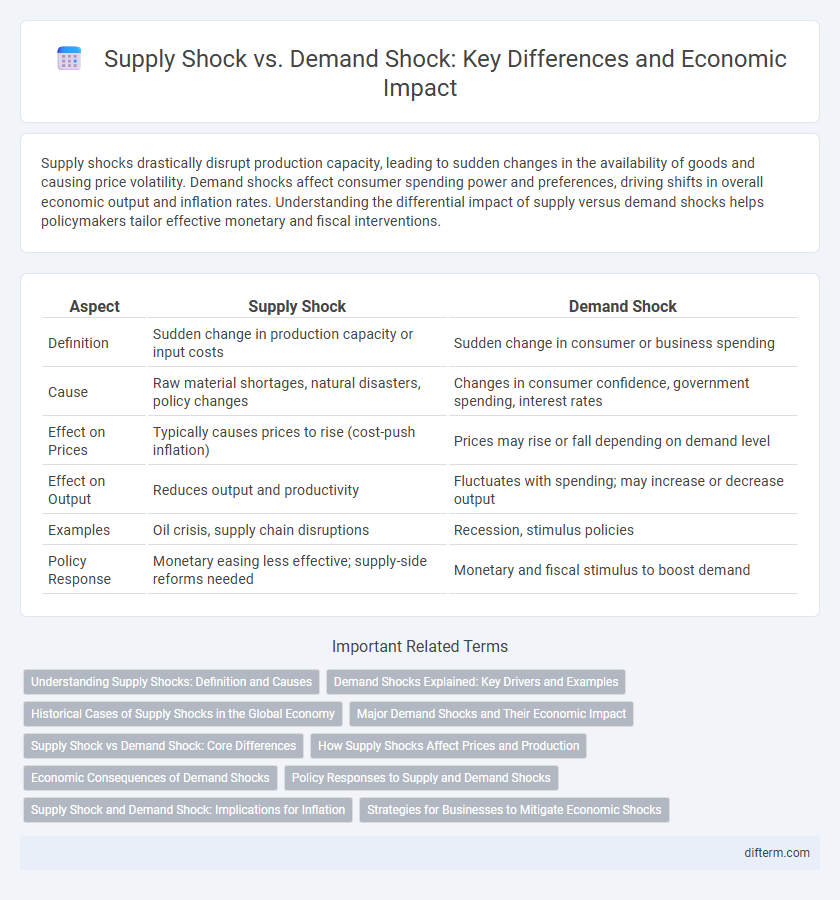

Supply shocks drastically disrupt production capacity, leading to sudden changes in the availability of goods and causing price volatility. Demand shocks affect consumer spending power and preferences, driving shifts in overall economic output and inflation rates. Understanding the differential impact of supply versus demand shocks helps policymakers tailor effective monetary and fiscal interventions.

Table of Comparison

| Aspect | Supply Shock | Demand Shock |

|---|---|---|

| Definition | Sudden change in production capacity or input costs | Sudden change in consumer or business spending |

| Cause | Raw material shortages, natural disasters, policy changes | Changes in consumer confidence, government spending, interest rates |

| Effect on Prices | Typically causes prices to rise (cost-push inflation) | Prices may rise or fall depending on demand level |

| Effect on Output | Reduces output and productivity | Fluctuates with spending; may increase or decrease output |

| Examples | Oil crisis, supply chain disruptions | Recession, stimulus policies |

| Policy Response | Monetary easing less effective; supply-side reforms needed | Monetary and fiscal stimulus to boost demand |

Understanding Supply Shocks: Definition and Causes

Supply shocks occur when sudden changes disrupt the production capacity of goods and services, leading to immediate shifts in supply levels. Common causes include natural disasters, geopolitical conflicts, sudden increases in raw material prices, and technological breakdowns that restrict output. These shocks typically result in higher production costs and reduced availability, causing inflationary pressures and altering market equilibrium.

Demand Shocks Explained: Key Drivers and Examples

Demand shocks refer to unexpected events that significantly alter consumer purchasing power or preferences, leading to sudden shifts in aggregate demand within an economy. Key drivers include changes in government fiscal policies, consumer confidence fluctuations, and shifts in global market conditions such as oil price volatility impacting disposable income. Examples of demand shocks include stimulus checks boosting spending power, pandemics reducing consumption due to health concerns, and financial crises triggering widespread drops in investment and consumption.

Historical Cases of Supply Shocks in the Global Economy

Historical supply shocks have significantly disrupted the global economy, with the 1973 oil crisis exemplifying a drastic reduction in oil supply caused by OPEC's embargo, which led to skyrocketing energy prices and stagflation. Another critical case includes the 2020 COVID-19 pandemic, where factory shutdowns and logistic constraints created severe supply chain bottlenecks, highlighting vulnerabilities in global manufacturing hubs. These supply shocks demonstrate how sudden decreases in production capacity or raw material availability directly elevate costs and constrain economic growth worldwide.

Major Demand Shocks and Their Economic Impact

Major demand shocks, such as sudden changes in consumer confidence, fiscal stimulus, or global pandemics, significantly disrupt aggregate demand, leading to rapid shifts in economic output and employment levels. These shocks often cause inflationary or deflationary pressures depending on the severity and duration, influencing central bank monetary policies and fiscal responses. The resulting fluctuations in consumption, investment, and overall economic growth can trigger recessions or recoveries, highlighting the critical need for timely policy interventions to stabilize demand.

Supply Shock vs Demand Shock: Core Differences

Supply shocks disrupt production and supply chains, leading to sudden increases or decreases in the availability of goods and services, often causing price volatility and inflationary or deflationary pressures. Demand shocks, on the other hand, shift consumer spending and investment behavior, influencing overall economic output and price levels through changes in aggregate demand. Understanding the core differences between supply shock and demand shock is crucial for policymakers to implement targeted measures that stabilize economic growth and control inflation.

How Supply Shocks Affect Prices and Production

Supply shocks cause sudden changes in the availability of goods, leading to higher production costs and reduced output, which typically result in rising prices. When supply decreases unexpectedly due to factors like natural disasters or geopolitical events, producers struggle to meet demand, causing price inflation and lower quantity of goods available. These disruptions can trigger stagflation, a combination of stagnant economic growth and inflation, complicating monetary policy responses.

Economic Consequences of Demand Shocks

Demand shocks cause significant shifts in consumer spending, leading to fluctuations in aggregate demand that can trigger inflation or deflation. Reduced demand often results in lower production output, rising unemployment, and decreased business revenues, thereby dampening economic growth. In contrast, positive demand shocks typically boost output and employment but may also generate inflationary pressures if supply cannot keep pace.

Policy Responses to Supply and Demand Shocks

Policy responses to supply shocks often involve measures to increase production capacity, such as investing in infrastructure, easing regulations, and providing subsidies to critical industries to stabilize supply chains. Demand shocks typically require stimulus policies, including monetary easing, tax cuts, or direct government spending to boost consumer demand and aggregate economic activity. Central banks may adjust interest rates differently depending on whether the shock is supply-driven or demand-driven to achieve inflation control and economic stability.

Supply Shock and Demand Shock: Implications for Inflation

Supply shocks cause sudden changes in the availability of goods and raw materials, leading to increased production costs and a rise in inflation as businesses pass these costs on to consumers. Demand shocks alter consumer spending patterns, affecting overall price levels by either driving demand-pull inflation during surges or causing deflation in downturns. Understanding how supply and demand shocks influence inflation helps policymakers design targeted fiscal and monetary responses to stabilize the economy.

Strategies for Businesses to Mitigate Economic Shocks

Businesses facing supply shocks should diversify their supplier base and maintain higher inventory levels to reduce dependency on any single source, ensuring continuity in production. In response to demand shocks, companies can implement flexible pricing strategies and increase marketing efforts to stimulate customer interest and adapt to changing consumer behavior. Leveraging data analytics allows businesses to anticipate shifts and adjust operations swiftly, enhancing resilience against economic volatility.

Supply shock vs Demand shock Infographic

difterm.com

difterm.com