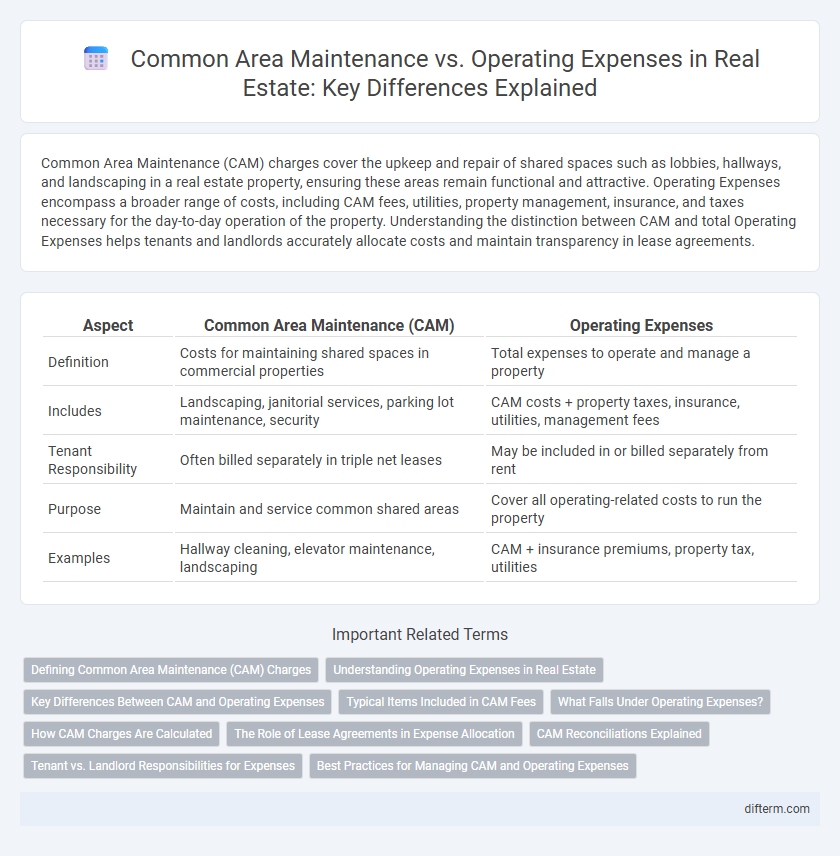

Common Area Maintenance (CAM) charges cover the upkeep and repair of shared spaces such as lobbies, hallways, and landscaping in a real estate property, ensuring these areas remain functional and attractive. Operating Expenses encompass a broader range of costs, including CAM fees, utilities, property management, insurance, and taxes necessary for the day-to-day operation of the property. Understanding the distinction between CAM and total Operating Expenses helps tenants and landlords accurately allocate costs and maintain transparency in lease agreements.

Table of Comparison

| Aspect | Common Area Maintenance (CAM) | Operating Expenses |

|---|---|---|

| Definition | Costs for maintaining shared spaces in commercial properties | Total expenses to operate and manage a property |

| Includes | Landscaping, janitorial services, parking lot maintenance, security | CAM costs + property taxes, insurance, utilities, management fees |

| Tenant Responsibility | Often billed separately in triple net leases | May be included in or billed separately from rent |

| Purpose | Maintain and service common shared areas | Cover all operating-related costs to run the property |

| Examples | Hallway cleaning, elevator maintenance, landscaping | CAM + insurance premiums, property tax, utilities |

Defining Common Area Maintenance (CAM) Charges

Common Area Maintenance (CAM) charges are fees tenants pay for the upkeep and repair of shared spaces within a commercial property, such as lobbies, parking lots, elevators, and landscaping. These charges cover routine services like janitorial work, security, and general maintenance, ensuring the property's common areas remain functional and attractive. CAM fees are typically outlined in lease agreements and are essential for maintaining property value and tenant satisfaction.

Understanding Operating Expenses in Real Estate

Operating expenses in real estate encompass all costs required to manage, maintain, and operate a property, including property taxes, insurance, utilities, repairs, and administrative fees. Common Area Maintenance (CAM) fees are a subset of operating expenses specifically allocated to the upkeep of shared spaces like lobbies, hallways, and landscaping in multi-tenant properties. Understanding the distinction between operating expenses and CAM charges is crucial for investors and tenants to accurately assess property profitability and lease obligations.

Key Differences Between CAM and Operating Expenses

Common Area Maintenance (CAM) fees specifically cover the costs associated with maintaining and repairing shared spaces like lobbies, parking lots, and landscaping in a commercial property, while Operating Expenses encompass a broader range of costs, including CAM, property taxes, insurance, and utilities required to operate and manage the entire property. CAM charges are usually passed directly to tenants based on their leased square footage, whereas Operating Expenses may include costs that are not passed on or are handled differently depending on the lease structure. Understanding the distinction between CAM and Operating Expenses is crucial for landlords and tenants to accurately budget and negotiate lease terms in commercial real estate.

Typical Items Included in CAM Fees

Typical items included in Common Area Maintenance (CAM) fees encompass landscaping, janitorial services, security, lighting, and repairs for shared spaces such as lobbies and parking lots. CAM fees generally cover expenses directly related to the upkeep and maintenance of communal areas within a commercial property. Operating Expenses, by contrast, may include broader costs such as property management fees, insurance, and utilities, but CAM specifically targets maintenance-related costs in common areas.

What Falls Under Operating Expenses?

Operating expenses in real estate include costs directly related to the day-to-day functioning and maintenance of a property, such as property management fees, utilities, insurance, property taxes, repairs, and janitorial services. These expenses exclude capital improvements but cover routine upkeep essential for tenant occupancy and property safety. Unlike common area maintenance (CAM) fees that specifically target shared space maintenance, operating expenses encompass a broader range of property operational costs.

How CAM Charges Are Calculated

CAM charges are calculated based on a tenant's proportionate share of the total leasable area within a commercial property, typically expressed as a percentage. These charges cover expenses such as landscaping, janitorial services, and security, which are divided among tenants according to their leased square footage. Operating expenses, encompassing CAM charges, also include utilities, property taxes, and insurance, calculated similarly but with a broader scope of property-related costs.

The Role of Lease Agreements in Expense Allocation

Lease agreements play a critical role in defining the allocation of Common Area Maintenance (CAM) charges versus Operating Expenses within commercial real estate. These contracts specify which expenses tenants are responsible for, often delineating CAM charges as shared costs for upkeep of shared spaces, while operating expenses may cover broader property management fees. Clear lease terms help prevent disputes by outlining expense categories, calculation methods, and reimbursement processes to ensure transparent financial obligations.

CAM Reconciliations Explained

CAM reconciliations are the process of comparing estimated Common Area Maintenance charges paid by tenants against actual expenses incurred by the landlord, ensuring accurate billing in commercial leases. Operating expenses include CAM costs along with utilities, property management fees, and repairs, but CAM reconciliations specifically focus on shared space maintenance costs like landscaping, cleaning, and security. This reconciliation helps prevent overpayment or underpayment by adjusting tenant invoices based on the true expenses from the previous fiscal period.

Tenant vs. Landlord Responsibilities for Expenses

Tenant responsibilities for Common Area Maintenance (CAM) expenses typically include costs related to the upkeep of shared spaces such as hallways, parking lots, and landscaping, ensuring a clean and safe environment. Landlords generally handle operating expenses, encompassing property management fees, insurance, taxes, and utilities necessary for the building's overall operation. Lease agreements often specify the division of these expenses, clarifying financial obligations to prevent disputes between tenants and landlords.

Best Practices for Managing CAM and Operating Expenses

Effective management of Common Area Maintenance (CAM) and operating expenses involves accurate tracking, transparent billing, and regular tenant communication to ensure compliance and reduce disputes. Implementing advanced property management software aids in detailed expense allocation and real-time reporting, enhancing financial accountability. Establishing clear lease terms and conducting periodic audits further optimize cost control and foster trust between landlords and tenants.

Common Area Maintenance vs Operating Expenses Infographic

difterm.com

difterm.com