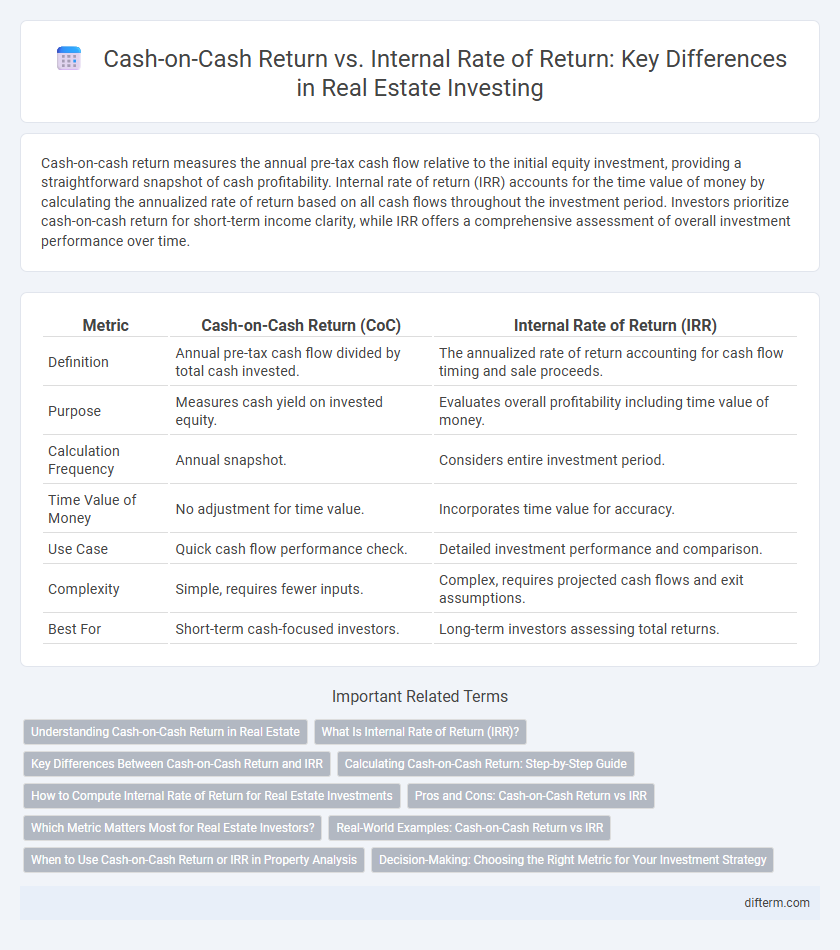

Cash-on-cash return measures the annual pre-tax cash flow relative to the initial equity investment, providing a straightforward snapshot of cash profitability. Internal rate of return (IRR) accounts for the time value of money by calculating the annualized rate of return based on all cash flows throughout the investment period. Investors prioritize cash-on-cash return for short-term income clarity, while IRR offers a comprehensive assessment of overall investment performance over time.

Table of Comparison

| Metric | Cash-on-Cash Return (CoC) | Internal Rate of Return (IRR) |

|---|---|---|

| Definition | Annual pre-tax cash flow divided by total cash invested. | The annualized rate of return accounting for cash flow timing and sale proceeds. |

| Purpose | Measures cash yield on invested equity. | Evaluates overall profitability including time value of money. |

| Calculation Frequency | Annual snapshot. | Considers entire investment period. |

| Time Value of Money | No adjustment for time value. | Incorporates time value for accuracy. |

| Use Case | Quick cash flow performance check. | Detailed investment performance and comparison. |

| Complexity | Simple, requires fewer inputs. | Complex, requires projected cash flows and exit assumptions. |

| Best For | Short-term cash-focused investors. | Long-term investors assessing total returns. |

Understanding Cash-on-Cash Return in Real Estate

Cash-on-cash return in real estate measures the annual pre-tax cash flow relative to the amount of cash initially invested, providing investors with a straightforward metric to evaluate the profitability of rental properties. Unlike internal rate of return (IRR), which considers the time value of money and projects overall investment performance, cash-on-cash return focuses solely on cash income generated each year. This metric is particularly valuable for real estate investors seeking quick insight into the immediate cash yield from their investment properties.

What Is Internal Rate of Return (IRR)?

Internal Rate of Return (IRR) in real estate measures the annualized rate of return on an investment by calculating the discount rate that makes the net present value (NPV) of all cash flows equal to zero. IRR accounts for the timing and magnitude of cash inflows and outflows, reflecting the investment's profitability over time. This metric provides a comprehensive view of potential returns, encompassing both interim cash flows and the final sale proceeds.

Key Differences Between Cash-on-Cash Return and IRR

Cash-on-cash return measures the annual pre-tax cash income relative to the actual cash invested, providing a straightforward snapshot of cash flow performance. Internal rate of return (IRR) calculates the overall profitability by accounting for the time value of money and the total expected cash flows throughout the investment holding period. Unlike cash-on-cash return, IRR offers a comprehensive assessment of long-term investment potential by incorporating timing and reinvestment assumptions.

Calculating Cash-on-Cash Return: Step-by-Step Guide

Calculating cash-on-cash return involves dividing the annual pre-tax cash flow by the total cash invested in the property, expressed as a percentage. Begin by determining your total cash investment, including down payment and any initial repairs or closing costs. Next, calculate the net operating income minus debt service to find the annual cash flow, then divide this figure by your initial cash investment to assess the investment's short-term profitability.

How to Compute Internal Rate of Return for Real Estate Investments

Calculating the Internal Rate of Return (IRR) for real estate investments involves estimating the discount rate that makes the net present value (NPV) of all cash flows, including initial investment and periodic returns, equal to zero. Investors typically use financial software or IRR functions in spreadsheets like Excel, inputting the series of cash inflows and outflows over the holding period. Unlike cash-on-cash return, which measures annual income relative to invested cash, IRR accounts for the time value of money, offering a more comprehensive profitability metric.

Pros and Cons: Cash-on-Cash Return vs IRR

Cash-on-cash return offers a straightforward metric by measuring annual pre-tax cash flow relative to initial equity, allowing investors to quickly gauge actual cash profitability but neglecting the time value of money and long-term growth. Internal Rate of Return (IRR) accounts for the time value of money and cash flow timing, providing a more comprehensive assessment of investment performance over the entire holding period, yet it relies on estimated future cash flows which may introduce uncertainty. Investors often use cash-on-cash return for short-term liquidity analysis and IRR for evaluating overall project viability and comparing different investment opportunities.

Which Metric Matters Most for Real Estate Investors?

Cash-on-cash return measures the annual pre-tax cash flow relative to the initial equity invested, providing real estate investors with a straightforward snapshot of cash profitability. Internal rate of return (IRR) accounts for the time value of money by calculating the compound annual growth rate of all cash flows, making it essential for evaluating long-term investment performance. For real estate investors focused on steady income, cash-on-cash return is critical, while IRR offers a more comprehensive assessment of overall investment efficiency and exit strategy potential.

Real-World Examples: Cash-on-Cash Return vs IRR

Cash-on-cash return measures the annual pre-tax cash flow relative to the actual cash invested, offering a straightforward snapshot of investment performance in real estate. Internal rate of return (IRR) incorporates the time value of money and the timing of cash flows, providing a more comprehensive view of long-term profitability in property investments. Real-world examples reveal that properties with high initial cash-on-cash returns may have lower IRRs if cash flows diminish over time, while investments with moderate cash-on-cash returns can yield higher IRRs due to appreciation and reinvested earnings.

When to Use Cash-on-Cash Return or IRR in Property Analysis

Cash-on-cash return is ideal for investors seeking straightforward, annual cash flow performance from rental properties without complex calculations. Internal rate of return (IRR) is better suited for analyzing long-term investments with variable cash flows and capital appreciation, incorporating the time value of money. Use cash-on-cash return for quick liquidity assessment, while IRR provides a comprehensive measure of overall investment profitability over the holding period.

Decision-Making: Choosing the Right Metric for Your Investment Strategy

Cash-on-cash return provides a straightforward measure of annual cash income relative to the cash invested, ideal for investors prioritizing immediate cash flow assessment. Internal rate of return (IRR) offers a comprehensive evaluation of an investment's profitability by incorporating the time value of money and projected cash flows over the entire holding period. Choosing the right metric depends on whether an investor values short-term cash yield or long-term growth potential when making real estate investment decisions.

Cash-on-cash return vs internal rate of return Infographic

difterm.com

difterm.com