Laissez-faire economics advocates for minimal government intervention, emphasizing free markets as the most efficient allocators of resources. Keynesianism argues that active government policies, including fiscal stimulus and monetary measures, are essential to manage economic cycles and mitigate recessions. Debates between these schools center on the balance between market freedom and regulatory oversight to achieve stable growth and employment.

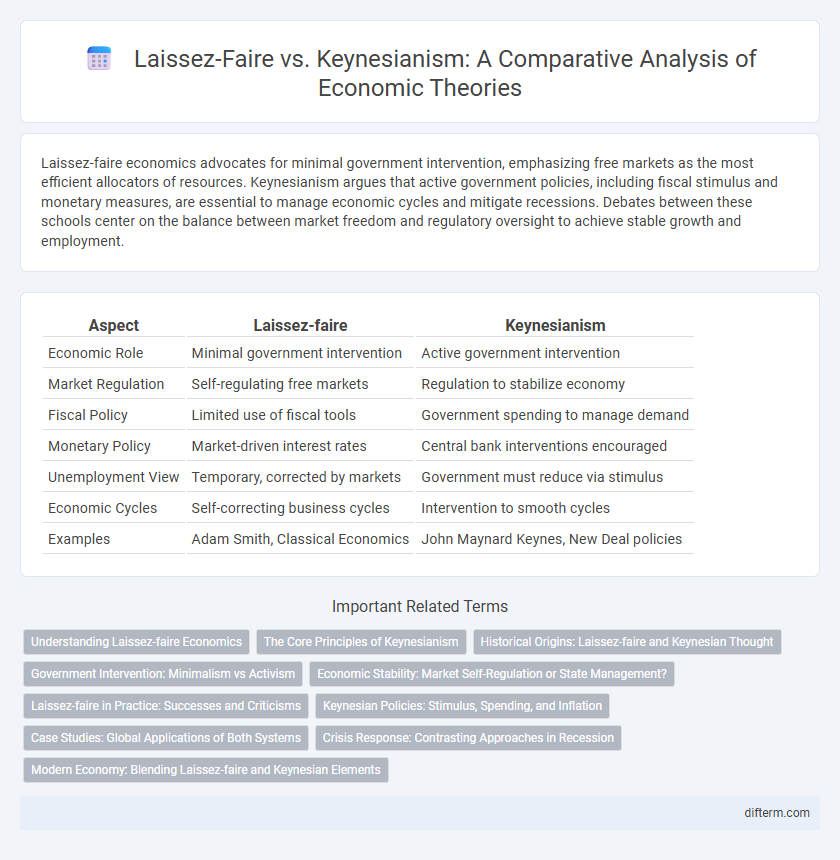

Table of Comparison

| Aspect | Laissez-faire | Keynesianism |

|---|---|---|

| Economic Role | Minimal government intervention | Active government intervention |

| Market Regulation | Self-regulating free markets | Regulation to stabilize economy |

| Fiscal Policy | Limited use of fiscal tools | Government spending to manage demand |

| Monetary Policy | Market-driven interest rates | Central bank interventions encouraged |

| Unemployment View | Temporary, corrected by markets | Government must reduce via stimulus |

| Economic Cycles | Self-correcting business cycles | Intervention to smooth cycles |

| Examples | Adam Smith, Classical Economics | John Maynard Keynes, New Deal policies |

Understanding Laissez-faire Economics

Laissez-faire economics prioritizes minimal government intervention, emphasizing free markets and individual entrepreneurship to drive economic growth. It argues that supply and demand naturally regulate prices and innovation, fostering efficient resource allocation. Critics contend this approach can lead to market failures and inequality without regulatory oversight.

The Core Principles of Keynesianism

Keynesianism centers on active government intervention to stabilize economic fluctuations through fiscal policies like government spending and taxation adjustments. It emphasizes aggregate demand as the primary driver of economic growth and unemployment levels, advocating for counter-cyclical measures to manage recessions. Unlike laissez-faire economics, Keynesianism supports using public sector tools to mitigate market failures and promote full employment.

Historical Origins: Laissez-faire and Keynesian Thought

Laissez-faire economics emerged in the 18th century, rooted in Adam Smith's advocacy for minimal government intervention and the invisible hand guiding free markets. Keynesianism developed during the Great Depression in the 1930s, propelled by John Maynard Keynes' argument that government spending and intervention are essential to stabilize economic cycles and promote employment. These contrasting economic philosophies reflect differing historical contexts: laissez-faire arose amid early capitalist expansion, while Keynesianism responded to the failures of unregulated markets during an economic crisis.

Government Intervention: Minimalism vs Activism

Laissez-faire economics advocates for minimal government intervention, emphasizing free markets where supply and demand regulate economic activity without regulatory constraints. Keynesianism supports active government intervention to stabilize economic fluctuations through fiscal policies like government spending and taxation adjustments. This fundamental difference highlights laissez-faire's trust in market self-regulation versus Keynesianism's emphasis on government activism to achieve full employment and economic growth.

Economic Stability: Market Self-Regulation or State Management?

Laissez-faire economics emphasizes market self-regulation, asserting that minimal government intervention allows supply and demand to naturally stabilize economic fluctuations. Keynesianism advocates for active state management, using fiscal and monetary policies to mitigate recessions and control inflation, thereby promoting economic stability. Empirical data from the Great Depression and 2008 financial crisis highlight the effectiveness of government intervention in stabilizing markets compared to pure laissez-faire approaches.

Laissez-faire in Practice: Successes and Criticisms

Laissez-faire economics, emphasizing minimal government intervention and free-market principles, has driven significant innovation and economic growth in various capitalist economies, particularly during the Industrial Revolution and in modern tech sectors. Its successes include fostering entrepreneurship and efficient resource allocation, yet critics argue it can lead to income inequality, market failures, and insufficient public goods provision. Empirical evidence highlights that economies relying solely on laissez-faire face challenges in addressing economic crises and social welfare compared to those with more regulatory frameworks.

Keynesian Policies: Stimulus, Spending, and Inflation

Keynesian policies advocate for increased government stimulus and public spending to boost economic demand during downturns, effectively reducing unemployment and spurring growth. These measures often involve deficit financing, which can lead to short-term inflation as aggregate demand outpaces supply. Balancing stimulus with inflation control remains a critical challenge for Keynesian economists aiming to stabilize the economy without triggering excessive price increases.

Case Studies: Global Applications of Both Systems

Laissez-faire economics, exemplified by Hong Kong's rapid growth due to minimal government intervention and open markets, contrasts with Keynesianism as seen in post-World War II United States, where government stimulus and fiscal policies mitigated the Great Depression's impact. Countries like Sweden blend Keynesian welfare policies with market capitalism, while Chile's 1970s free-market reforms under Pinochet demonstrate Laissez-faire principles fostering economic liberalization and foreign investment. These case studies illustrate how diverse historical and economic contexts influence the effectiveness of Laissez-faire versus Keynesian economic frameworks globally.

Crisis Response: Contrasting Approaches in Recession

Laissez-faire economics advocates minimal government intervention, relying on free markets to self-correct during recessions by allowing prices and wages to adjust naturally. Keynesianism supports active fiscal policies, such as increased public spending and tax cuts, to stimulate aggregate demand and mitigate economic downturns rapidly. While laissez-faire emphasizes long-term market equilibrium, Keynesianism prioritizes short-term stabilization to reduce unemployment and restore growth.

Modern Economy: Blending Laissez-faire and Keynesian Elements

Modern economies often blend laissez-faire principles with Keynesian intervention to balance free-market efficiency and government regulation. This mixed approach allows market forces to drive innovation and growth while fiscal policies stabilize economic cycles and address unemployment. Combining deregulation with strategic government spending fosters sustainable development and macroeconomic stability in complex global markets.

Laissez-faire vs Keynesianism Infographic

difterm.com

difterm.com