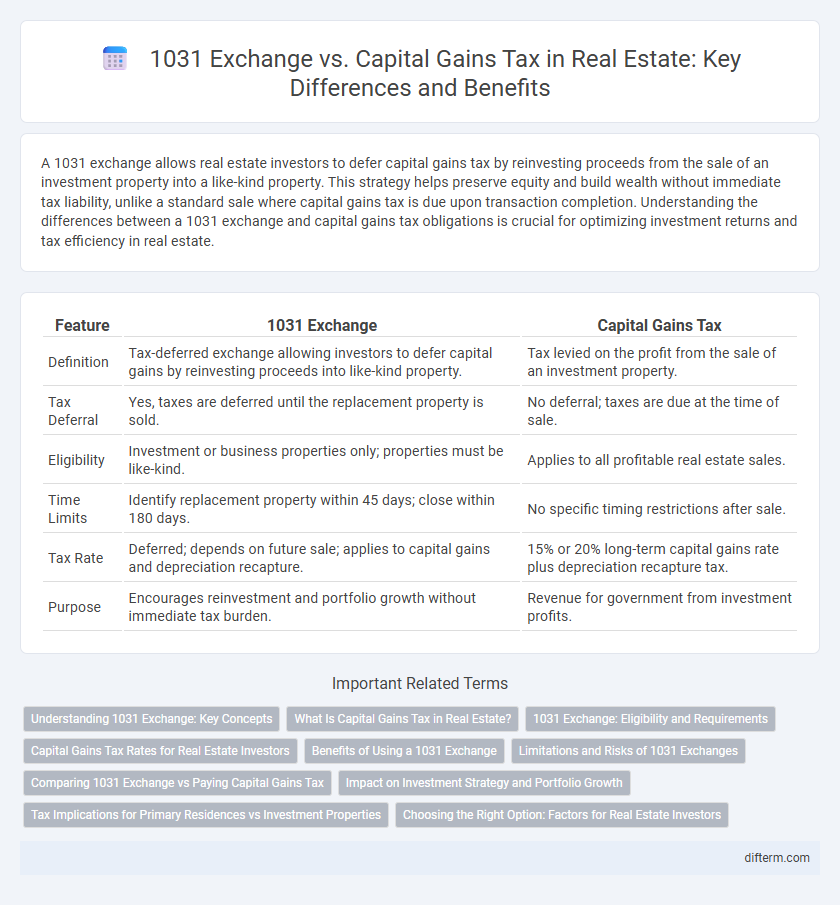

A 1031 exchange allows real estate investors to defer capital gains tax by reinvesting proceeds from the sale of an investment property into a like-kind property. This strategy helps preserve equity and build wealth without immediate tax liability, unlike a standard sale where capital gains tax is due upon transaction completion. Understanding the differences between a 1031 exchange and capital gains tax obligations is crucial for optimizing investment returns and tax efficiency in real estate.

Table of Comparison

| Feature | 1031 Exchange | Capital Gains Tax |

|---|---|---|

| Definition | Tax-deferred exchange allowing investors to defer capital gains by reinvesting proceeds into like-kind property. | Tax levied on the profit from the sale of an investment property. |

| Tax Deferral | Yes, taxes are deferred until the replacement property is sold. | No deferral; taxes are due at the time of sale. |

| Eligibility | Investment or business properties only; properties must be like-kind. | Applies to all profitable real estate sales. |

| Time Limits | Identify replacement property within 45 days; close within 180 days. | No specific timing restrictions after sale. |

| Tax Rate | Deferred; depends on future sale; applies to capital gains and depreciation recapture. | 15% or 20% long-term capital gains rate plus depreciation recapture tax. |

| Purpose | Encourages reinvestment and portfolio growth without immediate tax burden. | Revenue for government from investment profits. |

Understanding 1031 Exchange: Key Concepts

The 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of a property into a like-kind property within a specific timeframe. Key concepts include the identification period of 45 days and the exchange period of 180 days, which must be strictly followed to qualify for tax deferral. This strategy provides significant tax advantages by postponing capital gains taxes, enabling investors to leverage more capital for future property acquisitions.

What Is Capital Gains Tax in Real Estate?

Capital gains tax in real estate is a tax on the profit earned from the sale of a property, calculated as the difference between the sale price and the original purchase price, minus allowable expenses. The tax rate varies based on the holding period, with short-term capital gains taxed at ordinary income rates and long-term gains benefiting from lower rates. Understanding capital gains tax is crucial for real estate investors to effectively manage taxable income and explore strategies like the 1031 exchange to defer tax liabilities.

1031 Exchange: Eligibility and Requirements

A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of an investment property into a like-kind property, meeting strict eligibility criteria. To qualify, the properties involved must be held for business or investment purposes, and the replacement property must be identified within 45 days and acquired within 180 days of the sale. Failure to adhere to the IRS timelines and property eligibility requirements disqualifies the exchange, triggering immediate capital gains tax liabilities.

Capital Gains Tax Rates for Real Estate Investors

Capital gains tax rates for real estate investors vary based on the holding period and income level, with long-term rates typically ranging from 0% to 20% depending on the investor's tax bracket. Short-term capital gains are taxed as ordinary income, often resulting in higher tax liabilities compared to long-term holdings. Utilizing a 1031 exchange allows investors to defer capital gains taxes by reinvesting proceeds into like-kind properties, optimizing tax efficiency and preserving investment capital.

Benefits of Using a 1031 Exchange

A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from a sold property into a like-kind replacement property, preserving investment capital and enhancing portfolio growth. This tax-deferral mechanism enables compounding returns by postponing tax payments, which can increase long-term wealth accumulation. Utilizing a 1031 exchange also provides flexibility to diversify holdings or upgrade assets without immediate tax liability, optimizing investment strategies in the real estate market.

Limitations and Risks of 1031 Exchanges

1031 exchanges allow real estate investors to defer capital gains taxes by reinvesting proceeds into like-kind properties but are limited by strict IRS rules, including tight timelines for identification and closing swaps within 45 and 180 days, respectively. Failing to meet these deadlines or improperly structuring the exchange can trigger immediate capital gains tax liability, negating the expected tax deferral benefits. The process also carries risks such as market fluctuations during the exchange period and potential loss of liquidity, making it crucial for investors to carefully plan and execute 1031 exchanges to avoid costly tax consequences.

Comparing 1031 Exchange vs Paying Capital Gains Tax

A 1031 exchange allows real estate investors to defer paying capital gains tax by reinvesting proceeds into a like-kind property, preserving investment capital for future growth. In contrast, paying capital gains tax on property sales may reduce overall profit but provides immediate liquidity and freedom from reinvestment constraints. Choosing between a 1031 exchange and paying capital gains tax depends on investment goals, timing, and the desire to defer tax liability.

Impact on Investment Strategy and Portfolio Growth

A 1031 exchange allows real estate investors to defer capital gains tax by reinvesting proceeds into like-kind properties, preserving capital for continued portfolio growth. This strategy enhances investment flexibility and accelerates wealth accumulation by compounding returns without immediate tax liabilities. Conversely, paying capital gains tax can reduce available investment capital, potentially slowing portfolio expansion and limiting strategic acquisition opportunities.

Tax Implications for Primary Residences vs Investment Properties

In real estate, a 1031 exchange allows investors to defer capital gains tax on investment properties by reinvesting proceeds into like-kind properties, but it is not applicable to primary residences. Primary residences benefit from capital gains tax exclusions--up to $250,000 for single filers and $500,000 for married couples--provided ownership and use requirements are met. Investment properties, lacking such exclusions, often face significant capital gains taxes unless rolled over via a 1031 exchange, highlighting the critical tax planning differences between these property types.

Choosing the Right Option: Factors for Real Estate Investors

Real estate investors should evaluate their long-term investment goals, liquidity needs, and potential tax liabilities when choosing between a 1031 exchange and paying capital gains tax. A 1031 exchange allows deferral of capital gains taxes by reinvesting proceeds into like-kind properties, preserving investment capital and enabling portfolio growth. Conversely, paying capital gains tax may be preferable for investors seeking cash access, simpler transactions, or when expecting favorable tax rates in the near future.

1031 exchange vs capital gains tax Infographic

difterm.com

difterm.com