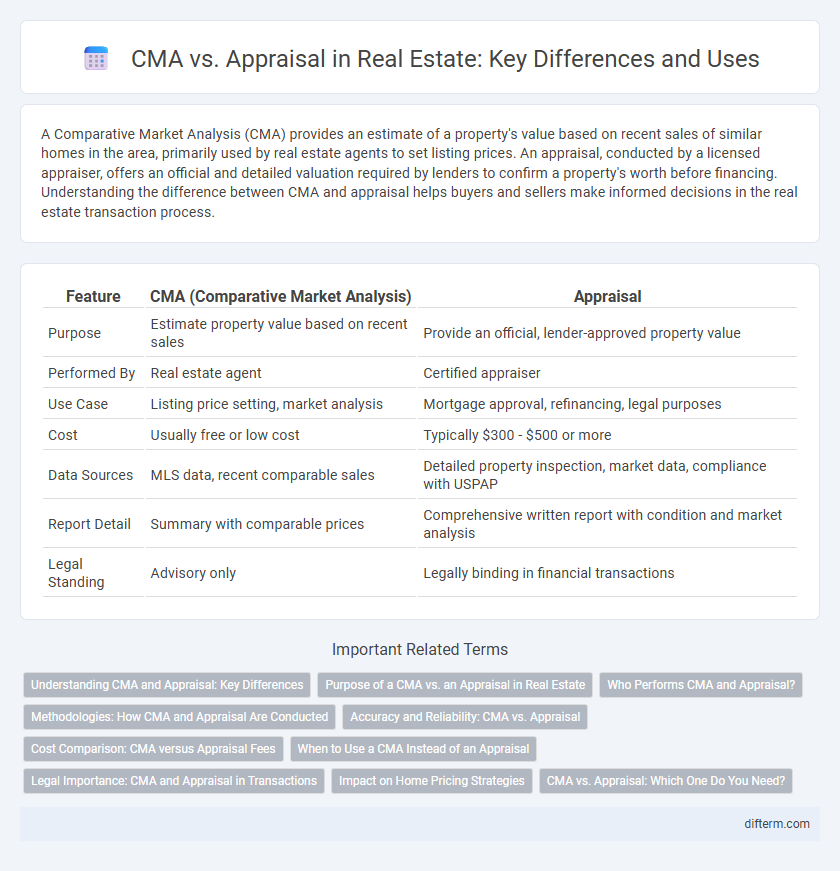

A Comparative Market Analysis (CMA) provides an estimate of a property's value based on recent sales of similar homes in the area, primarily used by real estate agents to set listing prices. An appraisal, conducted by a licensed appraiser, offers an official and detailed valuation required by lenders to confirm a property's worth before financing. Understanding the difference between CMA and appraisal helps buyers and sellers make informed decisions in the real estate transaction process.

Table of Comparison

| Feature | CMA (Comparative Market Analysis) | Appraisal |

|---|---|---|

| Purpose | Estimate property value based on recent sales | Provide an official, lender-approved property value |

| Performed By | Real estate agent | Certified appraiser |

| Use Case | Listing price setting, market analysis | Mortgage approval, refinancing, legal purposes |

| Cost | Usually free or low cost | Typically $300 - $500 or more |

| Data Sources | MLS data, recent comparable sales | Detailed property inspection, market data, compliance with USPAP |

| Report Detail | Summary with comparable prices | Comprehensive written report with condition and market analysis |

| Legal Standing | Advisory only | Legally binding in financial transactions |

Understanding CMA and Appraisal: Key Differences

A Comparative Market Analysis (CMA) estimates a property's value based on recent sales of similar homes in the same area, primarily used by real estate agents for pricing strategies. An appraisal is a formal, professional valuation conducted by a licensed appraiser, often required by lenders for mortgage approval. CMAs rely on local market trends and agent expertise, while appraisals follow strict regulatory standards and objective criteria.

Purpose of a CMA vs. an Appraisal in Real Estate

A Comparative Market Analysis (CMA) estimates a property's market value based on recent sales of similar homes in the area, primarily used by sellers and agents to set competitive listing prices. An appraisal, conducted by a licensed appraiser, provides an official, unbiased property valuation required by lenders during the mortgage approval process to ensure the loan amount matches the home's worth. CMAs offer market-driven pricing insights while appraisals deliver formal, legally recognized valuations essential for financing.

Who Performs CMA and Appraisal?

Comparative Market Analysis (CMA) is typically performed by real estate agents who use recent sales data, local market trends, and property features to estimate a home's value for buyers or sellers. Appraisals are conducted by licensed or certified appraisers trained to provide an unbiased valuation, often required by lenders during mortgage approval. Both CMA and appraisals provide critical insights, but appraisers rely on standardized methods and must adhere to regulatory guidelines.

Methodologies: How CMA and Appraisal Are Conducted

A Comparative Market Analysis (CMA) relies primarily on analyzing recent sales of similar properties within a specific area to estimate a home's market value, using data such as location, size, condition, and amenities. An appraisal involves a licensed appraiser conducting a detailed inspection of the property, examining structural elements, improvements, and local market trends, and applying standardized valuation methods including cost, income, and sales comparison approaches. While CMAs are typically prepared by real estate agents using accessible MLS data, appraisals require a formal process with professional evaluation to produce a legally recognized value report.

Accuracy and Reliability: CMA vs. Appraisal

A Comparative Market Analysis (CMA) leverages recent sales data and current listings to estimate a property's market value, offering a quick and cost-effective snapshot often used by real estate agents. In contrast, an appraisal is conducted by a licensed professional who performs a detailed inspection and analysis, resulting in a legally recognized and highly reliable valuation required for mortgage underwriting. While CMAs provide a valuable market perspective, appraisals deliver superior accuracy and credibility due to their standardized methodology and objective assessment.

Cost Comparison: CMA versus Appraisal Fees

Comparative Market Analysis (CMA) typically costs significantly less than a professional appraisal, with CMA fees often ranging from $0 to a few hundred dollars, as it is usually provided by real estate agents as part of their service package or for a nominal fee. Professional appraisals, required for mortgage approvals and detailed property valuations, usually cost between $300 and $600, depending on property size and location. Choosing between a CMA and an appraisal depends on the buyer's or seller's need for accuracy versus budget constraints.

When to Use a CMA Instead of an Appraisal

A Comparative Market Analysis (CMA) is ideal for sellers and buyers needing a quick, cost-effective estimate of a property's value based on recent sales of similar homes in the neighborhood. Real estate agents commonly use CMAs during the listing process to set competitive asking prices or to evaluate offer price ranges. An appraisal is more appropriate for formal needs such as mortgage approval, refinancing, or legal disputes, where a licensed appraiser provides a certified value assessment.

Legal Importance: CMA and Appraisal in Transactions

Comparative Market Analysis (CMA) serves as an informal estimate of property value used by real estate agents to guide pricing strategies, but it lacks legal standing in real estate transactions. In contrast, a professional appraisal is a legally recognized, objective valuation performed by a licensed appraiser, essential for mortgage approvals, tax assessments, and legal disputes. Courts and lending institutions rely on appraisals due to their regulatory compliance and standardized methodology, underscoring their critical legal importance over CMAs in contractual agreements.

Impact on Home Pricing Strategies

A Comparative Market Analysis (CMA) provides real estate agents with current market trends and recent sales data, offering a strategic pricing framework based on competitive market activity. An appraisal, conducted by a licensed appraiser, delivers an expert valuation grounded in property condition, location, and comparable sales, often used for mortgage approval. Incorporating both CMA and appraisal insights allows sellers to set accurate home prices that attract buyers while meeting lender requirements, enhancing pricing strategy effectiveness.

CMA vs. Appraisal: Which One Do You Need?

A Comparative Market Analysis (CMA) estimates a property's market value based on recent sales of similar homes, making it essential for sellers and buyers seeking a realistic price range. An appraisal, conducted by a licensed professional, provides a precise value required by lenders during mortgage approval, ensuring the loan amount reflects the property's true worth. Choosing between a CMA and an appraisal depends on your specific need: a CMA for strategic pricing and an appraisal for official financing.

CMA vs Appraisal Infographic

difterm.com

difterm.com