Off-market properties offer buyers exclusive access to homes not publicly advertised, often leading to lower competition and negotiated prices, while listed properties provide greater visibility and transparent market comparison. Buyers seeking privacy and unique opportunities tend to favor off-market deals, whereas those valuing convenience and market data usually prefer listed properties. Understanding these differences helps investors and homebuyers tailor strategies to their priorities and market conditions.

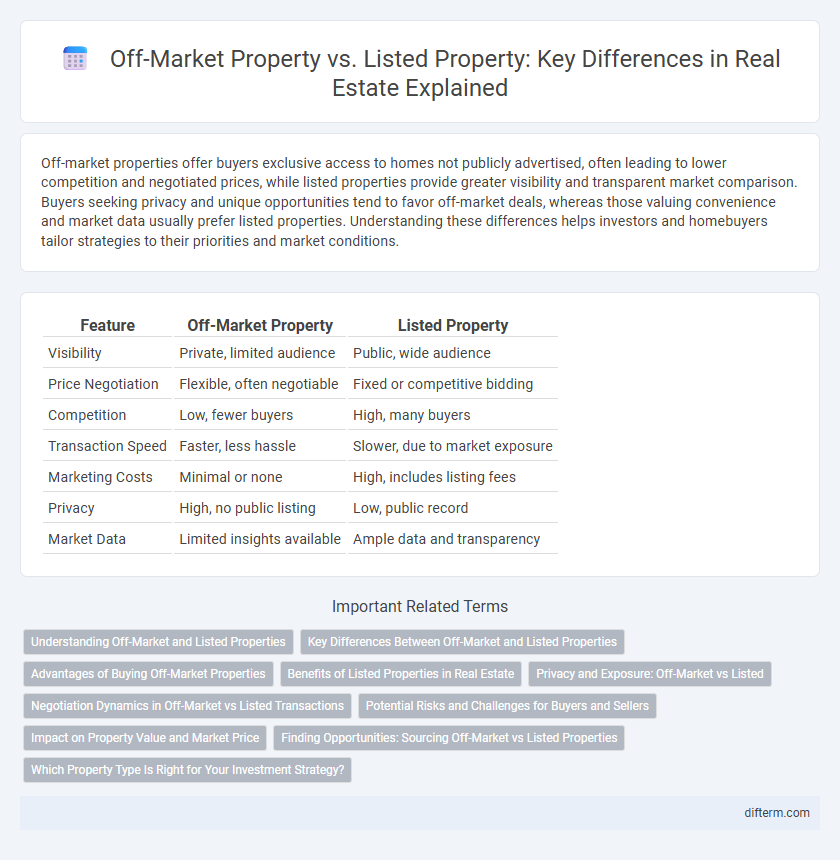

Table of Comparison

| Feature | Off-Market Property | Listed Property |

|---|---|---|

| Visibility | Private, limited audience | Public, wide audience |

| Price Negotiation | Flexible, often negotiable | Fixed or competitive bidding |

| Competition | Low, fewer buyers | High, many buyers |

| Transaction Speed | Faster, less hassle | Slower, due to market exposure |

| Marketing Costs | Minimal or none | High, includes listing fees |

| Privacy | High, no public listing | Low, public record |

| Market Data | Limited insights available | Ample data and transparency |

Understanding Off-Market and Listed Properties

Off-market properties are real estate assets not publicly advertised or listed on Multiple Listing Services (MLS), often accessible through private networks or direct seller outreach. Listed properties are actively marketed on MLS platforms, exposing them to a wide audience of buyers and real estate agents, which typically results in faster sales. Understanding the distinction between off-market and listed properties enables investors to leverage exclusive opportunities and avoid competitive bidding wars.

Key Differences Between Off-Market and Listed Properties

Off-market properties are sold privately without public listings, often allowing buyers to avoid competitive bidding and sellers to maintain privacy. Listed properties are publicly available through Multiple Listing Services (MLS), increasing visibility but also attracting multiple offers and potentially higher prices. The key differences lie in market exposure, negotiation dynamics, and transaction transparency.

Advantages of Buying Off-Market Properties

Buying off-market properties offers exclusive access to listings not publicly advertised, reducing competition and allowing for more favorable pricing negotiations. These properties often provide opportunities for investors to acquire unique or undervalued real estate, enhancing potential return on investment. Privacy and discretion in transactions can also benefit both buyers and sellers, streamlining the purchase process.

Benefits of Listed Properties in Real Estate

Listed properties provide extensive market exposure through multiple listing services (MLS), attracting a wider pool of potential buyers and increasing the chances of a competitive sale price. These properties offer transparency in pricing and property history, enabling informed decision-making for both buyers and sellers. Access to professional marketing tools and real estate agent networks enhances the negotiation process, often leading to quicker transactions and greater market visibility.

Privacy and Exposure: Off-Market vs Listed

Off-market properties offer increased privacy by limiting exposure to a select group of buyers, reducing public visibility and potential market competition. Listed properties, conversely, benefit from broad exposure through multiple listing services (MLS) and online platforms, attracting a wider audience but sacrificing confidentiality. Sellers seeking discretion often prefer off-market deals, while those aiming for maximum market reach choose listed options.

Negotiation Dynamics in Off-Market vs Listed Transactions

Negotiation dynamics in off-market property transactions often favor buyers and sellers due to reduced competition and increased confidentiality, enabling more flexible price discussions and personalized deal structures. Listed property negotiations typically involve multiple bidders, driving prices upward and limiting the seller's willingness to entertain significant concessions. Off-market deals also allow for longer negotiation periods and bespoke terms, creating opportunities for creative financing and tailored contingencies.

Potential Risks and Challenges for Buyers and Sellers

Off-market properties often lack transparency, increasing risks related to property condition, valuation accuracy, and market comparability, which can complicate due diligence for both buyers and sellers. Listed properties provide more comprehensive market data and disclosure requirements but may face higher competition and price volatility, posing challenges in negotiation and timely transactions. Buyers and sellers must carefully weigh these factors to mitigate risks such as overpaying, undisclosed defects, or prolonged sale periods.

Impact on Property Value and Market Price

Off-market properties often sell below market price due to limited exposure, impacting perceived property value and offering potential bargains to buyers. Listed properties benefit from broad market visibility, driving competitive pricing that usually aligns with or exceeds market value. The choice between off-market and listed properties significantly influences negotiation power and final transaction price in real estate.

Finding Opportunities: Sourcing Off-Market vs Listed Properties

Off-market properties often provide unique investment opportunities as they are not publicly listed, reducing competition and allowing for more flexible negotiations with motivated sellers. Listed properties, while widely accessible, tend to attract numerous buyers, driving up prices and limiting bargaining power. Leveraging off-market sourcing methods such as networking, direct outreach, and real estate investor connections increases the chance of discovering undervalued or exclusive deals not found through traditional listing services.

Which Property Type Is Right for Your Investment Strategy?

Off-market properties often present unique investment opportunities with less competition and potential for better pricing compared to listed properties, which benefit from greater market visibility and detailed property disclosures. Investors prioritizing privacy, negotiation flexibility, and potential value discovery may favor off-market deals, while those seeking liquidity, transparent market data, and streamlined transactions often prefer listed properties. Aligning your choice with goals such as risk tolerance, investment timeline, and capital availability ensures the selected property type optimizes portfolio performance.

Off-Market Property vs Listed Property Infographic

difterm.com

difterm.com