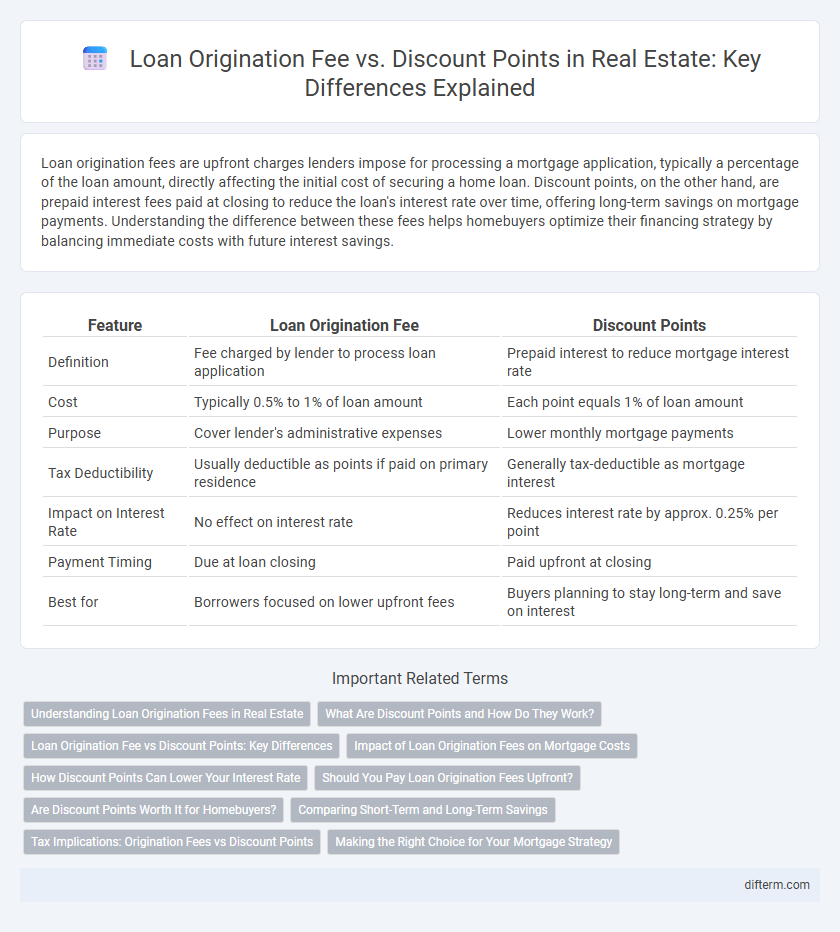

Loan origination fees are upfront charges lenders impose for processing a mortgage application, typically a percentage of the loan amount, directly affecting the initial cost of securing a home loan. Discount points, on the other hand, are prepaid interest fees paid at closing to reduce the loan's interest rate over time, offering long-term savings on mortgage payments. Understanding the difference between these fees helps homebuyers optimize their financing strategy by balancing immediate costs with future interest savings.

Table of Comparison

| Feature | Loan Origination Fee | Discount Points |

|---|---|---|

| Definition | Fee charged by lender to process loan application | Prepaid interest to reduce mortgage interest rate |

| Cost | Typically 0.5% to 1% of loan amount | Each point equals 1% of loan amount |

| Purpose | Cover lender's administrative expenses | Lower monthly mortgage payments |

| Tax Deductibility | Usually deductible as points if paid on primary residence | Generally tax-deductible as mortgage interest |

| Impact on Interest Rate | No effect on interest rate | Reduces interest rate by approx. 0.25% per point |

| Payment Timing | Due at loan closing | Paid upfront at closing |

| Best for | Borrowers focused on lower upfront fees | Buyers planning to stay long-term and save on interest |

Understanding Loan Origination Fees in Real Estate

Loan origination fees in real estate are upfront charges by lenders to cover the processing and evaluation of a mortgage application, typically amounting to 0.5% to 1% of the loan principal. Unlike discount points, which are prepaid interest to lower the mortgage rate, loan origination fees do not affect the loan's interest rate but contribute to the lender's administrative costs. Understanding these fees is crucial for homebuyers to accurately estimate closing costs and compare loan offers effectively.

What Are Discount Points and How Do They Work?

Discount points are prepaid interest fees paid upfront to reduce the mortgage loan's interest rate, effectively lowering monthly payments over the loan term. Each discount point typically costs 1% of the loan amount and can decrease the interest rate by approximately 0.25%, resulting in significant long-term savings for borrowers. Understanding how discount points work helps homebuyers evaluate whether paying more upfront is beneficial compared to the standard loan origination fee, which covers lender administrative costs.

Loan Origination Fee vs Discount Points: Key Differences

Loan origination fees are upfront charges paid to lenders for processing a mortgage application, typically ranging from 0.5% to 1% of the loan amount. Discount points are prepaid interest costs that borrowers purchase to reduce the mortgage interest rate, with one point equaling 1% of the loan amount and potentially lowering the rate by about 0.25%. Understanding the distinction between loan origination fees, which cover administrative expenses, and discount points, which directly affect monthly payments and total interest over the loan term, is crucial for optimizing mortgage costs.

Impact of Loan Origination Fees on Mortgage Costs

Loan origination fees typically range from 0.5% to 1% of the loan amount and directly increase the upfront closing costs, thereby raising the initial financial burden for homebuyers. Unlike discount points, which lower the interest rate over the loan term, loan origination fees do not reduce monthly payments but instead affect the overall cost structure at loan initiation. This increase in upfront costs can impact the borrower's cash flow and affordability when securing a mortgage.

How Discount Points Can Lower Your Interest Rate

Discount points are prepaid interest fees that borrowers can pay upfront to reduce their mortgage interest rate, effectively lowering monthly payments and the overall loan cost. While a loan origination fee covers the lender's administrative expenses, discount points directly impact the interest rate, offering long-term savings over the loan term. Paying discount points is a strategic choice for homeowners planning to stay in the property for an extended period, as it decreases total interest paid.

Should You Pay Loan Origination Fees Upfront?

Paying loan origination fees upfront can increase your closing costs but may secure a lower interest rate or better loan terms, enhancing long-term savings. Discount points act as prepaid interest, directly reducing your mortgage rate, while origination fees cover the lender's processing costs and do not lower your interest. Evaluate your financial situation and loan duration to decide if the upfront fee justifies the potential monthly payment reduction.

Are Discount Points Worth It for Homebuyers?

Discount points are prepaid interest that lower your mortgage rate, potentially saving thousands over the loan term, while loan origination fees cover the lender's administrative costs and do not affect the interest rate. Homebuyers who plan to stay in their home long-term may find discount points worth the upfront cost due to lower monthly payments and overall interest savings. Evaluating the break-even period and comparing it to your expected tenure can determine if discount points provide real financial benefits.

Comparing Short-Term and Long-Term Savings

Loan origination fees are upfront costs paid to processing your mortgage, typically 0.5% to 1% of the loan amount, impacting short-term expenses without affecting your interest rate. Discount points, costing about 1% of the loan amount per point, are prepaid interest that lower your mortgage interest rate and reduce long-term monthly payments. Comparing these fees involves evaluating how quickly you plan to sell or refinance; pay origination fees for short-term stays and discount points to maximize long-term savings through reduced interest costs.

Tax Implications: Origination Fees vs Discount Points

Loan origination fees are typically deductible as mortgage interest only if paid in the year the loan is taken out, while discount points often qualify as prepaid interest and may be fully deductible in the same year or amortized over the life of the loan. Tax implications for origination fees versus discount points depend on the loan type and taxpayer's specific circumstances, with discount points generally offering more favorable immediate tax benefits. Understanding IRS guidelines, including Publication 936, helps homeowners maximize deductions related to both loan origination fees and discount points.

Making the Right Choice for Your Mortgage Strategy

Loan origination fees are upfront charges by lenders to cover processing and underwriting costs, typically ranging from 0.5% to 1% of the loan amount, while discount points are prepaid interest that lower your mortgage rate by about 0.25% per point. Choosing between these depends on your financial goals and how long you plan to stay in the home; paying discount points saves money on interest over time, ideal for long-term ownership, whereas a lower origination fee reduces upfront costs, better for short-term plans. Carefully analyzing your mortgage duration and cash flow can help determine the optimal balance between loan origination fees and discount points to maximize savings.

Loan Origination Fee vs Discount Points Infographic

difterm.com

difterm.com