The Keynesian multiplier measures the total increase in economic output generated from an initial increase in spending, emphasizing consumption-driven demand effects. The fiscal multiplier, a broader concept, captures the impact of government fiscal policies, including taxes and transfers, on overall economic activity. Both multipliers highlight the importance of government intervention but differ in their focus on consumption versus fiscal policy components.

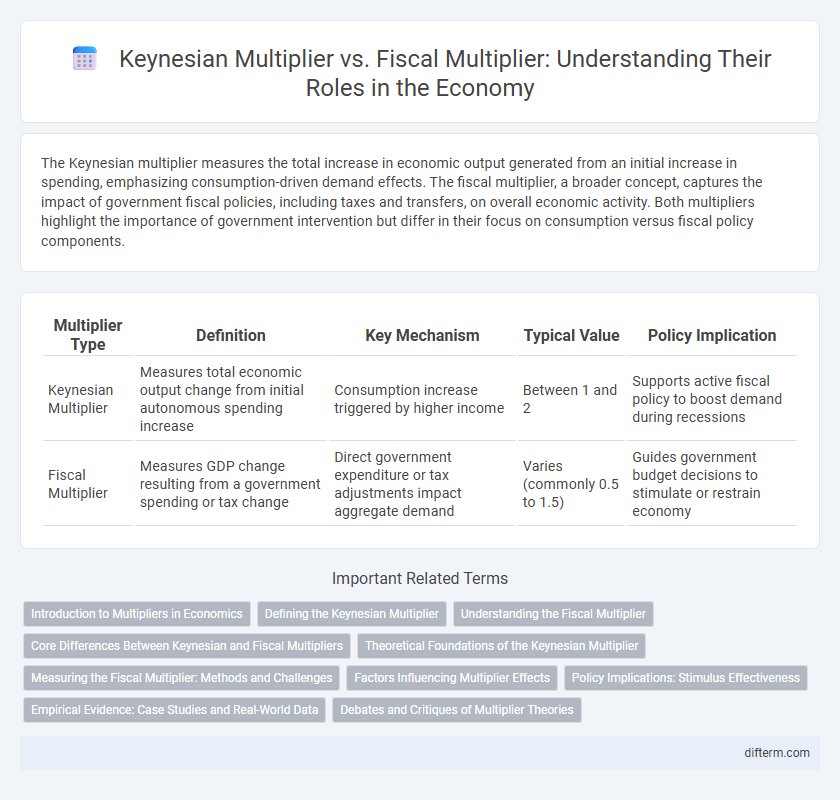

Table of Comparison

| Multiplier Type | Definition | Key Mechanism | Typical Value | Policy Implication |

|---|---|---|---|---|

| Keynesian Multiplier | Measures total economic output change from initial autonomous spending increase | Consumption increase triggered by higher income | Between 1 and 2 | Supports active fiscal policy to boost demand during recessions |

| Fiscal Multiplier | Measures GDP change resulting from a government spending or tax change | Direct government expenditure or tax adjustments impact aggregate demand | Varies (commonly 0.5 to 1.5) | Guides government budget decisions to stimulate or restrain economy |

Introduction to Multipliers in Economics

The Keynesian multiplier measures how initial government spending increases overall economic output by stimulating aggregate demand, while the fiscal multiplier encompasses broader fiscal policy effects, including taxes and transfers. Both multipliers analyze the ripple effects of fiscal interventions on GDP, but the fiscal multiplier provides a more comprehensive view by incorporating multiple channels of fiscal influence. Understanding these multipliers is critical for evaluating the effectiveness of government policies in stabilizing and growing the economy.

Defining the Keynesian Multiplier

The Keynesian multiplier quantifies the ratio of change in national income to an initial change in autonomous spending, highlighting how government expenditure can amplify economic output. It differs from the broader fiscal multiplier by specifically emphasizing the consumption-driven responses within Keynesian economic theory. This concept is critical for understanding the impact of fiscal policy on aggregate demand and overall economic growth.

Understanding the Fiscal Multiplier

The fiscal multiplier measures the change in economic output caused by a change in government spending or taxation, directly reflecting fiscal policy's impact on GDP. The Keynesian multiplier concept emphasizes that initial government expenditure generates additional income through increased consumption, amplifying the total economic effect. Understanding the fiscal multiplier helps policymakers estimate the effectiveness of stimulus measures in boosting aggregate demand and fostering economic growth.

Core Differences Between Keynesian and Fiscal Multipliers

Keynesian multiplier specifically measures the effect of a change in autonomous spending on overall economic output, highlighting the role of marginal propensities to consume. Fiscal multiplier broadly encompasses the impact of government fiscal policies, including taxes and spending, on GDP and employment levels. Core differences lie in Keynesian multiplier's theoretical focus on consumer behavior and marginal consumption, while fiscal multiplier integrates practical policy instruments and their varying multipliers depending on the economic conditions.

Theoretical Foundations of the Keynesian Multiplier

The Keynesian multiplier, rooted in Keynesian economics, quantifies the proportional increase in aggregate demand resulting from an initial increase in autonomous spending, emphasizing the role of consumption propensities and marginal propensity to consume (MPC). Fiscal multipliers expand this framework by incorporating government spending and taxation effects, reflecting how fiscal policy interventions amplify economic output. The theoretical foundation of the Keynesian multiplier lies in the marginal consumption function, income-expenditure model, and induced spending feedback loops that generate multiplied effects on GDP.

Measuring the Fiscal Multiplier: Methods and Challenges

Measuring the fiscal multiplier involves estimating the change in economic output resulting from a change in government spending or taxation, with the Keynesian multiplier highlighting the amplified effect due to increased aggregate demand. Empirical methods include structural vector autoregressions (SVAR), local projections, and dynamic stochastic general equilibrium (DSGE) models, each facing challenges like identification problems, endogeneity, and varying time horizons. Accurate measurement is complicated by factors such as fiscal policy timing, behavioral responses, and the economic context, which influence the multiplier's magnitude and effectiveness.

Factors Influencing Multiplier Effects

The effectiveness of Keynesian and fiscal multipliers depends on factors such as the marginal propensity to consume, openness of the economy, and initial economic conditions. High marginal propensity to consume boosts the Keynesian multiplier by increasing aggregate demand through successive spending rounds. Conversely, fiscal multipliers vary with government debt levels, crowding-out effects, and monetary policy responsiveness, influencing the overall expansionary impact on GDP.

Policy Implications: Stimulus Effectiveness

The Keynesian multiplier measures the total increase in economic output resulting from an initial government spending injection, emphasizing consumption-driven demand boosts. The fiscal multiplier extends this concept by including the broader effects of fiscal policy changes, such as tax adjustments and transfer payments, on aggregate demand and GDP growth. Understanding these multipliers aids policymakers in designing effective stimulus packages that maximize economic recovery by targeting the most responsive sectors and expenditure types.

Empirical Evidence: Case Studies and Real-World Data

Empirical evidence from case studies in diverse economies demonstrates that the Keynesian multiplier often exceeds the fiscal multiplier during periods of low interest rates and slack demand, as government spending more effectively stimulates aggregate demand. Real-world data from the 2008 financial crisis and COVID-19 pandemic reveal fiscal multipliers ranging from 0.8 to 1.5, highlighting the variable impact of fiscal policy contingent on economic context, such as openness to trade and monetary policy stance. These findings underscore the importance of targeted fiscal interventions and the interplay between government spending and private sector responses in shaping multiplier effects.

Debates and Critiques of Multiplier Theories

Keynesian multiplier theory posits that government spending has a proportional effect on national income, yet critics argue it oversimplifies complex economic dynamics and ignores supply-side constraints. Fiscal multiplier debates focus on varying empirical estimates, with some studies suggesting multipliers below one, challenging the assumption that all government spending yields immediate economic expansion. Critics emphasize factors like crowding out, timing lags, and state of the economy, asserting that multiplier effects depend heavily on context rather than fixed magnitudes.

keynesian multiplier vs fiscal multiplier Infographic

difterm.com

difterm.com