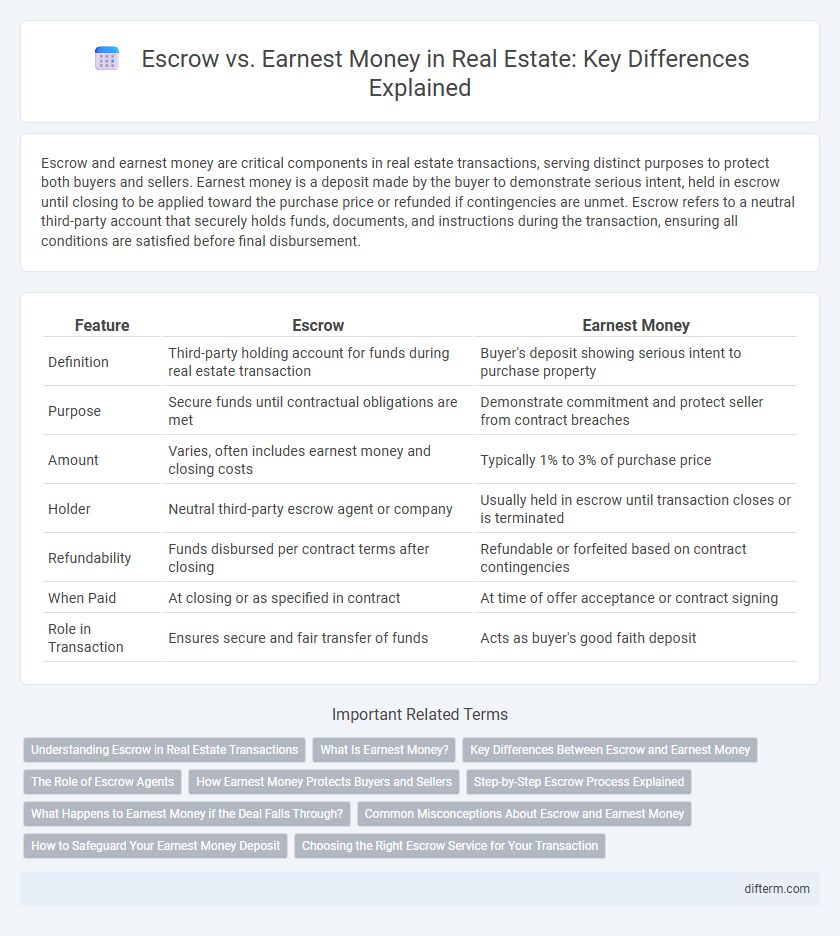

Escrow and earnest money are critical components in real estate transactions, serving distinct purposes to protect both buyers and sellers. Earnest money is a deposit made by the buyer to demonstrate serious intent, held in escrow until closing to be applied toward the purchase price or refunded if contingencies are unmet. Escrow refers to a neutral third-party account that securely holds funds, documents, and instructions during the transaction, ensuring all conditions are satisfied before final disbursement.

Table of Comparison

| Feature | Escrow | Earnest Money |

|---|---|---|

| Definition | Third-party holding account for funds during real estate transaction | Buyer's deposit showing serious intent to purchase property |

| Purpose | Secure funds until contractual obligations are met | Demonstrate commitment and protect seller from contract breaches |

| Amount | Varies, often includes earnest money and closing costs | Typically 1% to 3% of purchase price |

| Holder | Neutral third-party escrow agent or company | Usually held in escrow until transaction closes or is terminated |

| Refundability | Funds disbursed per contract terms after closing | Refundable or forfeited based on contract contingencies |

| When Paid | At closing or as specified in contract | At time of offer acceptance or contract signing |

| Role in Transaction | Ensures secure and fair transfer of funds | Acts as buyer's good faith deposit |

Understanding Escrow in Real Estate Transactions

Escrow in real estate transactions serves as a neutral holding account for funds, such as earnest money deposits, until all contractual conditions are met, ensuring security for both buyers and sellers. It protects parties by verifying that obligations like inspections, title searches, and financing are completed before funds are released. This process reduces risk and fosters trust throughout the home buying or selling journey.

What Is Earnest Money?

Earnest money is a deposit made by a homebuyer to demonstrate serious intent to purchase a property, typically held in escrow until closing. This deposit, often ranging from 1% to 3% of the purchase price, provides sellers with financial assurance and can be applied toward the down payment or closing costs. Earnest money protects both parties by ensuring the buyer commits to the transaction while allowing funds to be refunded or forfeited based on contract contingencies.

Key Differences Between Escrow and Earnest Money

Escrow and earnest money serve distinct roles in real estate transactions, with escrow acting as a neutral third-party account that holds funds, documents, and instructions until all conditions of the sale are met, ensuring secure and impartial management. Earnest money is a deposit made by the buyer to demonstrate serious intent and good faith, typically applied towards the purchase price or returned based on contract terms. While escrow safeguards the entire transaction process, earnest money specifically functions as a buyer's commitment, highlighting key differences in purpose, timing, and control of funds.

The Role of Escrow Agents

Escrow agents serve as neutral third parties who securely hold funds, such as earnest money deposits, during real estate transactions to ensure contractual conditions are met before funds are released. They manage escrow accounts, safeguarding buyer and seller interests by preventing premature access to money until all contingencies, inspections, and title verifications are satisfied. Their role minimizes risk and builds trust, facilitating a smoother closing process in property sales.

How Earnest Money Protects Buyers and Sellers

Earnest money serves as a financial commitment from the buyer, demonstrating serious intent to purchase and protecting sellers from potential losses if the buyer defaults. This deposit is held in escrow, ensuring neutral management until the completion or termination of the transaction, which safeguards both parties by confirming buyer good faith and seller security. In real estate deals, earnest money reduces transaction risks by incentivizing buyer follow-through and compensating sellers for the time their property is off the market.

Step-by-Step Escrow Process Explained

The escrow process in real estate begins when the buyer submits earnest money as a good faith deposit to demonstrate commitment. Escrow agents hold these funds securely, verify contract conditions, coordinate property inspections, and ensure all contingencies are met before closing. Upon successful completion of requirements, the escrow agent disburses funds appropriately, facilitating a transparent and secure property transaction.

What Happens to Earnest Money if the Deal Falls Through?

If the deal falls through, the fate of earnest money depends on the terms of the purchase agreement and contingencies met. Typically, if the buyer backs out without a valid contingency, the seller may keep the earnest money as compensation. Conversely, if the deal dissolves due to unmet contingencies like inspection or financing, the buyer is usually entitled to a refund of the earnest money.

Common Misconceptions About Escrow and Earnest Money

Common misconceptions about escrow and earnest money include the belief that earnest money is a deposit held by the seller, when it is actually held in an escrow account by a neutral third party. Many buyers mistakenly think escrow funds are immediately applied to the purchase price, but they primarily ensure contractual obligations are met before closing. Understanding that escrow provides a secure holding place for both earnest money and other transaction funds clarifies its critical role in protecting buyer and seller interests.

How to Safeguard Your Earnest Money Deposit

Safeguarding your earnest money deposit involves ensuring it is held by a neutral third party, typically an escrow company, which protects the funds until transaction conditions are met. Carefully review the purchase agreement for clear contingencies that allow refunding the deposit if contract terms are not satisfied. Verifying the escrow agent's credentials and maintaining thorough documentation of all communications and agreements strengthens protection against potential disputes.

Choosing the Right Escrow Service for Your Transaction

Choosing the right escrow service for your real estate transaction ensures secure handling of funds and compliance with local regulations. Evaluate escrow companies based on their licensing, reputation, transparency in fees, and ability to provide clear communication throughout the closing process. A reliable escrow service protects both buyers and sellers, minimizing risks and facilitating a smooth transfer of ownership.

Escrow vs Earnest Money Infographic

difterm.com

difterm.com