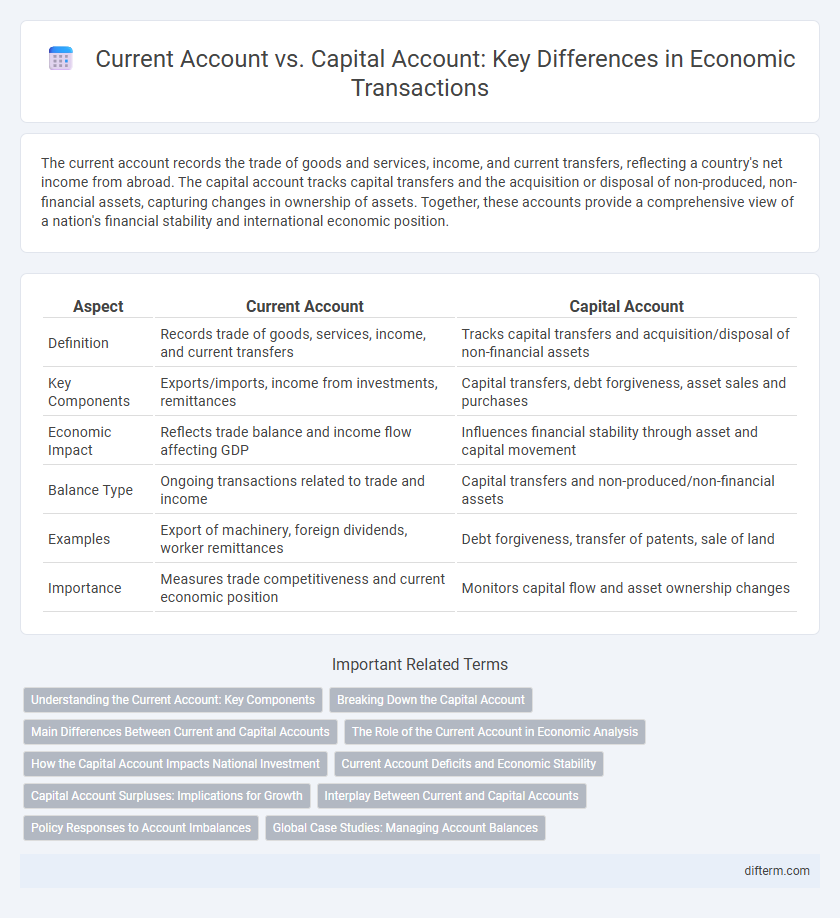

The current account records the trade of goods and services, income, and current transfers, reflecting a country's net income from abroad. The capital account tracks capital transfers and the acquisition or disposal of non-produced, non-financial assets, capturing changes in ownership of assets. Together, these accounts provide a comprehensive view of a nation's financial stability and international economic position.

Table of Comparison

| Aspect | Current Account | Capital Account |

|---|---|---|

| Definition | Records trade of goods, services, income, and current transfers | Tracks capital transfers and acquisition/disposal of non-financial assets |

| Key Components | Exports/imports, income from investments, remittances | Capital transfers, debt forgiveness, asset sales and purchases |

| Economic Impact | Reflects trade balance and income flow affecting GDP | Influences financial stability through asset and capital movement |

| Balance Type | Ongoing transactions related to trade and income | Capital transfers and non-produced/non-financial assets |

| Examples | Export of machinery, foreign dividends, worker remittances | Debt forgiveness, transfer of patents, sale of land |

| Importance | Measures trade competitiveness and current economic position | Monitors capital flow and asset ownership changes |

Understanding the Current Account: Key Components

The current account reflects a country's trade balance, including exports and imports of goods and services, net income from abroad, and current transfers such as foreign aid. It indicates whether a nation is a net lender or borrower to the rest of the world, influencing exchange rates and economic policies. Key components include the trade balance, primary income from investments, and secondary income transfers.

Breaking Down the Capital Account

The capital account records international transfers of financial assets and liabilities, including foreign direct investment, portfolio investment, and changes in reserve assets. It complements the current account, which tracks trade in goods and services, income, and current transfers, by reflecting cross-border capital flows that influence a country's financial stability. Understanding the capital account is crucial for analyzing external financing, investment trends, and their impact on exchange rates and economic growth.

Main Differences Between Current and Capital Accounts

The current account primarily records trade in goods and services, income, and current transfers, reflecting the nation's net income and foreign transactions. In contrast, the capital account tracks cross-border capital transfers and acquisition or disposal of non-produced, non-financial assets, indicating changes in ownership of assets. The main differences lie in their functions: the current account affects a country's balance of payments through trade and income flows, while the capital account influences long-term investment and financial capital movement.

The Role of the Current Account in Economic Analysis

The current account provides critical insights into a country's trade balance, net income from abroad, and current transfers, reflecting its economic health and external competitiveness. It helps economists assess sustainability of a nation's external position by indicating whether it is a net borrower or lender to the rest of the world. Monitoring the current account balance allows policymakers to identify imbalances that may affect exchange rates, foreign reserves, and overall macroeconomic stability.

How the Capital Account Impacts National Investment

The capital account records financial transactions involving the purchase and sale of assets between a country and the rest of the world, directly influencing national investment levels by facilitating foreign direct investment (FDI) and portfolio flows. A surplus in the capital account typically reflects increased inflows of foreign capital, boosting domestic investment capacity and supporting economic growth. Conversely, a capital account deficit can constrain investment funding, limiting infrastructure development and industrial expansion essential for long-term economic stability.

Current Account Deficits and Economic Stability

Current account deficits indicate a country is importing more goods, services, and capital than it exports, potentially signaling vulnerabilities in economic stability. Persistent deficits may lead to increased foreign debt, influencing exchange rates and investor confidence negatively. However, capital account inflows can offset current account deficits by financing investments and supporting economic growth, maintaining overall financial equilibrium.

Capital Account Surpluses: Implications for Growth

Capital account surpluses reflect net inflows from foreign investments, including direct investments and portfolio inflows, indicating increased foreign confidence in domestic markets. This influx of capital can finance infrastructure projects, boost industrial expansion, and enhance technological advancements, driving sustainable economic growth. However, excessive surpluses may lead to currency appreciation, affecting export competitiveness and requiring careful macroeconomic management.

Interplay Between Current and Capital Accounts

The current account records a country's trade balance, net income from abroad, and current transfers, directly impacting foreign exchange earnings and reserves. The capital account captures cross-border investments, including portfolio flows, foreign direct investment (FDI), and changes in reserve assets, influencing financial stability and currency valuation. A surplus in the current account typically leads to capital outflows, while deficits often require capital inflows to finance the gap, highlighting the dynamic interplay that shapes a nation's external financial position.

Policy Responses to Account Imbalances

Policy responses to current account and capital account imbalances often involve coordinated monetary and fiscal measures aimed at restoring external balance. Central banks may adjust interest rates to influence capital flows, while governments implement trade policies or fiscal stimulus to correct persistent deficits or surpluses. Structural reforms targeting competitiveness and investment climate also play a crucial role in addressing underlying causes of account imbalances.

Global Case Studies: Managing Account Balances

Current account deficits often signal a country's reliance on foreign capital inflows, as seen in the United States, which balances persistent trade deficits with substantial capital account surpluses from foreign investments. Germany exemplifies a surplus in the current account due to robust exports, investing those earnings abroad to maintain capital account equilibrium. Emerging economies like Brazil face volatility in managing capital account flows, where sudden stops or reversals can destabilize their current account balances and overall economic stability.

Current account vs Capital account Infographic

difterm.com

difterm.com