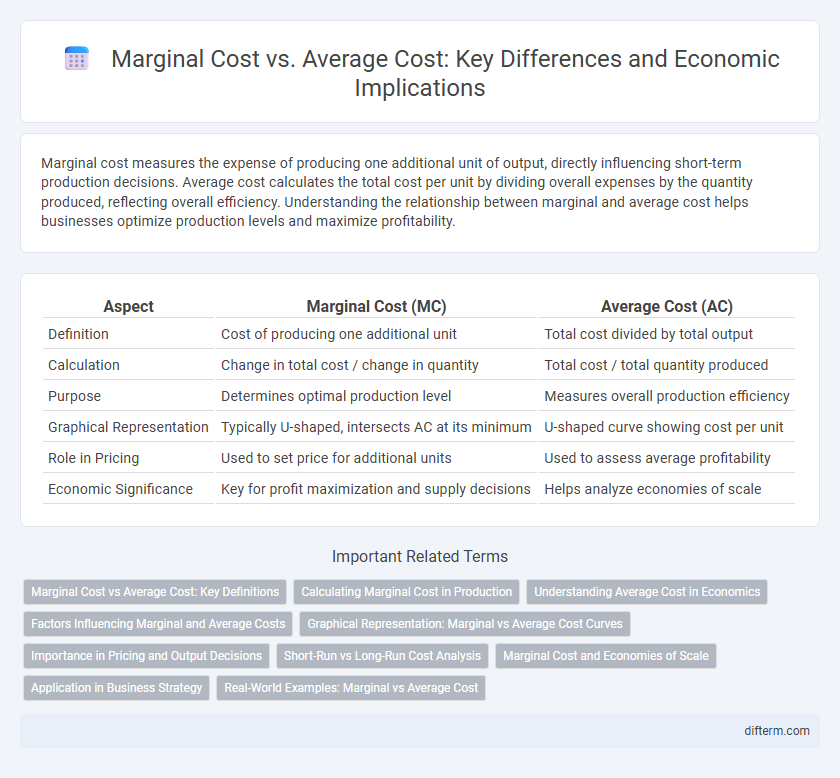

Marginal cost measures the expense of producing one additional unit of output, directly influencing short-term production decisions. Average cost calculates the total cost per unit by dividing overall expenses by the quantity produced, reflecting overall efficiency. Understanding the relationship between marginal and average cost helps businesses optimize production levels and maximize profitability.

Table of Comparison

| Aspect | Marginal Cost (MC) | Average Cost (AC) |

|---|---|---|

| Definition | Cost of producing one additional unit | Total cost divided by total output |

| Calculation | Change in total cost / change in quantity | Total cost / total quantity produced |

| Purpose | Determines optimal production level | Measures overall production efficiency |

| Graphical Representation | Typically U-shaped, intersects AC at its minimum | U-shaped curve showing cost per unit |

| Role in Pricing | Used to set price for additional units | Used to assess average profitability |

| Economic Significance | Key for profit maximization and supply decisions | Helps analyze economies of scale |

Marginal Cost vs Average Cost: Key Definitions

Marginal cost represents the additional expense incurred from producing one more unit of output, while average cost calculates the total cost divided by the number of units produced. Understanding the distinction between these costs is vital for optimizing production decisions and pricing strategies. Firms use marginal cost to determine the cost-effectiveness of increasing production, compared against average cost to evaluate overall efficiency.

Calculating Marginal Cost in Production

Marginal cost is calculated by dividing the change in total production cost by the change in quantity produced, highlighting the cost of producing one additional unit. This figure is essential for businesses to make efficient production decisions and optimize resource allocation. Understanding marginal cost helps in identifying the point where increasing production no longer remains cost-effective compared to average cost.

Understanding Average Cost in Economics

Average cost in economics represents the total cost per unit of output produced, calculated by dividing the total cost by the quantity of goods. It provides a critical measure for firms to assess production efficiency and pricing strategies across different output levels. Understanding how average cost changes with production enables businesses to optimize resource allocation and maximize profit margins.

Factors Influencing Marginal and Average Costs

Marginal cost is primarily influenced by variable input prices, production technology, and scale of output, while average cost depends on both fixed and variable costs spread over total production units. Changes in labor efficiency, raw material costs, and economies of scale significantly impact marginal and average costs differently. Understanding these factors aids in optimizing production decisions and cost management strategies.

Graphical Representation: Marginal vs Average Cost Curves

Marginal cost (MC) and average cost (AC) curves illustrate critical cost behaviors in production, where the MC curve typically intersects the AC curve at its minimum point, marking the most efficient production scale. The MC curve initially declines due to increasing returns but rises due to diminishing marginal returns, causing the AC curve to first fall and then rise, forming a U-shape. Graphically, when MC is below AC, the average cost decreases, and when MC exceeds AC, the average cost increases, providing essential insights for cost optimization and pricing strategies.

Importance in Pricing and Output Decisions

Marginal cost represents the expense of producing one additional unit, guiding firms in determining optimal output levels where marginal cost equals marginal revenue, thus maximizing profit. Average cost, calculated by dividing total cost by total output, helps businesses assess overall efficiency and set prices above this threshold to ensure profitability. Understanding the relationship between marginal and average costs is crucial for pricing strategies and production decisions that enhance competitive advantage and market sustainability.

Short-Run vs Long-Run Cost Analysis

Marginal cost in the short run typically increases due to fixed inputs and diminishing marginal returns, whereas in the long run, marginal cost reflects changes in all inputs, allowing firms to optimize production scale. Average cost in the short run includes fixed and variable costs, often resulting in a U-shaped curve as output changes, while long-run average cost assesses the lowest possible cost at varying output levels with all inputs variable. Understanding these distinctions aids firms in making production decisions and adjusting capacity for cost efficiency over different time horizons.

Marginal Cost and Economies of Scale

Marginal cost refers to the additional expense incurred when producing one more unit of a good, crucial for optimizing production levels and maximizing profits. Economies of scale occur when increasing production lowers the average cost per unit due to fixed costs being spread over more units and operational efficiencies. Understanding marginal cost relative to average cost helps businesses identify cost-saving opportunities and scale production effectively.

Application in Business Strategy

Marginal cost analysis enables businesses to determine the expense of producing one additional unit, guiding optimal production levels and pricing strategies that maximize profit margins. Average cost provides insights into overall cost efficiency by spreading total costs over total output, essential for assessing economies of scale and competitive positioning. Integrating marginal and average cost data supports strategic decisions on product line expansion, cost control, and resource allocation in dynamic market environments.

Real-World Examples: Marginal vs Average Cost

Marginal cost represents the additional expense of producing one more unit, while average cost reflects the total cost divided by the number of units produced. Real-world examples include manufacturing firms where marginal costs initially decrease due to economies of scale but rise as capacity limits are reached, contrasting with average cost trends that smooth out fluctuations over total output. In the airline industry, marginal costs such as fuel and crew expenses influence pricing decisions for extra passengers, whereas average costs incorporate fixed expenses like aircraft leases spread over all flights.

Marginal cost vs Average cost Infographic

difterm.com

difterm.com