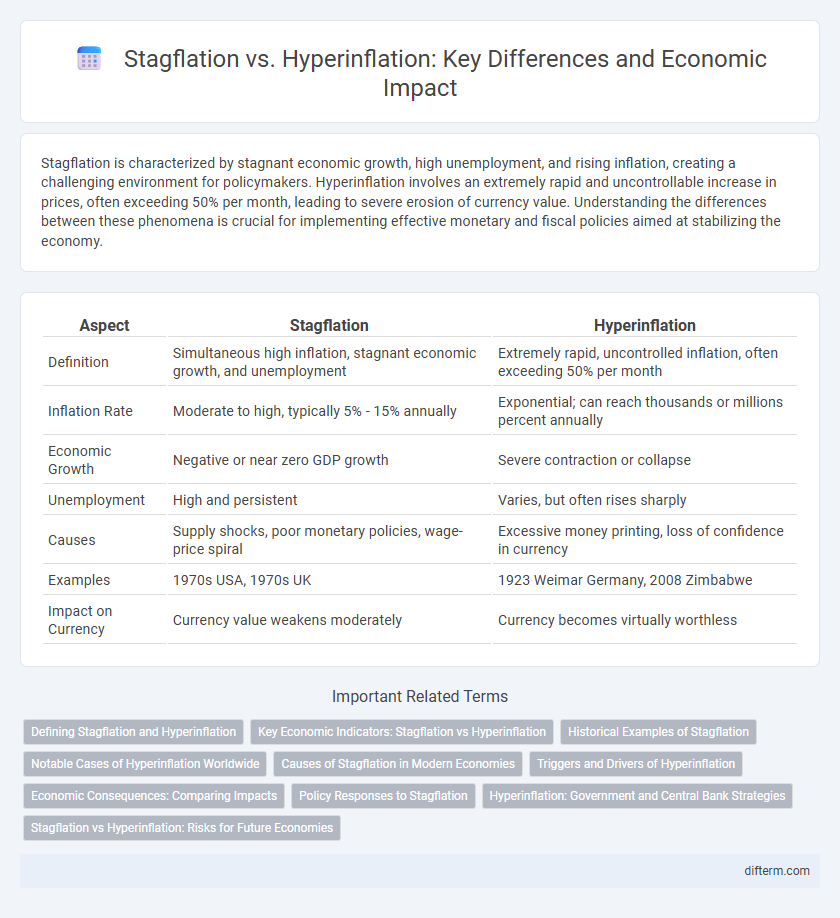

Stagflation is characterized by stagnant economic growth, high unemployment, and rising inflation, creating a challenging environment for policymakers. Hyperinflation involves an extremely rapid and uncontrollable increase in prices, often exceeding 50% per month, leading to severe erosion of currency value. Understanding the differences between these phenomena is crucial for implementing effective monetary and fiscal policies aimed at stabilizing the economy.

Table of Comparison

| Aspect | Stagflation | Hyperinflation |

|---|---|---|

| Definition | Simultaneous high inflation, stagnant economic growth, and unemployment | Extremely rapid, uncontrolled inflation, often exceeding 50% per month |

| Inflation Rate | Moderate to high, typically 5% - 15% annually | Exponential; can reach thousands or millions percent annually |

| Economic Growth | Negative or near zero GDP growth | Severe contraction or collapse |

| Unemployment | High and persistent | Varies, but often rises sharply |

| Causes | Supply shocks, poor monetary policies, wage-price spiral | Excessive money printing, loss of confidence in currency |

| Examples | 1970s USA, 1970s UK | 1923 Weimar Germany, 2008 Zimbabwe |

| Impact on Currency | Currency value weakens moderately | Currency becomes virtually worthless |

Defining Stagflation and Hyperinflation

Stagflation is an economic condition characterized by stagnant growth, high unemployment, and persistent inflation, often resulting from supply shocks or misguided monetary policies. Hyperinflation refers to an extremely rapid and uncontrollable rise in prices, typically exceeding 50% monthly inflation, caused by excessive money supply and loss of confidence in the currency. Both phenomena severely disrupt economic stability, but stagflation combines inflation with economic stagnation, while hyperinflation involves explosive price increases eroding purchasing power.

Key Economic Indicators: Stagflation vs Hyperinflation

Stagflation is characterized by stagnant GDP growth, high unemployment rates often exceeding 6%, and rising inflation typically between 5-10%, which erodes purchasing power without economic expansion. Hyperinflation involves rapid and uncontrolled price increases often surpassing 50% monthly inflation, causing currency devaluation, plummeting real income, and severe economic instability. Key economic indicators such as Consumer Price Index (CPI), unemployment rate, and GDP growth distinctly differ: stagflation shows a combination of high inflation with stagnant output and employment, while hyperinflation reflects extreme inflation with collapsing GDP and financial system breakdowns.

Historical Examples of Stagflation

Historical examples of stagflation prominently include the 1970s in the United States and the United Kingdom, where inflation rates exceeded 10% while economic growth slowed dramatically. This period was marked by stagnant GDP, rising unemployment reaching double digits, and persistent inflation, driven largely by oil price shocks and monetary policy responses. The combination of these factors created a unique economic dilemma, contrasting with hyperinflation scenarios like Zimbabwe in the 2000s, where inflation rates spiraled uncontrollably beyond 79 billion percent.

Notable Cases of Hyperinflation Worldwide

Notable cases of hyperinflation include Zimbabwe in the late 2000s, where inflation peaked at 79.6 billion percent month-over-month, and Venezuela, which experienced hyperinflation exceeding 1,000,000 percent annually since 2016 due to economic mismanagement and political instability. These events contrast sharply with stagflation periods, such as the 1970s US economy, characterized by simultaneous high inflation and stagnant growth rather than runaway price increases. Understanding these cases highlights the severity and causes behind hyperinflation's rapid erosion of currency value worldwide.

Causes of Stagflation in Modern Economies

Stagflation in modern economies primarily arises from supply-side shocks such as sudden increases in oil prices and disruptions in production chains, which simultaneously drive up inflation and suppress economic growth. Rigid labor markets and inflation expectations further exacerbate stagnant output and rising unemployment. Central bank policies that fail to address these imbalances can prolong stagflation by mismanaging inflation control without stimulating growth.

Triggers and Drivers of Hyperinflation

Hyperinflation is primarily triggered by excessive money supply growth often caused by governments financing large fiscal deficits through central bank money printing. Supply shocks and loss of confidence in the currency exacerbate hyperinflation by accelerating velocity of money and price increases. In contrast, stagflation results from simultaneous supply-side shocks and rigid wage-price dynamics, leading to stagnant growth and rising inflation without the rapid monetary expansion characteristic of hyperinflation.

Economic Consequences: Comparing Impacts

Stagflation, characterized by stagnant economic growth and rising inflation, leads to high unemployment rates and reduced consumer purchasing power, creating prolonged economic hardship and policy challenges. Hyperinflation causes rapid and uncontrollable price increases, severely eroding currency value, destabilizing financial markets, and leading to loss of savings and investment confidence. While stagflation primarily hampers economic growth and employment, hyperinflation results in extreme monetary instability and economic collapse.

Policy Responses to Stagflation

Policy responses to stagflation typically involve a careful balance of monetary tightening to control inflation and fiscal measures to stimulate economic growth without exacerbating unemployment. Central banks may increase interest rates to reduce inflationary pressures, while governments implement targeted spending programs or tax incentives to boost productivity and job creation. Coordinated efforts between monetary and fiscal authorities are crucial to address the simultaneous challenges of rising prices and stagnant economic output.

Hyperinflation: Government and Central Bank Strategies

Hyperinflation occurs when prices rise uncontrollably, often exceeding 50% monthly, severely eroding currency value and purchasing power. Governments and central banks combat hyperinflation by implementing stringent monetary policies, including tightening money supply, raising interest rates, and restoring fiscal discipline through reduced public spending. Stabilization plans often involve currency reform or adopting a foreign currency to rebuild confidence and curb runaway inflation.

Stagflation vs Hyperinflation: Risks for Future Economies

Stagflation poses a unique threat with sustained inflation coupled with stagnant economic growth and high unemployment, undermining consumer confidence and investment. Hyperinflation dramatically erodes currency value at an accelerating rate, leading to loss of purchasing power and severe economic instability. Both conditions threaten future economies by destabilizing markets, increasing uncertainty, and complicating policymaking aimed at sustainable growth.

Stagflation vs Hyperinflation Infographic

difterm.com

difterm.com