The due diligence period in real estate allows buyers to thoroughly review contracts, title reports, and financing options to make an informed decision, while the inspection period specifically focuses on assessing the physical condition of the property through professional inspections. Understanding the distinction helps buyers manage risks and negotiate repairs or concessions effectively. Properly navigating both periods ensures a smoother transaction and protects the buyer's investment.

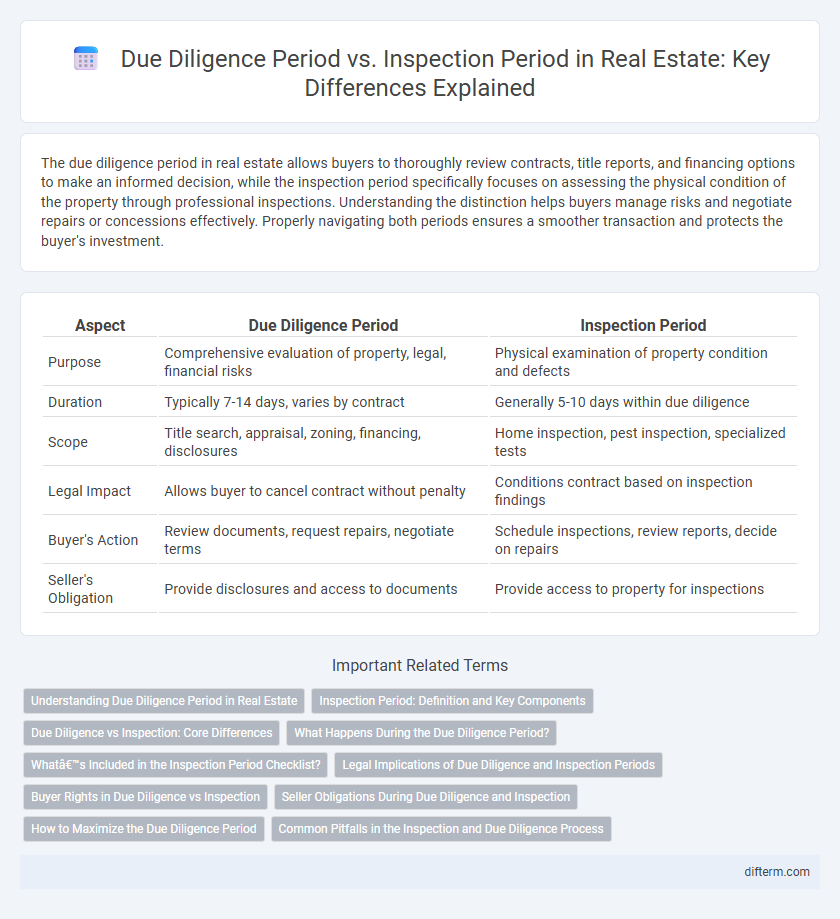

Table of Comparison

| Aspect | Due Diligence Period | Inspection Period |

|---|---|---|

| Purpose | Comprehensive evaluation of property, legal, financial risks | Physical examination of property condition and defects |

| Duration | Typically 7-14 days, varies by contract | Generally 5-10 days within due diligence |

| Scope | Title search, appraisal, zoning, financing, disclosures | Home inspection, pest inspection, specialized tests |

| Legal Impact | Allows buyer to cancel contract without penalty | Conditions contract based on inspection findings |

| Buyer's Action | Review documents, request repairs, negotiate terms | Schedule inspections, review reports, decide on repairs |

| Seller's Obligation | Provide disclosures and access to documents | Provide access to property for inspections |

Understanding Due Diligence Period in Real Estate

Due diligence period in real estate is a negotiated timeframe allowing buyers to thoroughly investigate property details, including title, zoning, and financial records, before finalizing a purchase. Unlike the inspection period, which focuses mainly on examining the physical condition of the property, due diligence encompasses broader legal and financial evaluations critical for informed decision-making. This period protects buyers by enabling contract termination or renegotiation if significant issues arise, ensuring transparency and reducing investment risk.

Inspection Period: Definition and Key Components

The inspection period in real estate is a designated timeframe within the due diligence period where the buyer conducts physical assessments of the property, including home inspections and specialized evaluations such as pest, mold, or structural inspections. Key components of the inspection period include scheduling professional inspections, reviewing reports for potential issues, and negotiating repairs or contingencies based on findings. This period ensures the buyer has the necessary information to make an informed decision before finalizing the purchase contract.

Due Diligence vs Inspection: Core Differences

The due diligence period in real estate encompasses a comprehensive evaluation of the property, including title review, zoning laws, and financial assessments, while the inspection period primarily focuses on the physical condition of the property through professional home inspections. Due diligence involves legal and financial investigations to uncover any potential risks or liabilities, whereas the inspection period targets identifying structural issues, safety hazards, and repair needs. Understanding the distinction between due diligence and inspection periods is crucial for buyers to make informed decisions and negotiate contingencies effectively.

What Happens During the Due Diligence Period?

During the due diligence period, buyers conduct comprehensive research and analysis of the property, including reviewing title records, zoning laws, and any potential liens or encumbrances. This timeframe allows for physical inspections, but also encompasses evaluating financial documents, verifying property disclosures, and assessing environmental reports. The due diligence period ensures buyers identify risks and make informed decisions before finalizing the real estate transaction.

What’s Included in the Inspection Period Checklist?

The inspection period checklist in real estate includes a comprehensive assessment of the property's structural integrity, plumbing, electrical systems, HVAC functionality, and potential pest infestations. Buyers often review reports from licensed inspectors covering the roof condition, foundation stability, and presence of mold or asbestos. This phase allows for evaluation of repair needs or contingencies before finalizing the purchase, ensuring informed decision-making during the due diligence process.

Legal Implications of Due Diligence and Inspection Periods

The due diligence period in real estate involves a comprehensive legal review of contracts, title clearances, and zoning compliance to identify potential liabilities before finalizing a transaction. The inspection period primarily focuses on the physical evaluation of the property, allowing buyers to uncover defects or repair needs but does not replace the legal obligations addressed during due diligence. Failure to properly conduct due diligence can result in unenforceable contracts or hidden legal risks, whereas neglecting inspections may lead to unforeseen maintenance costs.

Buyer Rights in Due Diligence vs Inspection

The due diligence period grants buyers comprehensive rights to investigate all aspects of a property, including title, zoning, and financial matters, ensuring informed decisions before finalizing the purchase. During the inspection period, buyers specifically focus on physical property conditions, such as structural integrity, pest issues, and HVAC functionality, allowing them to negotiate repairs or withdraw without penalty. Understanding these distinct rights helps buyers effectively manage risks and protect their investment throughout the transaction process.

Seller Obligations During Due Diligence and Inspection

During the due diligence period, sellers are obligated to disclose all known material defects and provide access to property records, ensuring transparency for potential buyers. The inspection period specifically requires sellers to allow reasonable access for physical property inspections while maintaining the home's condition. Both periods emphasize seller cooperation to facilitate informed decision-making and uphold contractual obligations in real estate transactions.

How to Maximize the Due Diligence Period

Maximizing the due diligence period in real estate involves thoroughly reviewing all property documents, conducting comprehensive inspections, and verifying zoning or environmental restrictions to avoid costly surprises. Buyers should coordinate with inspectors, title companies, and legal advisors early to ensure all aspects of the property are evaluated within the timeframe. Prioritizing critical tasks and maintaining clear communication with sellers can help secure necessary repairs, negotiate terms, or walk away without penalties if significant issues arise.

Common Pitfalls in the Inspection and Due Diligence Process

Common pitfalls in the inspection and due diligence process include inadequate evaluation of property conditions, overlooked contingencies, and insufficient time to conduct thorough assessments. Buyers often confuse the due diligence period with the inspection period, leading to missed deadlines for negotiating repairs or addressing title issues. Failure to clearly understand contract terms and timelines can result in forfeiture of earnest money or unexpected costs after closing.

Due diligence period vs inspection period Infographic

difterm.com

difterm.com