Value Added Tax (VAT) is levied at each stage of the production and distribution process, capturing the incremental value added to goods and services, whereas Sales Tax is imposed only at the point of final sale to the consumer. VAT typically ensures a more consistent revenue stream for governments and reduces tax evasion by requiring businesses to report payments throughout the supply chain. Sales Tax, in contrast, can lead to cascading effects and tax-on-tax scenarios if not carefully designed, impacting the final price for consumers.

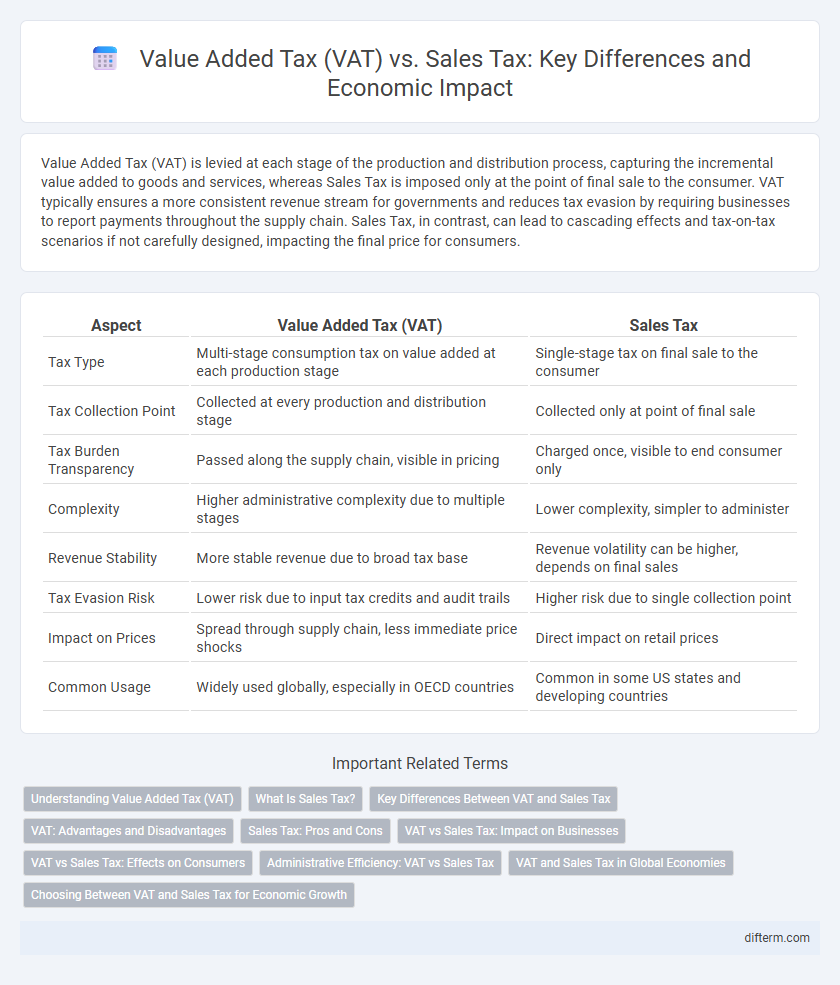

Table of Comparison

| Aspect | Value Added Tax (VAT) | Sales Tax |

|---|---|---|

| Tax Type | Multi-stage consumption tax on value added at each production stage | Single-stage tax on final sale to the consumer |

| Tax Collection Point | Collected at every production and distribution stage | Collected only at point of final sale |

| Tax Burden Transparency | Passed along the supply chain, visible in pricing | Charged once, visible to end consumer only |

| Complexity | Higher administrative complexity due to multiple stages | Lower complexity, simpler to administer |

| Revenue Stability | More stable revenue due to broad tax base | Revenue volatility can be higher, depends on final sales |

| Tax Evasion Risk | Lower risk due to input tax credits and audit trails | Higher risk due to single collection point |

| Impact on Prices | Spread through supply chain, less immediate price shocks | Direct impact on retail prices |

| Common Usage | Widely used globally, especially in OECD countries | Common in some US states and developing countries |

Understanding Value Added Tax (VAT)

Value Added Tax (VAT) is a consumption tax levied on the value added at each stage of production or distribution, differing from sales tax which is only applied at the final sale to consumers. VAT improves tax collection efficiency by taxing businesses on the incremental value, reducing tax evasion risks and promoting transparency. Countries in the European Union and many developing economies rely heavily on VAT for government revenue due to its comprehensive and cascading tax structure.

What Is Sales Tax?

Sales tax is a consumption tax imposed on the sale of goods and services, typically calculated as a percentage of the final purchase price paid by the consumer. Unlike Value Added Tax (VAT), which is collected at each stage of production and distribution, sales tax is only collected at the point of sale to the end consumer. This tax system simplifies revenue collection but can create challenges in tracking tax evasion and managing multistate compliance.

Key Differences Between VAT and Sales Tax

Value Added Tax (VAT) is levied on the value added at each stage of the production and distribution process, while Sales Tax is collected only at the final point of sale to the consumer. VAT allows businesses to claim credits for taxes paid on inputs, reducing the cascading effect common in Sales Tax systems, which are typically simpler but less efficient in tax collection. VAT is widely adopted in many countries for its transparency and ability to generate steady government revenue, whereas Sales Tax is mostly used in the United States and a few other regions.

VAT: Advantages and Disadvantages

Value Added Tax (VAT) provides a systematic approach to taxation by applying levies at each stage of production, which enhances transparency and reduces tax evasion through input tax credits. The main advantage of VAT lies in its ability to generate significant revenue while promoting compliance due to its self-policing mechanism. However, its complexity can increase administrative costs for businesses and create compliance challenges, especially for small enterprises.

Sales Tax: Pros and Cons

Sales tax is straightforward to administer and transparent, as it is only charged at the point of sale, making compliance simpler for both businesses and consumers. However, sales tax can be regressive, disproportionately impacting lower-income households since it is levied on consumption rather than income. Additionally, sales tax may encourage tax avoidance through untaxed transactions, reducing overall revenue efficiency.

VAT vs Sales Tax: Impact on Businesses

Value Added Tax (VAT) impacts businesses differently than Sales Tax by taxing the value added at each stage of production, improving cash flow through input tax credits and reducing tax evasion risks. Sales Tax, collected only at the final point of sale, often creates a heavier compliance burden on retailers and can lead to cascading taxes on intermediate goods. Businesses benefit from VAT's transparency and efficiency, which encourage better record-keeping and smoother cross-border trade in VAT-implementing countries.

VAT vs Sales Tax: Effects on Consumers

Value Added Tax (VAT) is levied at each stage of production, resulting in a cumulative cost that is often embedded in the final price consumers pay, whereas sales tax is charged only at the point of purchase. VAT tends to make prices more transparent across the supply chain, but it can increase the cost burden on producers, which may be passed on to consumers indirectly. Sales tax, being simpler to administer, can lead to price hikes only when goods are sold, potentially making it less distortive but sometimes less visible to consumers.

Administrative Efficiency: VAT vs Sales Tax

Value Added Tax (VAT) offers higher administrative efficiency than sales tax due to its multi-stage collection process, which reduces tax evasion and increases revenue accuracy. VAT systems leverage input tax credits, encouraging businesses to maintain detailed records, streamlining compliance monitoring and audits. In contrast, sales tax is collected only at the final sale point, often resulting in higher avoidance and administrative burdens for tax authorities.

VAT and Sales Tax in Global Economies

Value Added Tax (VAT) is a consumption tax levied at each stage of the supply chain, commonly adopted by over 160 countries worldwide, including all European Union members, as a critical source of government revenue. Sales tax is typically imposed only at the final point of sale to consumers, used predominantly in the United States and select other countries, often resulting in less comprehensive tax collection. The global preference for VAT over sales tax is driven by its efficiency in reducing tax evasion and ensuring a steady, transparent revenue stream for national economies.

Choosing Between VAT and Sales Tax for Economic Growth

Choosing between Value Added Tax (VAT) and sales tax significantly impacts economic growth by influencing consumption behavior and government revenue stability. VAT, charged at each production stage, enhances tax compliance and reduces tax evasion compared to single-stage sales tax, fostering a more consistent revenue stream for public investment. Sales tax, applied only at the point of sale, may discourage consumer spending but simplifies administration, making it more suitable for economies with limited tax infrastructure.

Value Added Tax (VAT) vs Sales Tax Infographic

difterm.com

difterm.com