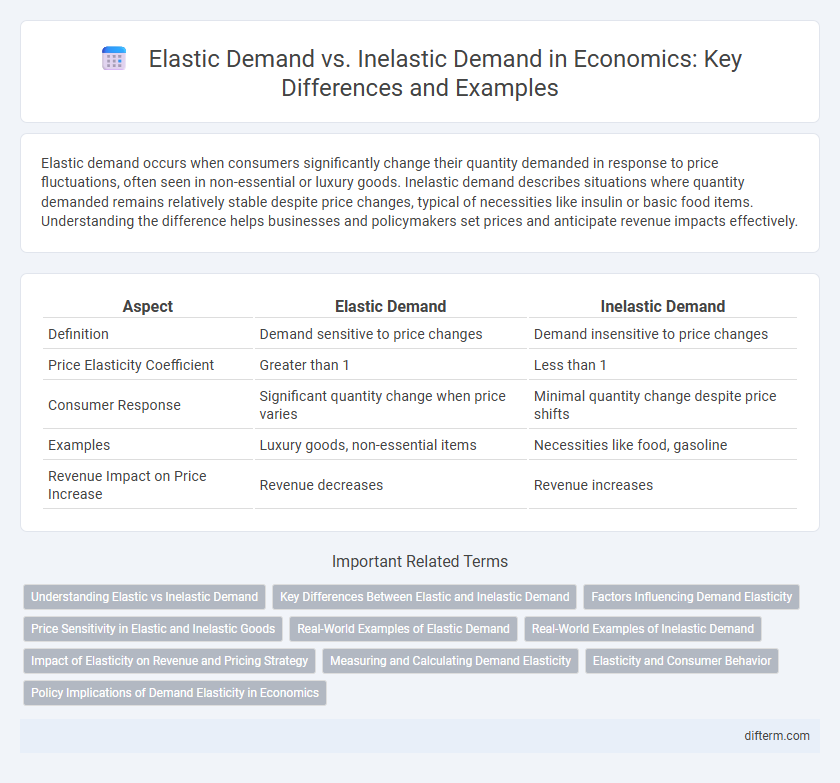

Elastic demand occurs when consumers significantly change their quantity demanded in response to price fluctuations, often seen in non-essential or luxury goods. Inelastic demand describes situations where quantity demanded remains relatively stable despite price changes, typical of necessities like insulin or basic food items. Understanding the difference helps businesses and policymakers set prices and anticipate revenue impacts effectively.

Table of Comparison

| Aspect | Elastic Demand | Inelastic Demand |

|---|---|---|

| Definition | Demand sensitive to price changes | Demand insensitive to price changes |

| Price Elasticity Coefficient | Greater than 1 | Less than 1 |

| Consumer Response | Significant quantity change when price varies | Minimal quantity change despite price shifts |

| Examples | Luxury goods, non-essential items | Necessities like food, gasoline |

| Revenue Impact on Price Increase | Revenue decreases | Revenue increases |

Understanding Elastic vs Inelastic Demand

Elastic demand occurs when consumers significantly alter their quantity demanded in response to price changes, typically seen in non-essential goods with many substitutes. Inelastic demand characterizes products with few or no substitutes, where quantity demanded remains relatively constant despite price fluctuations, such as essential medications or basic utilities. Understanding the distinction between elastic and inelastic demand is crucial for businesses and policymakers to set prices and anticipate market reactions.

Key Differences Between Elastic and Inelastic Demand

Elastic demand is characterized by a significant change in quantity demanded when prices fluctuate, often measured by a price elasticity greater than one, indicating high consumer sensitivity. In contrast, inelastic demand exhibits minimal quantity changes despite price variations, reflected by a price elasticity less than one, revealing consumers' necessity or lack of substitutes. These key differences affect revenue outcomes: price increases reduce total revenue in elastic demand, while they tend to increase total revenue under inelastic demand conditions.

Factors Influencing Demand Elasticity

Price elasticity of demand depends on factors such as the availability of substitutes, the proportion of income spent on the good, and the time horizon for adjustment. Goods with close substitutes tend to have more elastic demand because consumers can easily switch, while necessities with few alternatives exhibit inelastic demand. Additionally, demand is typically more elastic over the long run as consumers find alternatives or adjust consumption habits.

Price Sensitivity in Elastic and Inelastic Goods

Elastic demand refers to products or services whose quantity demanded changes significantly with price fluctuations, indicating high price sensitivity; consumers readily adjust their purchasing behavior when prices rise or fall. In contrast, inelastic demand characterizes goods with relatively stable quantity demanded despite price variations, reflecting low price sensitivity, often due to the necessity or lack of close substitutes. Understanding the price elasticity of demand helps businesses and policymakers predict consumer responses to pricing strategies and economic policies.

Real-World Examples of Elastic Demand

Luxury goods such as high-end electronics and designer clothing exhibit elastic demand, where price changes significantly impact consumer purchasing behavior. In contrast, essential items like basic food and fuel demonstrate inelastic demand, with consumption remaining stable despite price fluctuations. Understanding these real-world examples helps businesses strategize pricing to maximize revenue and market share.

Real-World Examples of Inelastic Demand

Essential goods such as insulin for diabetics and gasoline for commuters exemplify inelastic demand, where quantity purchased remains relatively unchanged despite price fluctuations. In healthcare and energy sectors, consumers prioritize necessity over cost, leading to minimal sensitivity to price changes. This behavior contrasts sharply with luxury goods, where demand elasticity is significantly higher due to discretionary spending.

Impact of Elasticity on Revenue and Pricing Strategy

Elastic demand significantly influences revenue optimization by allowing businesses to adjust prices to increase total revenue, as consumers respond strongly to price changes. In contrast, inelastic demand enables firms to raise prices with minimal loss in quantity sold, often boosting total revenue despite reduced sales volume. Understanding demand elasticity guides pricing strategies to balance profit margins and sales volume effectively across diverse market conditions.

Measuring and Calculating Demand Elasticity

Demand elasticity is measured by calculating the percentage change in quantity demanded divided by the percentage change in price, known as the price elasticity of demand (PED). Elastic demand occurs when PED is greater than 1, indicating consumers are highly responsive to price changes, while inelastic demand has a PED less than 1, showing limited sensitivity to price fluctuations. Understanding these metrics helps businesses optimize pricing strategies and forecast revenue impacts under varying market conditions.

Elasticity and Consumer Behavior

Elastic demand indicates that consumers are highly responsive to price changes, causing significant shifts in quantity demanded when prices fluctuate. Inelastic demand reflects minimal consumer sensitivity, where quantity demanded remains relatively stable despite price variations. Understanding elasticity helps businesses predict consumer behavior, optimize pricing strategies, and maximize revenue by aligning supply with demand responsiveness.

Policy Implications of Demand Elasticity in Economics

Elastic demand influences government policies by prompting adjustments in taxation and subsidies to manage consumption patterns effectively, as consumers are highly responsive to price changes. In contrast, inelastic demand limits the effectiveness of such interventions because changes in price lead to relatively small shifts in quantity demanded, often necessitating alternative policy tools like regulation or direct provision of goods. Understanding demand elasticity helps policymakers predict the impact of taxes, price controls, and welfare programs on market behavior and revenue generation.

Elastic Demand vs Inelastic Demand Infographic

difterm.com

difterm.com