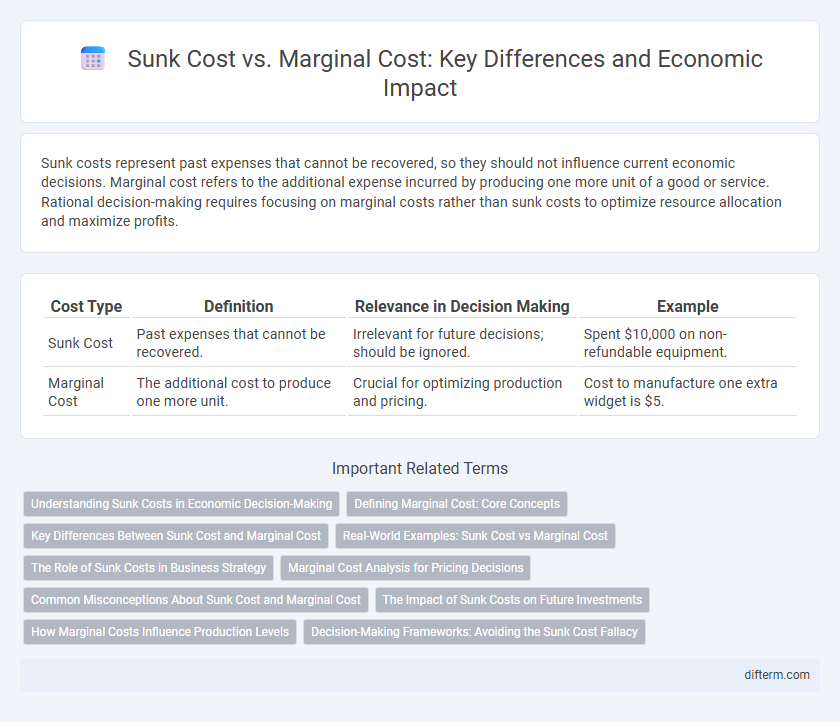

Sunk costs represent past expenses that cannot be recovered, so they should not influence current economic decisions. Marginal cost refers to the additional expense incurred by producing one more unit of a good or service. Rational decision-making requires focusing on marginal costs rather than sunk costs to optimize resource allocation and maximize profits.

Table of Comparison

| Cost Type | Definition | Relevance in Decision Making | Example |

|---|---|---|---|

| Sunk Cost | Past expenses that cannot be recovered. | Irrelevant for future decisions; should be ignored. | Spent $10,000 on non-refundable equipment. |

| Marginal Cost | The additional cost to produce one more unit. | Crucial for optimizing production and pricing. | Cost to manufacture one extra widget is $5. |

Understanding Sunk Costs in Economic Decision-Making

Sunk costs represent past expenditures that cannot be recovered and should not influence current economic decisions, as they do not affect future costs or benefits. Marginal cost, the additional cost of producing one more unit, is crucial for optimizing production levels and maximizing profit. Recognizing the difference between sunk and marginal costs allows businesses to avoid the sunk cost fallacy and make rational, forward-looking economic choices.

Defining Marginal Cost: Core Concepts

Marginal cost represents the additional expense incurred when producing one more unit of a good or service, focusing solely on variable costs that change with output levels. It excludes sunk costs, which are past expenses that cannot be recovered and do not impact current production decisions. Understanding marginal cost is essential for businesses to optimize resource allocation and maximize profit by producing up to the point where marginal cost equals marginal revenue.

Key Differences Between Sunk Cost and Marginal Cost

Sunk cost refers to expenses that have already been incurred and cannot be recovered, making them irrelevant to future decision-making processes. Marginal cost, on the other hand, represents the additional expense required to produce one more unit of a good or service, playing a crucial role in optimizing production levels. The key difference lies in sunk costs being past expenditures, while marginal costs influence current and future economic choices.

Real-World Examples: Sunk Cost vs Marginal Cost

Companies often face sunk costs such as initial research and development expenses that cannot be recovered once spent, while marginal costs represent the additional expense of producing one more unit, like the cost of materials and labor for manufacturing an extra product. For instance, a software firm may ignore the sunk cost of previous unsuccessful projects when deciding whether to launch a new feature, focusing instead on the marginal cost of development and potential revenue. In manufacturing, firms optimize production by analyzing marginal costs to determine whether producing additional goods increases profitability despite fixed sunk investments in factory equipment.

The Role of Sunk Costs in Business Strategy

Sunk costs are expenses that have already been incurred and cannot be recovered, making them irrelevant to future business decisions when comparing marginal costs and benefits. In business strategy, understanding sunk costs helps managers avoid the sunk cost fallacy, where past investments unduly influence ongoing project evaluations. Focusing on marginal cost analysis enables firms to optimize resource allocation by considering only incremental costs and benefits, leading to more rational and effective strategic decisions.

Marginal Cost Analysis for Pricing Decisions

Marginal cost analysis plays a crucial role in pricing decisions by identifying the additional cost incurred from producing one more unit of a good or service. Firms use this analysis to set prices that cover marginal costs while maximizing profit, ensuring efficient resource allocation without considering sunk costs already incurred. Marginal cost pricing helps businesses respond dynamically to market demand and avoid losses associated with fixed or sunk expenses.

Common Misconceptions About Sunk Cost and Marginal Cost

Common misconceptions about sunk cost involve treating these irreversible expenses as relevant for future decision-making, despite their irretrievability affecting only past choices. Marginal cost, often confused with average or fixed costs, represents the cost of producing one additional unit and should guide optimal production levels. Ignoring the distinction leads to inefficient resource allocation and suboptimal economic decisions.

The Impact of Sunk Costs on Future Investments

Sunk costs, expenses that have already been incurred and cannot be recovered, should not influence future investment decisions because they do not affect marginal costs. Marginal cost, the additional expense of producing one more unit, is critical for evaluating whether new investments will be profitable. Ignoring sunk costs and focusing on marginal costs helps businesses allocate resources efficiently and avoid the fallacy of throwing good money after bad.

How Marginal Costs Influence Production Levels

Marginal costs directly impact production decisions by determining the cost of producing one additional unit of output, guiding firms to increase production only when marginal costs are lower than marginal revenue. Unlike sunk costs, which are unrecoverable and should not affect future production choices, marginal costs provide real-time data crucial for optimizing resource allocation and maximizing profit. Firms continuously analyze marginal costs to adjust production levels, ensuring efficient use of inputs and responsiveness to market demand fluctuations.

Decision-Making Frameworks: Avoiding the Sunk Cost Fallacy

In economic decision-making frameworks, recognizing sunk costs is essential to avoid the sunk cost fallacy, which can distort rational choices by overvaluing past investments. Marginal cost analysis focuses solely on the additional cost of producing one more unit, guiding optimal resource allocation by considering future costs rather than irrecoverable expenditures. Effective decision-making requires distinguishing between sunk costs and marginal costs to maximize economic efficiency and avoid escalating commitment to failing projects.

sunk cost vs marginal cost Infographic

difterm.com

difterm.com