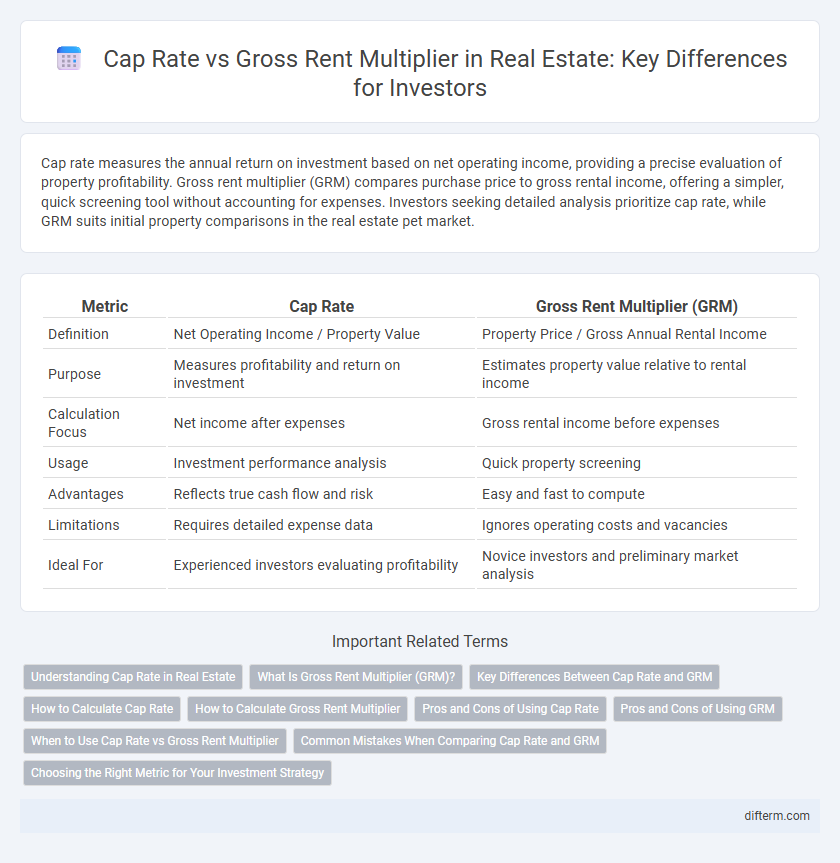

Cap rate measures the annual return on investment based on net operating income, providing a precise evaluation of property profitability. Gross rent multiplier (GRM) compares purchase price to gross rental income, offering a simpler, quick screening tool without accounting for expenses. Investors seeking detailed analysis prioritize cap rate, while GRM suits initial property comparisons in the real estate pet market.

Table of Comparison

| Metric | Cap Rate | Gross Rent Multiplier (GRM) |

|---|---|---|

| Definition | Net Operating Income / Property Value | Property Price / Gross Annual Rental Income |

| Purpose | Measures profitability and return on investment | Estimates property value relative to rental income |

| Calculation Focus | Net income after expenses | Gross rental income before expenses |

| Usage | Investment performance analysis | Quick property screening |

| Advantages | Reflects true cash flow and risk | Easy and fast to compute |

| Limitations | Requires detailed expense data | Ignores operating costs and vacancies |

| Ideal For | Experienced investors evaluating profitability | Novice investors and preliminary market analysis |

Understanding Cap Rate in Real Estate

Cap rate, or capitalization rate, is a critical metric in real estate that measures the annual return on investment based on the property's net operating income relative to its current market value. Unlike the gross rent multiplier, which only considers gross rental income, the cap rate accounts for operating expenses, providing a more accurate assessment of a property's profitability. Investors use cap rates to compare potential investments and assess market risks, with higher cap rates typically indicating greater risk and potentially higher returns.

What Is Gross Rent Multiplier (GRM)?

Gross Rent Multiplier (GRM) is a simplified metric used in real estate to evaluate rental property investment potential by dividing the property's price by its gross rental income. It offers a quick comparison of properties by highlighting the relationship between purchase price and rental income before expenses, unlike the cap rate which accounts for net operating income. Investors use GRM to screen properties rapidly, especially in markets where detailed financial data might not be readily available.

Key Differences Between Cap Rate and GRM

Cap rate measures the annual return on investment based on net operating income relative to property value, while Gross Rent Multiplier (GRM) compares property price to gross annual rental income without expenses. Key differences include cap rate's incorporation of operating costs, offering a more comprehensive profitability metric, whereas GRM provides a simpler, quicker valuation tool primarily used in initial property screening. Investors rely on cap rate for evaluating income efficiency and risk, while GRM helps estimate market value based on rental potential.

How to Calculate Cap Rate

Cap rate is calculated by dividing the annual net operating income (NOI) of a property by its current market value or purchase price, expressed as a percentage. This metric provides investors with a clear assessment of the property's potential return on investment, excluding financing and tax considerations. The formula is: Cap Rate = (Net Operating Income / Property Value) x 100.

How to Calculate Gross Rent Multiplier

Gross Rent Multiplier (GRM) is calculated by dividing the property's purchase price by its gross annual rental income. This metric helps investors quickly assess the potential return on a rental property before considering operating expenses. Unlike the Cap Rate, which factors in net income, GRM focuses solely on rental income, making it a straightforward tool for initial property comparisons.

Pros and Cons of Using Cap Rate

Cap rate provides a clear measure of an investment property's return by relating net operating income to its current market value, helping investors assess profitability and compare different properties independently of financing methods. However, it does not account for potential changes in income or expenses, nor does it reflect property financing terms, which can lead to an incomplete risk assessment. While cap rate favors standardized evaluation, investors must complement it with other metrics like gross rent multiplier to gain a fuller understanding of cash flow and long-term value.

Pros and Cons of Using GRM

Gross Rent Multiplier (GRM) offers a quick, straightforward metric for evaluating real estate investments by comparing property price to gross rental income, facilitating initial screening without detailed expense analysis. However, GRM overlooks operating costs, vacancies, and financing, which can lead to an overestimation of profitability and mask potential cash flow issues. While useful for rapid market comparison, GRM should be complemented with Cap Rate analysis for a comprehensive assessment of property performance and investment risk.

When to Use Cap Rate vs Gross Rent Multiplier

Cap rate is ideal for evaluating property performance by measuring net operating income relative to market value, making it suitable for comparing investment quality. Gross Rent Multiplier (GRM) is best used during initial property screening, focusing on the ratio of asking price to gross rental income without accounting for expenses. Investors should apply cap rate analysis for detailed cash flow assessment and GRM for quick property comparisons or market research.

Common Mistakes When Comparing Cap Rate and GRM

Confusing cap rate with gross rent multiplier often leads to inaccurate property valuations due to their fundamentally different calculations; cap rate accounts for net operating income while GRM only considers gross rental income. Overlooking expenses when using GRM causes an inflated perception of return on investment, as it ignores operating costs that impact profitability. Relying solely on GRM can misguide investors, particularly in markets with varying expenses, emphasizing the need to analyze both metrics carefully for informed real estate decisions.

Choosing the Right Metric for Your Investment Strategy

Cap rate provides a more comprehensive measure of an investment's profitability by accounting for net operating income relative to property value, making it ideal for comparing different real estate assets. Gross Rent Multiplier (GRM) offers a simpler calculation based on gross rental income but overlooks operating expenses, which can lead to an incomplete assessment of cash flow. Investors focused on precise income analysis and long-term value should prioritize cap rate, while those seeking quick, initial screening may find GRM effective.

Cap rate vs gross rent multiplier Infographic

difterm.com

difterm.com