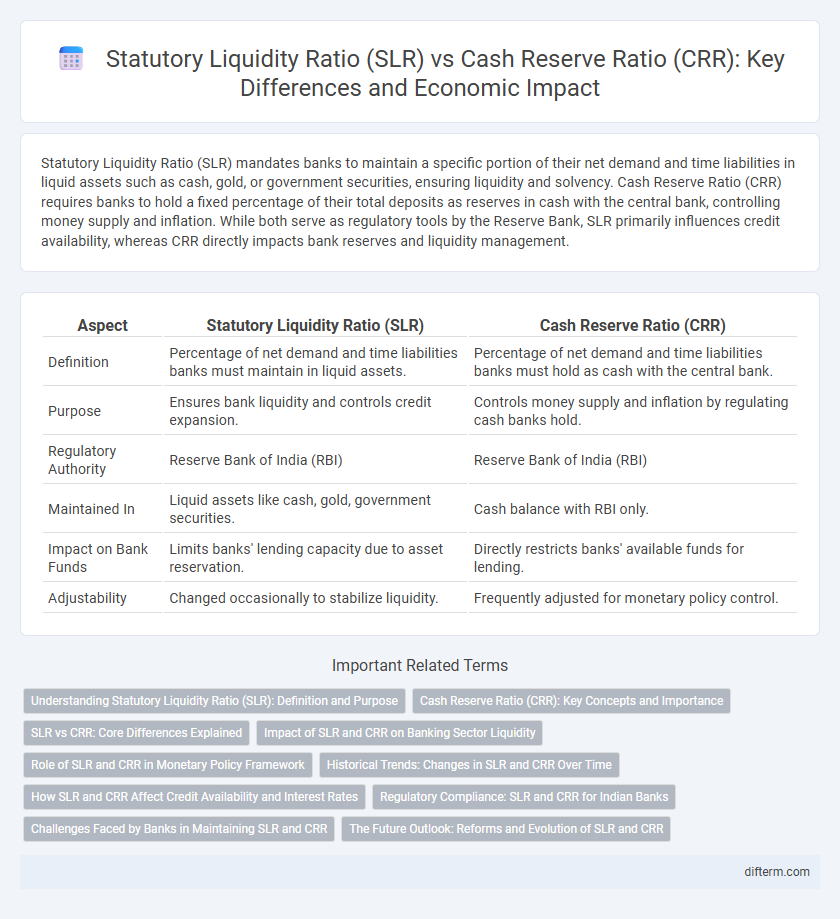

Statutory Liquidity Ratio (SLR) mandates banks to maintain a specific portion of their net demand and time liabilities in liquid assets such as cash, gold, or government securities, ensuring liquidity and solvency. Cash Reserve Ratio (CRR) requires banks to hold a fixed percentage of their total deposits as reserves in cash with the central bank, controlling money supply and inflation. While both serve as regulatory tools by the Reserve Bank, SLR primarily influences credit availability, whereas CRR directly impacts bank reserves and liquidity management.

Table of Comparison

| Aspect | Statutory Liquidity Ratio (SLR) | Cash Reserve Ratio (CRR) |

|---|---|---|

| Definition | Percentage of net demand and time liabilities banks must maintain in liquid assets. | Percentage of net demand and time liabilities banks must hold as cash with the central bank. |

| Purpose | Ensures bank liquidity and controls credit expansion. | Controls money supply and inflation by regulating cash banks hold. |

| Regulatory Authority | Reserve Bank of India (RBI) | Reserve Bank of India (RBI) |

| Maintained In | Liquid assets like cash, gold, government securities. | Cash balance with RBI only. |

| Impact on Bank Funds | Limits banks' lending capacity due to asset reservation. | Directly restricts banks' available funds for lending. |

| Adjustability | Changed occasionally to stabilize liquidity. | Frequently adjusted for monetary policy control. |

Understanding Statutory Liquidity Ratio (SLR): Definition and Purpose

Statutory Liquidity Ratio (SLR) is a regulatory requirement mandating banks to maintain a fixed percentage of their net demand and time liabilities in the form of liquid assets like cash, government securities, and gold. The primary purpose of SLR is to ensure the bank's solvency and control excess credit growth, thus stabilizing the economy by curbing inflation and protecting depositors' interest. Unlike Cash Reserve Ratio (CRR), which requires banks to keep a portion of their deposits as cash with the central bank, SLR mandates holding liquid assets with the banks themselves.

Cash Reserve Ratio (CRR): Key Concepts and Importance

Cash Reserve Ratio (CRR) mandates banks to hold a specific percentage of their net demand and time liabilities in the form of liquid cash with the central bank, ensuring liquidity and financial stability. By controlling the CRR, the Reserve Bank of India (RBI) regulates money supply, curbing inflation and safeguarding depositor interests. CRR is a crucial monetary policy instrument that influences credit availability, interest rates, and overall economic growth.

SLR vs CRR: Core Differences Explained

The Statutory Liquidity Ratio (SLR) mandates banks to maintain a specific percentage of their net demand and time liabilities in the form of liquid assets such as cash, gold, or government securities, whereas the Cash Reserve Ratio (CRR) requires banks to hold a fixed portion of their deposits solely as cash with the central bank. SLR primarily ensures banks' financial stability and liquidity by controlling the amount available for lending, while CRR directly influences money supply and inflation by restricting banks' ability to deploy funds. Both ratios are crucial monetary policy tools used by central banks to regulate credit growth and maintain economic equilibrium.

Impact of SLR and CRR on Banking Sector Liquidity

Statutory Liquidity Ratio (SLR) mandates banks to maintain a specific percentage of their net demand and time liabilities in liquid assets like government securities, directly influencing the availability of funds for lending. Cash Reserve Ratio (CRR) requires banks to keep a certain portion of their deposits as reserves with the central bank, limiting the amount of money banks can use for credit creation. Higher SLR and CRR levels reduce banking sector liquidity, restraining loan growth and affecting overall credit flow in the economy.

Role of SLR and CRR in Monetary Policy Framework

Statutory Liquidity Ratio (SLR) mandates banks to maintain a fixed percentage of their net demand and time liabilities in the form of liquid assets like government securities, ensuring liquidity and controlling credit expansion. Cash Reserve Ratio (CRR) requires banks to hold a specified portion of their total deposits as cash with the central bank, regulating money supply and inflation. Both SLR and CRR serve as crucial monetary policy tools used by central banks to stabilize the banking sector, manage liquidity, and influence interest rates.

Historical Trends: Changes in SLR and CRR Over Time

Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR) have shown distinct historical trends reflecting monetary policy priorities; SLR was higher in the 1990s, often exceeding 38%, to ensure banks held substantial liquid assets, while CRR remained relatively lower. Over time, CRR adjustments have been more frequent and responsive to inflationary pressures and liquidity management, fluctuating between 3% and 15% since the 1970s. Both ratios have gradually decreased in recent decades, with SLR currently around 18-20% and CRR maintained near 4%, signaling a shift toward more market-driven banking operations and enhanced credit flow.

How SLR and CRR Affect Credit Availability and Interest Rates

The Statutory Liquidity Ratio (SLR) mandates banks to maintain a fixed percentage of their net demand and time liabilities in liquid assets, limiting the funds available for lending and thus tightening credit availability. The Cash Reserve Ratio (CRR) requires banks to keep a portion of their deposits as reserves with the central bank, reducing liquidity in the banking system and exerting upward pressure on interest rates. Higher SLR and CRR levels constrain bank credit supply, increasing borrowing costs and influencing overall economic growth.

Regulatory Compliance: SLR and CRR for Indian Banks

Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR) are critical regulatory tools mandated by the Reserve Bank of India to ensure liquidity and financial stability in Indian banks. While CRR requires banks to maintain a minimum percentage of their net demand and time liabilities in cash with the central bank, promoting immediate liquidity, SLR mandates holding a specific portion of net demand and time liabilities in liquid assets like government securities to safeguard solvency. Compliance with SLR and CRR norms helps Indian banks manage liquidity risks, support monetary policy transmission, and maintain investor confidence in the banking system.

Challenges Faced by Banks in Maintaining SLR and CRR

Banks face significant challenges in maintaining the Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR) due to liquidity constraints and the need to balance regulatory compliance with operational funding. Holding substantial government securities for SLR limits the funds available for lending, directly impacting profitability and credit growth. Simultaneously, maintaining CRR in non-interest-bearing reserves with the central bank reduces banks' ability to generate income, creating pressure on liquidity management.

The Future Outlook: Reforms and Evolution of SLR and CRR

The future outlook of Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR) involves ongoing reforms aimed at enhancing liquidity management and promoting financial stability in the banking sector. Regulatory bodies like the Reserve Bank of India (RBI) are expected to revise these ratios in response to evolving economic conditions, incentivizing banks to optimize asset deployment and credit flow. Continuous evolution of SLR and CRR will leverage technology and data analytics to improve precision in monetary policy transmission and support sustainable economic growth.

Statutory Liquidity Ratio (SLR) vs Cash Reserve Ratio (CRR) Infographic

difterm.com

difterm.com