Forward contracts are customized agreements between two parties to buy or sell an asset at a specified price on a future date, offering flexibility but carrying counterparty risk. Futures contracts are standardized, exchange-traded agreements that reduce counterparty risk through clearinghouses and require margin deposits. Both instruments serve as tools for hedging price risk in financial markets but differ significantly in terms of liquidity, regulation, and settlement.

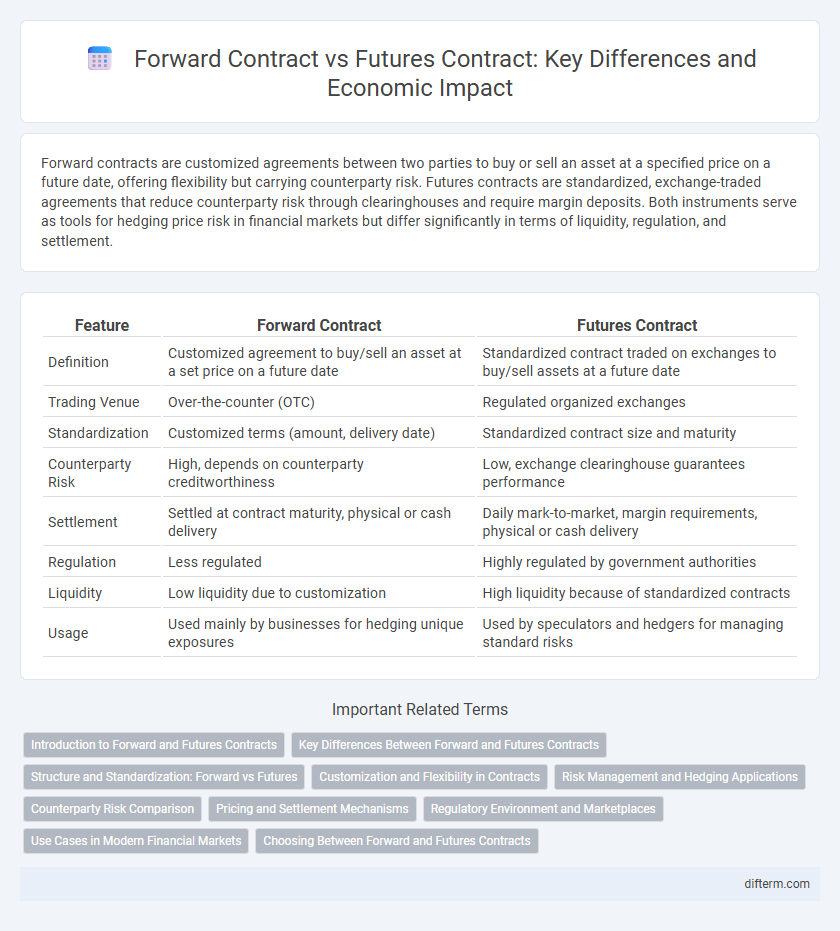

Table of Comparison

| Feature | Forward Contract | Futures Contract |

|---|---|---|

| Definition | Customized agreement to buy/sell an asset at a set price on a future date | Standardized contract traded on exchanges to buy/sell assets at a future date |

| Trading Venue | Over-the-counter (OTC) | Regulated organized exchanges |

| Standardization | Customized terms (amount, delivery date) | Standardized contract size and maturity |

| Counterparty Risk | High, depends on counterparty creditworthiness | Low, exchange clearinghouse guarantees performance |

| Settlement | Settled at contract maturity, physical or cash delivery | Daily mark-to-market, margin requirements, physical or cash delivery |

| Regulation | Less regulated | Highly regulated by government authorities |

| Liquidity | Low liquidity due to customization | High liquidity because of standardized contracts |

| Usage | Used mainly by businesses for hedging unique exposures | Used by speculators and hedgers for managing standard risks |

Introduction to Forward and Futures Contracts

Forward contracts represent private agreements between two parties to buy or sell an asset at a specified future date for a price agreed upon today, offering customization but carrying counterparty risk. Futures contracts are standardized agreements traded on exchanges, requiring margin deposits and daily settlement, which mitigate credit risk while providing liquidity. Both instruments are essential for hedging price risk in commodities, currencies, and financial assets, with futures offering greater transparency and regulation compared to forwards.

Key Differences Between Forward and Futures Contracts

Forward contracts are customized agreements traded over-the-counter (OTC) between two parties to buy or sell an asset at a predetermined price on a future date, offering flexibility but higher counterparty risk. Futures contracts are standardized, exchange-traded agreements with daily settlement and margin requirements, reducing credit risk and enhancing liquidity. The key differences include customization, trading venue, counterparty risk, and settlement procedures.

Structure and Standardization: Forward vs Futures

Forward contracts are customizable agreements traded over-the-counter, allowing parties to tailor contract terms such as quantity, price, and settlement date to their specific needs. Futures contracts are standardized agreements traded on regulated exchanges, featuring fixed contract sizes, expiration dates, and price increments to facilitate liquidity and ease of trading. This inherent standardization in futures contracts enables greater market transparency and reduces counterparty risk compared to the bespoke nature of forwards.

Customization and Flexibility in Contracts

Forward contracts offer high customization, allowing parties to tailor terms such as contract size, maturity date, and underlying asset specifications to their specific needs, which provides superior flexibility for unique hedging or investment strategies. Futures contracts, traded on standardized exchanges, have fixed contract sizes and maturity dates, limiting customization but enhancing liquidity and ease of trade. This distinction makes forwards ideal for bespoke risk management while futures suit traders seeking standardization and quick execution.

Risk Management and Hedging Applications

Forward contracts offer customized risk management solutions by allowing parties to tailor contract terms to specific hedging needs, effectively mitigating price volatility in commodities or currencies. Futures contracts provide standardized agreements traded on exchanges, enabling liquidity and transparency, which facilitate hedging against market fluctuations while minimizing counterparty risk. Both instruments serve as essential tools for businesses and investors to stabilize cash flows and protect against adverse price movements in financial markets.

Counterparty Risk Comparison

Forward contracts carry higher counterparty risk due to their over-the-counter nature and lack of standardized regulation, making them more susceptible to default by one party. Futures contracts minimize counterparty risk through centralized exchange clearinghouses that guarantee contract performance and require daily margin settlements. This risk mitigation mechanism in futures contracts enhances market integrity and reduces the probability of default compared to forwards.

Pricing and Settlement Mechanisms

Forward contracts are customized agreements between two parties with pricing based on the negotiated price of the underlying asset and settlement occurring at contract maturity through physical delivery or cash settlement. Futures contracts are standardized, exchange-traded agreements with daily marked-to-market pricing and margin requirements, enabling continuous settlement through profit and loss adjustments before the contract's expiration. The key difference lies in the customization versus standardization of pricing and the timing of settlement, with forwards settling once at maturity and futures settling daily.

Regulatory Environment and Marketplaces

Futures contracts are standardized agreements traded on regulated exchanges such as the CME Group, ensuring transparency, liquidity, and centralized clearing through entities like the CME Clearing House. Forward contracts are privately negotiated between parties in over-the-counter (OTC) markets, lacking standardization and centralized regulatory oversight, which increases counterparty risk. Regulatory bodies like the Commodity Futures Trading Commission (CFTC) impose strict rules on futures markets to prevent manipulation and ensure market integrity, while forwards operate under less stringent regulatory frameworks.

Use Cases in Modern Financial Markets

Forward contracts are primarily used by corporations and financial institutions to hedge specific, customized exposures to currency, interest rate, or commodity price fluctuations, providing tailored risk management solutions. Futures contracts, standardized and exchange-traded, facilitate liquidity and price discovery, making them ideal for speculators, hedgers, and arbitrageurs in markets such as commodities, equities, and foreign exchange. Both instruments play crucial roles in modern financial markets by enabling risk transfer, price stabilization, and strategic investment across diverse asset classes.

Choosing Between Forward and Futures Contracts

Choosing between forward and futures contracts depends on the level of customization and counterparty risk an investor is willing to accept. Forward contracts offer tailored terms and direct negotiation, making them ideal for businesses seeking specific delivery dates and quantities, but they carry higher counterparty risk due to lack of standardized clearing. Futures contracts provide standardized terms, centralized clearing, and daily settlement, which reduce default risk and enhance liquidity, making them suitable for investors prioritizing transparency and ease of exit.

Forward contract vs Futures contract Infographic

difterm.com

difterm.com