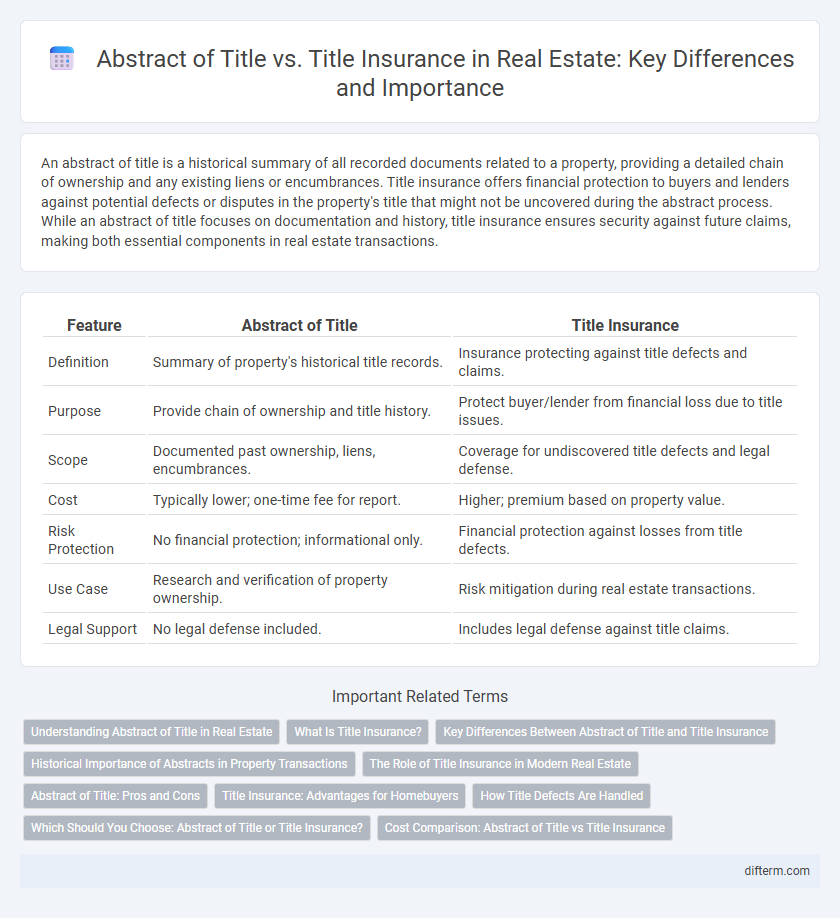

An abstract of title is a historical summary of all recorded documents related to a property, providing a detailed chain of ownership and any existing liens or encumbrances. Title insurance offers financial protection to buyers and lenders against potential defects or disputes in the property's title that might not be uncovered during the abstract process. While an abstract of title focuses on documentation and history, title insurance ensures security against future claims, making both essential components in real estate transactions.

Table of Comparison

| Feature | Abstract of Title | Title Insurance |

|---|---|---|

| Definition | Summary of property's historical title records. | Insurance protecting against title defects and claims. |

| Purpose | Provide chain of ownership and title history. | Protect buyer/lender from financial loss due to title issues. |

| Scope | Documented past ownership, liens, encumbrances. | Coverage for undiscovered title defects and legal defense. |

| Cost | Typically lower; one-time fee for report. | Higher; premium based on property value. |

| Risk Protection | No financial protection; informational only. | Financial protection against losses from title defects. |

| Use Case | Research and verification of property ownership. | Risk mitigation during real estate transactions. |

| Legal Support | No legal defense included. | Includes legal defense against title claims. |

Understanding Abstract of Title in Real Estate

An Abstract of Title is a comprehensive summary of the historical recorded ownership and legal claims associated with a specific property, including deeds, mortgages, wills, and court judgments. It serves as a foundational document for real estate transactions by providing a chronological chain of title, enabling buyers and professionals to verify ownership and identify potential liens or encumbrances. Unlike title insurance, which offers financial protection against undiscovered defects, the Abstract of Title solely provides factual historical information without guaranteeing clear title.

What Is Title Insurance?

Title insurance is a form of indemnity insurance that protects real estate buyers and lenders against losses arising from defects or issues in the property's title, such as liens, encumbrances, or ownership disputes. Unlike an abstract of title, which is a summarized history of the legal ownership and transfers of a property, title insurance provides financial coverage and legal defense if title problems surface after the purchase. This insurance ensures peace of mind by safeguarding the owner's investment and lending institutions from potential risks tied to the property's legal status.

Key Differences Between Abstract of Title and Title Insurance

An Abstract of Title is a comprehensive summary of all recorded documents affecting a property's ownership, providing historical evidence of title but not guaranteeing its validity. Title Insurance offers financial protection against undiscovered defects or claims on the property that may arise after purchase, covering legal fees and losses. The key difference lies in risk transfer: Abstract of Title informs buyers about title history, while Title Insurance protects buyers or lenders from future title disputes.

Historical Importance of Abstracts in Property Transactions

Abstracts of title have historically served as vital documents in property transactions by providing a comprehensive summary of the ownership history and encumbrances tied to a parcel of real estate. These detailed records, often prepared by title companies or attorneys, allowed buyers and lenders to assess potential risks before closing deals. Despite the rise of title insurance offering financial protection against hidden defects, abstracts remain an essential reference for understanding the legal background of property ownership.

The Role of Title Insurance in Modern Real Estate

Title insurance plays a critical role in modern real estate by protecting buyers and lenders from potential defects or disputes related to property ownership that may not be uncovered through an abstract of title. While an abstract of title provides a detailed history of the property's ownership and liens, it does not guarantee clear title or shield against future claims. Title insurance offers comprehensive coverage against issues such as undisclosed heirs, forged documents, or errors in public records, ensuring greater security and peace of mind in real estate transactions.

Abstract of Title: Pros and Cons

Abstract of Title provides a detailed historical summary of property ownership and recorded liens, offering transparency for real estate transactions. Its primary advantage lies in the thorough documentation of past recorded events, allowing buyers to identify potential issues before purchase. However, the cons include the reliance on manual review, which can lead to errors or omissions, and a lack of protection against undiscovered title defects or fraud, unlike title insurance.

Title Insurance: Advantages for Homebuyers

Title insurance provides homebuyers with financial protection against defects or disputes over property ownership that may arise after purchase, unlike an abstract of title which only offers a historical record. It covers unknown title issues such as liens, encumbrances, or forgery that could threaten the buyer's legal ownership. This insurance mitigates risks, offering peace of mind and safeguarding the investment in real estate transactions.

How Title Defects Are Handled

Title defects uncovered through an abstract of title require a thorough legal review to resolve issues such as liens or claims before closing, often involving manual correction or clearance. Title insurance provides protection by compensating the insured for losses arising from undiscovered title defects, shifting the financial risk away from the buyer or lender. This insurance covers defects that may surface after purchase, offering ongoing security that an abstract alone cannot guarantee.

Which Should You Choose: Abstract of Title or Title Insurance?

Choosing between an abstract of title and title insurance hinges on understanding the risk coverage and verification process. An abstract of title provides a detailed summary of property ownership history and recorded liens, while title insurance offers financial protection against future undiscovered title defects or claims. Title insurance is generally preferred for its comprehensive protection in real estate transactions, safeguarding buyers and lenders from potential legal disputes.

Cost Comparison: Abstract of Title vs Title Insurance

Abstract of Title involves compiling historical records of property ownership, which often incurs lower upfront fees but can lead to higher indirect costs if undiscovered issues arise. Title Insurance requires an initial premium, typically ranging from 0.5% to 1% of the property's purchase price, offering protection against future claims and reducing long-term financial risk. Comparing cost-effectiveness, abstract searches may seem cheaper initially, but title insurance provides comprehensive coverage that can prevent significant expenses from title defects.

Abstract of Title vs Title Insurance Infographic

difterm.com

difterm.com