Supply-side economics emphasizes boosting production through tax cuts and deregulation to stimulate economic growth and increase job creation. Demand-side economics focuses on increasing consumer spending by implementing fiscal policies like government stimulus and social welfare programs to drive economic expansion. Both approaches target economic prosperity but differ fundamentally in whether growth is driven by producers or consumers.

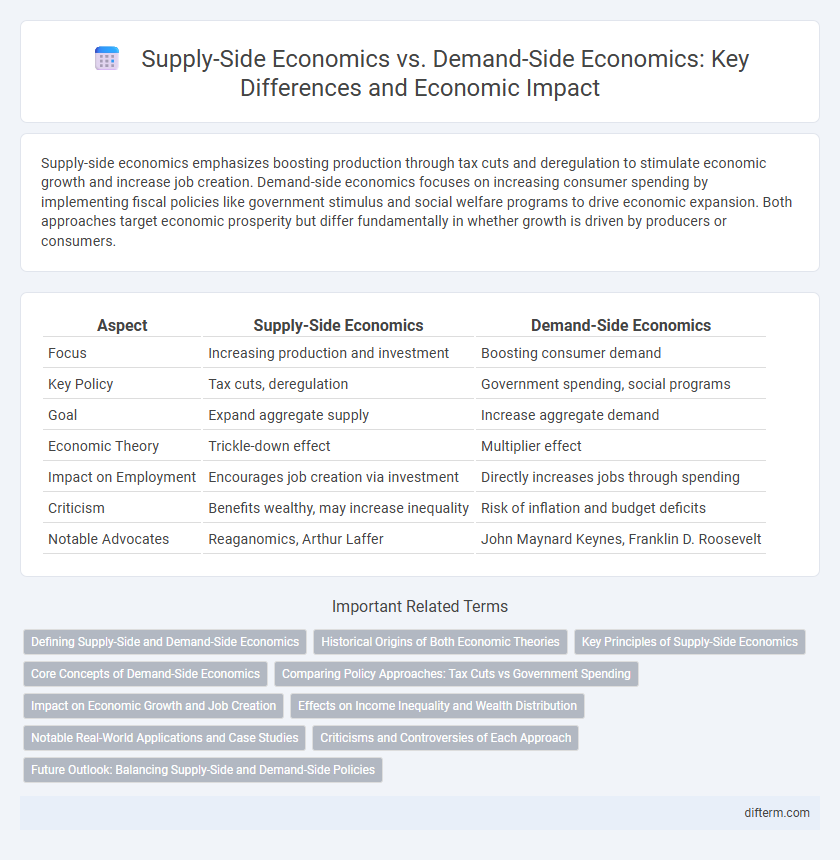

Table of Comparison

| Aspect | Supply-Side Economics | Demand-Side Economics |

|---|---|---|

| Focus | Increasing production and investment | Boosting consumer demand |

| Key Policy | Tax cuts, deregulation | Government spending, social programs |

| Goal | Expand aggregate supply | Increase aggregate demand |

| Economic Theory | Trickle-down effect | Multiplier effect |

| Impact on Employment | Encourages job creation via investment | Directly increases jobs through spending |

| Criticism | Benefits wealthy, may increase inequality | Risk of inflation and budget deficits |

| Notable Advocates | Reaganomics, Arthur Laffer | John Maynard Keynes, Franklin D. Roosevelt |

Defining Supply-Side and Demand-Side Economics

Supply-side economics emphasizes boosting production by reducing taxes and regulatory barriers to encourage investment, entrepreneurship, and job creation. Demand-side economics focuses on stimulating consumer spending through government intervention, such as increased public spending and social welfare programs, to drive economic growth. Both approaches offer distinct mechanisms to influence aggregate demand and overall economic performance.

Historical Origins of Both Economic Theories

Supply-side economics originated in the 1970s, championed by economists like Arthur Laffer who emphasized tax cuts and deregulation to stimulate production and economic growth. Demand-side economics dates back to the 1930s, gaining prominence through John Maynard Keynes' advocacy for government intervention and increased public spending to boost aggregate demand during economic downturns. These contrasting theories reflect fundamentally different approaches to economic policy, with supply-side focusing on incentives for producers and demand-side prioritizing consumer spending and government support.

Key Principles of Supply-Side Economics

Supply-side economics centers on reducing taxes and regulation to stimulate production, investment, and economic growth. Key principles include incentivizing entrepreneurship, expanding capital formation, and enhancing labor market flexibility to increase aggregate supply. Advocates argue that lower marginal tax rates boost work effort and innovation, ultimately leading to higher income and employment levels.

Core Concepts of Demand-Side Economics

Demand-side economics centers on boosting consumer demand through government intervention, primarily via fiscal policies such as increased public spending and tax cuts for lower- and middle-income households. The core concept asserts that higher consumer demand spurs production, leading to job creation and economic growth. Key mechanisms include stimulus packages, welfare programs, and monetary policies aimed at increasing disposable income to drive aggregate demand.

Comparing Policy Approaches: Tax Cuts vs Government Spending

Supply-side economics emphasizes tax cuts to stimulate investment, increase production, and boost economic growth by improving incentives for businesses and entrepreneurs. Demand-side economics advocates for increased government spending to directly raise aggregate demand, targeting job creation and income support to drive consumption. Both approaches aim to enhance economic performance but differ in mechanisms: supply-side relies on reduced taxation to encourage supply, while demand-side focuses on fiscal stimulus to increase consumer spending.

Impact on Economic Growth and Job Creation

Supply-side economics emphasizes tax cuts, deregulation, and incentives for producers to stimulate investment, leading to increased production capacity, economic growth, and job creation over time. Demand-side economics focuses on boosting consumer demand through government spending and social programs, which directly supports business revenue and employment in the short term. Empirical evidence suggests that supply-side policies foster long-term sustainable growth, while demand-side measures provide immediate relief but risk inflation if overused.

Effects on Income Inequality and Wealth Distribution

Supply-side economics emphasizes tax cuts and deregulation to stimulate production and investment, often benefiting higher-income earners and potentially exacerbating income inequality and wealth concentration. Demand-side economics focuses on increasing consumer spending through government intervention, such as social welfare programs and minimum wage hikes, which can reduce income disparities by boosting the purchasing power of lower- and middle-income households. Empirical studies suggest that demand-side policies tend to promote more equitable wealth distribution, while supply-side approaches may lead to greater income polarization over time.

Notable Real-World Applications and Case Studies

Supply-side economics prominently influenced the Reagan administration in the 1980s, resulting in significant tax cuts and deregulation aimed at boosting production and long-term economic growth. Demand-side economics found practical application during the 2009 global financial crisis when governments, including the U.S., implemented expansive fiscal stimulus packages to spur consumption and revitalize economic activity. Case studies from these periods reveal that supply-side policies often lead to increased investment and job creation over time, while demand-side approaches provide immediate relief during downturns by supporting consumer spending.

Criticisms and Controversies of Each Approach

Supply-side economics faces criticism for disproportionately benefiting the wealthy through tax cuts, which may increase income inequality and result in budget deficits without guaranteed trickle-down effects. Demand-side economics is often contested due to concerns over escalating government debt and inflation stemming from increased public spending and intervention. Both approaches spark debates on their long-term effectiveness and socioeconomic impacts, influencing fiscal policy decisions worldwide.

Future Outlook: Balancing Supply-Side and Demand-Side Policies

Future economic growth hinges on a balanced interplay between supply-side policies promoting innovation, productivity, and investment, and demand-side policies that stimulate consumer spending and aggregate demand. Integrating tax incentives, deregulation, and workforce development with strategic government spending and social programs can create resilient economies adaptable to technological shifts and global market changes. Policymakers are increasingly prioritizing hybrid approaches to maximize employment, control inflation, and ensure sustainable long-term prosperity.

Supply-side economics vs Demand-side economics Infographic

difterm.com

difterm.com