Leasehold properties grant the tenant the right to use and occupy land or buildings for a fixed period, typically ranging from 99 to 999 years, after which ownership reverts to the freeholder. Freehold ownership confers full and permanent ownership of the property and land, providing greater control and long-term security. Understanding the differences between leasehold and freehold is crucial for investors and homeowners to make informed decisions regarding property rights, responsibilities, and future value.

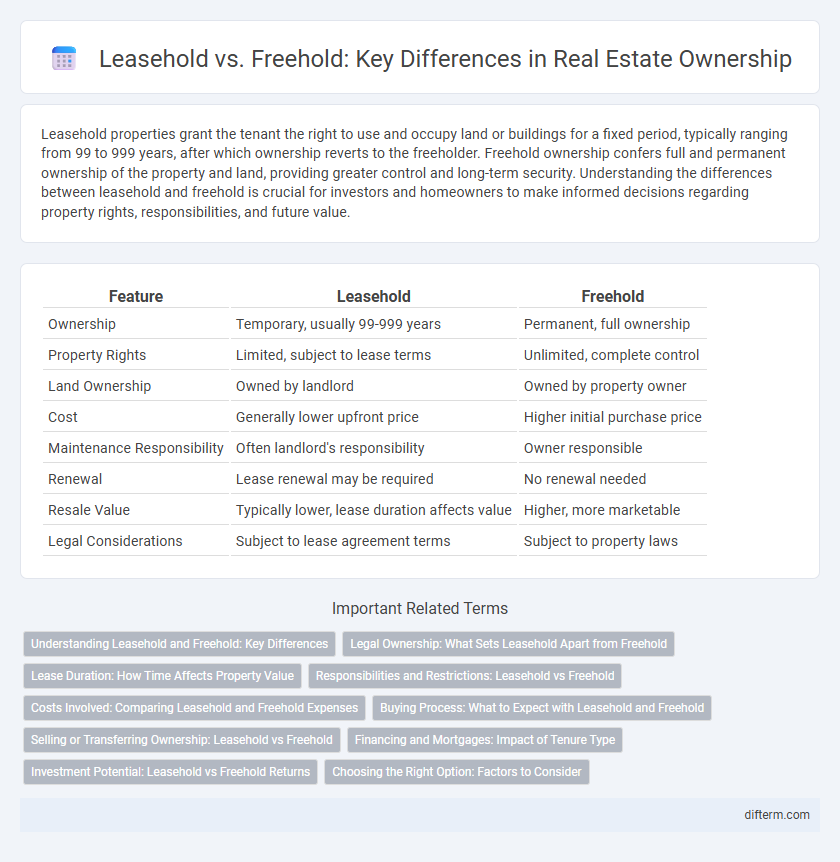

Table of Comparison

| Feature | Leasehold | Freehold |

|---|---|---|

| Ownership | Temporary, usually 99-999 years | Permanent, full ownership |

| Property Rights | Limited, subject to lease terms | Unlimited, complete control |

| Land Ownership | Owned by landlord | Owned by property owner |

| Cost | Generally lower upfront price | Higher initial purchase price |

| Maintenance Responsibility | Often landlord's responsibility | Owner responsible |

| Renewal | Lease renewal may be required | No renewal needed |

| Resale Value | Typically lower, lease duration affects value | Higher, more marketable |

| Legal Considerations | Subject to lease agreement terms | Subject to property laws |

Understanding Leasehold and Freehold: Key Differences

Leasehold property grants ownership for a fixed term, typically between 99 to 999 years, after which the ownership reverts to the freeholder, while freehold property provides permanent ownership of both the building and the land. Leaseholders often face ground rent, service charges, and restrictions on modifications, whereas freeholders have full control over their property without such constraints. Understanding these differences is crucial for buyers evaluating long-term value, legal responsibilities, and property control.

Legal Ownership: What Sets Leasehold Apart from Freehold

Leasehold properties grant legal ownership for a fixed term, typically ranging from 99 to 999 years, after which ownership reverts to the freeholder. Freehold ownership provides indefinite, outright ownership of the land and property, including the right to modify or sell the asset without seeking permission. The key legal distinction lies in leasehold's time-bound rights and obligations, contrasted with freehold's perpetual ownership and complete control.

Lease Duration: How Time Affects Property Value

Leasehold properties typically have a fixed lease duration, often ranging from 99 to 999 years, which directly impacts their market value as the lease term shortens. Freehold properties offer indefinite ownership, maintaining stable or appreciating value over time without diminishing lease concerns. The decreasing lease duration in leasehold agreements can lead to lower property values and higher costs for lease extension, affecting long-term investment potential.

Responsibilities and Restrictions: Leasehold vs Freehold

Leasehold properties impose specific responsibilities and restrictions on tenants, such as maintaining the property, paying ground rent, and adhering to lease terms set by the freeholder. Freehold ownership grants full control and responsibility over the property and land, including decisions on modifications, maintenance, and no external fees or lease limitations. Leaseholders may face limitations on alterations or subletting, whereas freeholders enjoy unrestricted rights within local planning laws.

Costs Involved: Comparing Leasehold and Freehold Expenses

Leasehold properties typically involve ongoing costs such as ground rent, service charges, and potential lease extension fees, often making them more expensive over time compared to freehold estates. Freehold ownership generally entails a one-time purchase cost with fewer recurring expenses, primarily property taxes and maintenance, offering better long-term financial predictability. Understanding these cost differences is crucial for buyers evaluating total investment and future liabilities in real estate transactions.

Buying Process: What to Expect with Leasehold and Freehold

When buying leasehold property, expect a thorough review of the lease terms, including duration, ground rent, and any service charges, as these significantly impact long-term costs and ownership rights. For freehold purchases, the process centers on verifying clear ownership of both the building and the land, ensuring no outstanding liens or covenants restrict use. Due diligence in both cases involves legal searches and obtaining mortgage approvals, but leasehold transactions often require additional consideration of lease extensions and management agreements.

Selling or Transferring Ownership: Leasehold vs Freehold

Selling or transferring ownership of freehold property offers full asset control and straightforward title transfer, attracting buyers seeking long-term security. Leasehold property sales involve complexities due to limited lease terms and landlord permissions, often requiring lease extension negotiations to maintain value. Understanding title conditions and potential restrictions is crucial for maximizing sale proceeds in both leasehold and freehold transactions.

Financing and Mortgages: Impact of Tenure Type

Leasehold properties typically face stricter financing criteria, with lenders often requiring higher down payments and shorter mortgage terms due to the limited ownership period, affecting loan approval rates. Freehold properties generally offer easier access to favorable mortgage options, longer terms, and lower interest rates, reflecting the unrestricted ownership rights. The lease length remaining on a leasehold significantly influences lender willingness, with shorter leases reducing mortgage availability and property value.

Investment Potential: Leasehold vs Freehold Returns

Freehold properties typically offer higher long-term investment returns due to complete ownership and the absence of lease expiry risk, attracting buyers seeking asset appreciation and control. Leasehold investments often have lower upfront costs but may face diminishing value as lease terms shorten, impacting resale potential and lender interest. Investors weigh freehold's stability and capital gain prospects against leasehold's initial affordability and shorter investment horizon.

Choosing the Right Option: Factors to Consider

When choosing between leasehold and freehold properties, consider factors such as ownership duration, maintenance responsibilities, and resale value. Freehold offers permanent ownership and greater control, while leasehold may have restrictions and diminishing lease terms impacting investment security. Evaluate legal implications, long-term financial benefits, and property location to make an informed decision that aligns with your goals.

Leasehold vs Freehold Infographic

difterm.com

difterm.com