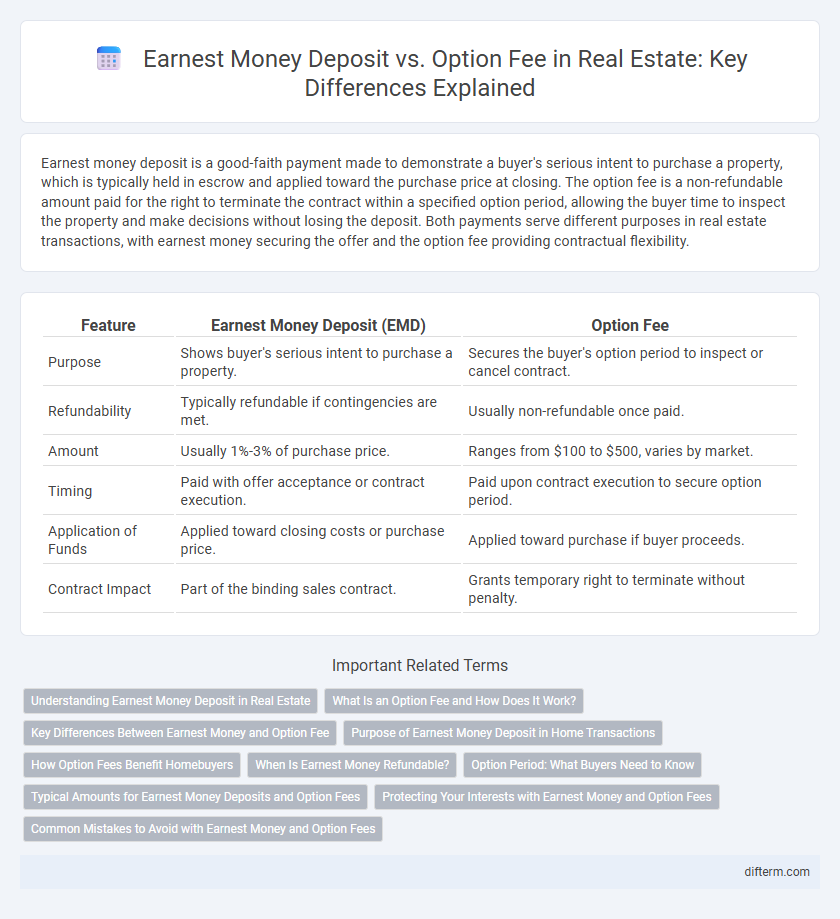

Earnest money deposit is a good-faith payment made to demonstrate a buyer's serious intent to purchase a property, which is typically held in escrow and applied toward the purchase price at closing. The option fee is a non-refundable amount paid for the right to terminate the contract within a specified option period, allowing the buyer time to inspect the property and make decisions without losing the deposit. Both payments serve different purposes in real estate transactions, with earnest money securing the offer and the option fee providing contractual flexibility.

Table of Comparison

| Feature | Earnest Money Deposit (EMD) | Option Fee |

|---|---|---|

| Purpose | Shows buyer's serious intent to purchase a property. | Secures the buyer's option period to inspect or cancel contract. |

| Refundability | Typically refundable if contingencies are met. | Usually non-refundable once paid. |

| Amount | Usually 1%-3% of purchase price. | Ranges from $100 to $500, varies by market. |

| Timing | Paid with offer acceptance or contract execution. | Paid upon contract execution to secure option period. |

| Application of Funds | Applied toward closing costs or purchase price. | Applied toward purchase if buyer proceeds. |

| Contract Impact | Part of the binding sales contract. | Grants temporary right to terminate without penalty. |

Understanding Earnest Money Deposit in Real Estate

Earnest money deposit in real estate acts as a good faith gesture from the buyer to the seller, typically ranging from 1% to 3% of the purchase price, and is held in escrow until closing. This deposit demonstrates the buyer's serious intent to proceed with the transaction and can be forfeited if the buyer breaches the contract without valid contingencies. Unlike the non-refundable option fee that secures the buyer's right to terminate the contract within a specified option period, the earnest money deposit is refundable under certain conditions outlined in the purchase agreement.

What Is an Option Fee and How Does It Work?

An option fee is a non-refundable payment made by the buyer to the seller, securing the exclusive right to terminate a real estate contract within a specified option period without forfeiting their earnest money deposit. This fee grants the buyer a designated time frame, typically 7 to 10 days, to conduct inspections and negotiate repairs or decide to back out of the purchase. Unlike earnest money deposits, option fees are paid directly to the seller and provide a financial incentive for the seller to take the property off the market temporarily.

Key Differences Between Earnest Money and Option Fee

Earnest money deposit is a good faith payment made to demonstrate the buyer's serious intent to purchase a property, typically held in escrow and credited towards the purchase price at closing. The option fee is a non-refundable payment paid to secure the buyer's right to terminate the contract within a specified option period without losing the earnest money. Key differences include the purpose, refundability, and timing: earnest money protects the seller by showing buyer commitment, while the option fee provides the buyer flexibility to back out during the option period.

Purpose of Earnest Money Deposit in Home Transactions

The earnest money deposit serves as a buyer's good faith demonstration to the seller during a home transaction, securing the buyer's intent to complete the purchase and reducing the risk of contract cancellation. This deposit is typically held in escrow and credited toward the down payment or closing costs once the sale proceeds. Unlike the option fee, which grants the buyer the right to terminate the contract within a specified option period, the earnest money primarily functions to show commitment and provide financial assurance to the seller.

How Option Fees Benefit Homebuyers

Option fees provide homebuyers with the unique advantage of securing the right to terminate a purchase agreement within a specified option period, offering greater flexibility and control during the inspection and decision-making process. Unlike earnest money deposits, which are applied toward the purchase price and typically forfeited if the buyer backs out, option fees are often non-refundable but allow the buyer to exit the contract without forfeiting the earnest money. This option fee structure benefits homebuyers by minimizing financial risk while enabling thorough property evaluation before full commitment.

When Is Earnest Money Refundable?

Earnest money is refundable only if the buyer terminates the contract within specific contingencies, such as inspection or financing clauses outlined in the purchase agreement. Unlike the non-refundable option fee that secures the right to cancel without penalty, earnest money serves as a good faith deposit to show serious intent to purchase. If contingencies are met or waived and the buyer defaults, the seller typically keeps the earnest money as compensation.

Option Period: What Buyers Need to Know

The option period is a negotiated timeframe allowing buyers to inspect the property and decide without risking losing their earnest money deposit, which is typically held as a good faith gesture in the contract. The option fee, paid directly to the seller, secures this period and is usually non-refundable, giving buyers the right to back out for any reason during inspections. Understanding the distinction between the refundable earnest money and the non-refundable option fee is crucial for buyers to manage risks and leverage contingencies in Texas real estate transactions.

Typical Amounts for Earnest Money Deposits and Option Fees

Typical amounts for earnest money deposits in real estate transactions range from 1% to 3% of the purchase price, serving as a buyer's good faith guarantee. Option fees, often used in markets like Texas, usually range from $100 to $500 and provide the buyer a short period to cancel the contract for any reason. Both the earnest money deposit and option fee are negotiated upfront and vary depending on regional market conditions and property values.

Protecting Your Interests with Earnest Money and Option Fees

Earnest money deposits demonstrate buyer commitment by securing the property during the contract period, while option fees provide the buyer with the exclusive right to terminate the contract within a specified option period. Protecting your interests involves negotiating appropriate earnest money amounts to show good faith without overcommitting funds and utilizing option fees to maintain flexibility for thorough inspections or market reevaluation. Understanding the legal implications and timelines of both deposits ensures effective risk management in real estate transactions.

Common Mistakes to Avoid with Earnest Money and Option Fees

Confusing earnest money deposits with option fees often leads to legal complications and loss of funds in real estate transactions. Buyers frequently mistake the option fee as a refundable deposit, while it is non-refundable and grants the right to terminate the contract within the option period. Ensure clear contract terms to avoid forfeiting earnest money due to misinterpreted contingencies or missing deadline requirements.

Earnest money deposit vs Option fee Infographic

difterm.com

difterm.com