Pre-approval in real estate involves a thorough evaluation of a buyer's financial background by a lender, resulting in a conditional commitment for a specific loan amount. Pre-qualification offers a preliminary estimate of borrowing power based on self-reported financial information, without in-depth verification. Understanding the distinction helps buyers gauge their readiness and strengthens their position when making offers on properties.

Table of Comparison

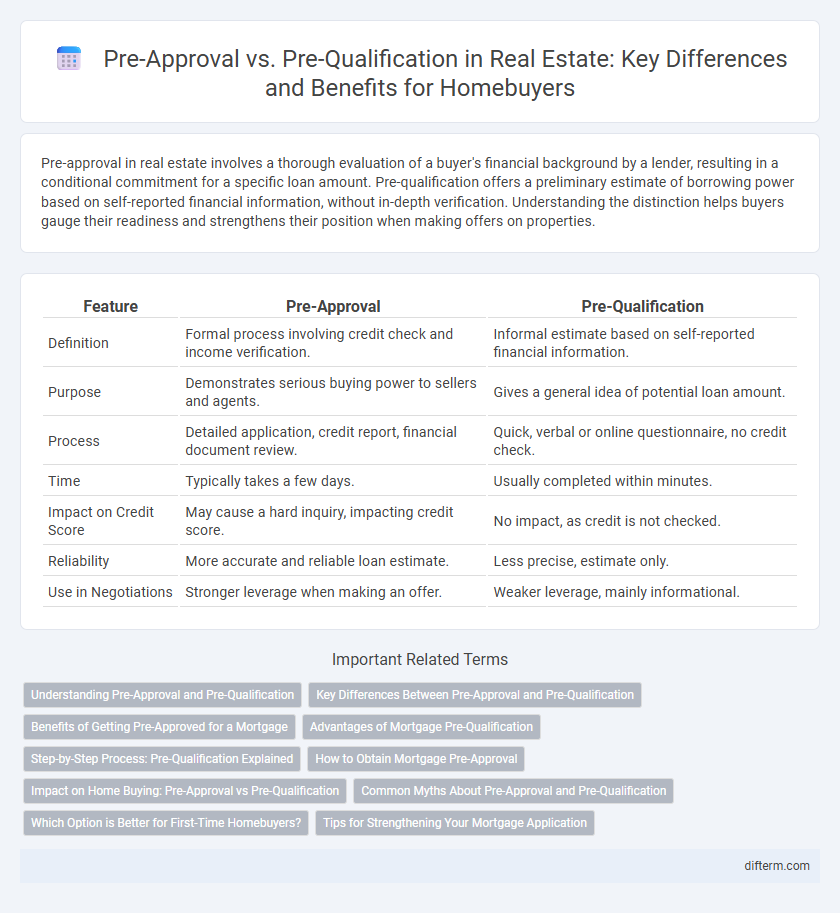

| Feature | Pre-Approval | Pre-Qualification |

|---|---|---|

| Definition | Formal process involving credit check and income verification. | Informal estimate based on self-reported financial information. |

| Purpose | Demonstrates serious buying power to sellers and agents. | Gives a general idea of potential loan amount. |

| Process | Detailed application, credit report, financial document review. | Quick, verbal or online questionnaire, no credit check. |

| Time | Typically takes a few days. | Usually completed within minutes. |

| Impact on Credit Score | May cause a hard inquiry, impacting credit score. | No impact, as credit is not checked. |

| Reliability | More accurate and reliable loan estimate. | Less precise, estimate only. |

| Use in Negotiations | Stronger leverage when making an offer. | Weaker leverage, mainly informational. |

Understanding Pre-Approval and Pre-Qualification

Pre-qualification is an initial assessment based on self-reported financial information, giving buyers a general idea of their borrowing capacity without a credit check. Pre-approval involves a thorough evaluation by the lender, including credit verification and documentation, providing a more concrete estimate of loan eligibility and strengthening the buyer's position in competitive markets. Understanding the differences helps homebuyers prioritize their financial readiness and improve credibility with sellers and real estate agents.

Key Differences Between Pre-Approval and Pre-Qualification

Pre-approval involves a thorough evaluation of a buyer's financial background, including credit checks and income verification, providing a more accurate estimate of loan eligibility. Pre-qualification offers a preliminary assessment based on self-reported financial information without verification, resulting in a less reliable indication of purchasing power. Real estate agents and sellers give greater weight to pre-approval letters, as they demonstrate a serious, qualified buyer ready to move forward with a mortgage.

Benefits of Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage provides a clear understanding of your borrowing capacity, allowing you to shop confidently within your budget. This formal process involves a thorough evaluation of your financial documents, giving sellers and real estate agents assurance that you are a serious buyer. Securing pre-approval can expedite the home buying process, increasing your chances of having an offer accepted in competitive markets.

Advantages of Mortgage Pre-Qualification

Mortgage pre-qualification offers the advantage of a quick and straightforward assessment of a buyer's financial situation, providing a preliminary estimate of the loan amount they might qualify for. This process helps buyers understand their budget early, enhancing confidence when searching for properties and streamlining discussions with real estate agents. Pre-qualification requires minimal documentation, making it an efficient first step before pursuing a more detailed mortgage pre-approval.

Step-by-Step Process: Pre-Qualification Explained

Pre-qualification in real estate involves an initial assessment of a buyer's financial situation based on self-reported information such as income, assets, and debts to estimate the loan amount they might qualify for. The process typically begins with a buyer submitting financial details to a lender, who then provides a rough estimate of loan eligibility without conducting credit checks or verifying documentation. This step helps buyers understand their budget and strengthens their position when searching for properties, but it does not guarantee loan approval.

How to Obtain Mortgage Pre-Approval

Obtaining mortgage pre-approval requires submitting detailed financial documents, including income statements, credit reports, and employment verification, to a lender for evaluation. The lender performs a thorough credit check and assesses your debt-to-income ratio to determine how much you can afford to borrow. Pre-approval provides a conditional commitment for a loan amount, strengthening your position when making offers on real estate properties.

Impact on Home Buying: Pre-Approval vs Pre-Qualification

Pre-approval significantly strengthens a buyer's position by providing a conditional commitment from a lender, demonstrating financial readiness and increasing negotiating power. Pre-qualification offers a preliminary estimate of borrowing capacity but lacks the rigorous verification of credit and income, making it less impactful during offer evaluations. Understanding the distinction helps homebuyers prioritize pre-approval to expedite the purchase process and improve chances of securing their desired property.

Common Myths About Pre-Approval and Pre-Qualification

Many homebuyers mistakenly believe pre-qualification guarantees loan approval, while it only offers a preliminary estimate based on self-reported financial information. Pre-approval involves a thorough credit check and documentation verification, making it a more reliable indicator of loan readiness. Confusing these processes can delay home purchases, as sellers often prefer buyers with pre-approval letters demonstrating financial credibility.

Which Option is Better for First-Time Homebuyers?

Pre-approval offers first-time homebuyers a clearer advantage by providing a conditional commitment from a lender based on verified financial information, boosting their credibility in competitive markets. Pre-qualification, while quicker and less formal, relies on self-reported data and does not guarantee loan approval, making it less reliable for serious house hunting. Choosing pre-approval helps buyers understand their budget accurately and negotiate confidently with sellers.

Tips for Strengthening Your Mortgage Application

Securing a mortgage pre-approval rather than just a pre-qualification significantly strengthens your home loan application by providing a conditional commitment from lenders based on verified financial documentation. To enhance your chances, maintain a consistent credit score above 700, minimize debt-to-income ratio below 36%, and compile comprehensive proofs of income, assets, and employment stability. Demonstrating these financial metrics improves lender confidence, accelerates the approval process, and positions you competitively in the real estate market.

Pre-Approval vs Pre-Qualification Infographic

difterm.com

difterm.com