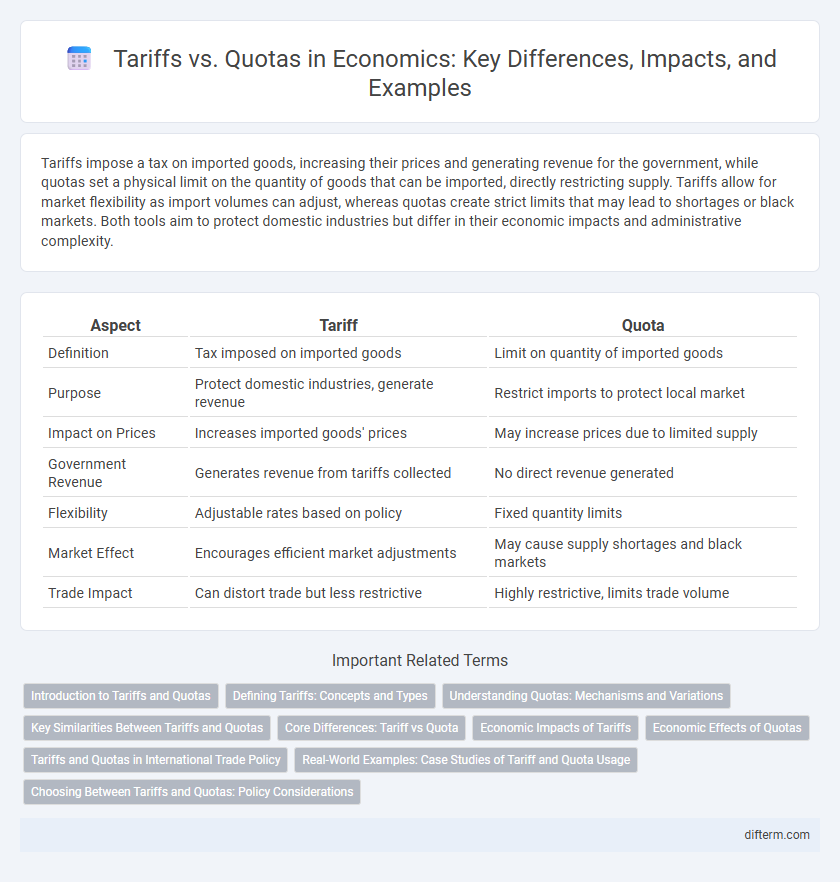

Tariffs impose a tax on imported goods, increasing their prices and generating revenue for the government, while quotas set a physical limit on the quantity of goods that can be imported, directly restricting supply. Tariffs allow for market flexibility as import volumes can adjust, whereas quotas create strict limits that may lead to shortages or black markets. Both tools aim to protect domestic industries but differ in their economic impacts and administrative complexity.

Table of Comparison

| Aspect | Tariff | Quota |

|---|---|---|

| Definition | Tax imposed on imported goods | Limit on quantity of imported goods |

| Purpose | Protect domestic industries, generate revenue | Restrict imports to protect local market |

| Impact on Prices | Increases imported goods' prices | May increase prices due to limited supply |

| Government Revenue | Generates revenue from tariffs collected | No direct revenue generated |

| Flexibility | Adjustable rates based on policy | Fixed quantity limits |

| Market Effect | Encourages efficient market adjustments | May cause supply shortages and black markets |

| Trade Impact | Can distort trade but less restrictive | Highly restrictive, limits trade volume |

Introduction to Tariffs and Quotas

Tariffs are taxes imposed on imported goods that increase their cost, thereby protecting domestic industries by making foreign products less competitive. Quotas limit the quantity of a specific good that can be imported, restricting supply to support local producers and stabilize market prices. Both tariffs and quotas serve as trade barriers but differ in their mechanisms and economic impacts on international trade flows.

Defining Tariffs: Concepts and Types

Tariffs are taxes imposed on imported goods designed to increase their price and protect domestic industries, classified primarily into ad valorem tariffs, specific tariffs, and compound tariffs. Ad valorem tariffs are calculated as a fixed percentage of the item's value, while specific tariffs charge a fixed fee per unit weight or quantity. Compound tariffs combine both methods, applying a percentage of value plus a fixed fee, allowing governments to control import costs and influence trade balances.

Understanding Quotas: Mechanisms and Variations

Quotas restrict the physical quantity of goods that can be imported or exported, directly limiting supply in international trade markets. Unlike tariffs that impose a tax to regulate trade volume, quotas set a strict numerical limit on imports, often leading to supply shortages and price increases. Variations of quotas include global quotas, which restrict total imports irrespective of source, and country-specific quotas, which allocate import limits among different trading partners.

Key Similarities Between Tariffs and Quotas

Tariffs and quotas are both trade policy tools used by governments to regulate imports and protect domestic industries. Each imposes restrictions on foreign goods, influencing market prices and controlling supply to support local economic interests. Both mechanisms aim to reduce competition from imported products and generate revenue or safeguard employment within the domestic market.

Core Differences: Tariff vs Quota

Tariffs impose a fixed tax on imported goods, directly increasing their cost and generating revenue for the government, while quotas establish a physical limit on the quantity of goods that can be imported, restricting supply without producing government income. Tariffs allow market prices to adjust based on demand and supply changes, whereas quotas create supply shortages that may lead to higher prices due to limited availability. The economic impact of tariffs tends to be more predictable and flexible, but quotas can cause inefficiencies and encourage black markets or smuggling.

Economic Impacts of Tariffs

Tariffs increase the cost of imported goods, leading to higher prices for consumers and reduced purchasing power, which can slow economic growth. They protect domestic industries by making foreign products less competitive, potentially preserving jobs but also risking retaliatory trade measures that disrupt exports. Tariffs generate government revenue, but their overall economic impact often includes efficiency losses and market distortions that hinder global trade dynamics.

Economic Effects of Quotas

Quotas restrict the quantity of goods that can be imported, leading to reduced market competition and higher domestic prices. This limitation often benefits domestic producers by protecting them from foreign competition but can cause inefficiencies and deadweight loss in the economy. Consumers face higher costs and reduced variety, while government revenue remains unchanged unlike tariffs, which generate income through import taxes.

Tariffs and Quotas in International Trade Policy

Tariffs impose a tax on imported goods, raising their prices to protect domestic industries and generate government revenue, while quotas set a physical limit on the quantity of goods allowed for import, restricting supply to support local producers. In international trade policy, tariffs offer a flexible mechanism that adjusts with trade volume, whereas quotas strictly cap imports regardless of demand or price changes. Economists often favor tariffs over quotas because tariffs provide transparency and generate fiscal income, unlike quotas which can lead to black markets and trade distortions.

Real-World Examples: Case Studies of Tariff and Quota Usage

The United States imposed tariffs on Chinese steel imports to protect domestic producers, resulting in higher prices but sustained local employment. In contrast, the European Union implemented quotas on textile imports from Bangladesh to control market supply and support its regional manufacturers. Both mechanisms demonstrate how tariffs raise government revenue and quotas restrict volume, affecting international trade dynamics and domestic industries differently.

Choosing Between Tariffs and Quotas: Policy Considerations

When choosing between tariffs and quotas, policymakers must evaluate the impact on government revenue and market efficiency. Tariffs generate government income and allow price flexibility, while quotas restrict quantity, often leading to supply shortages and black markets. Economic goals such as controlling inflation, protecting domestic industries, and international trade relations shape the decision between implementing tariffs or quotas.

Tariff vs Quota Infographic

difterm.com

difterm.com