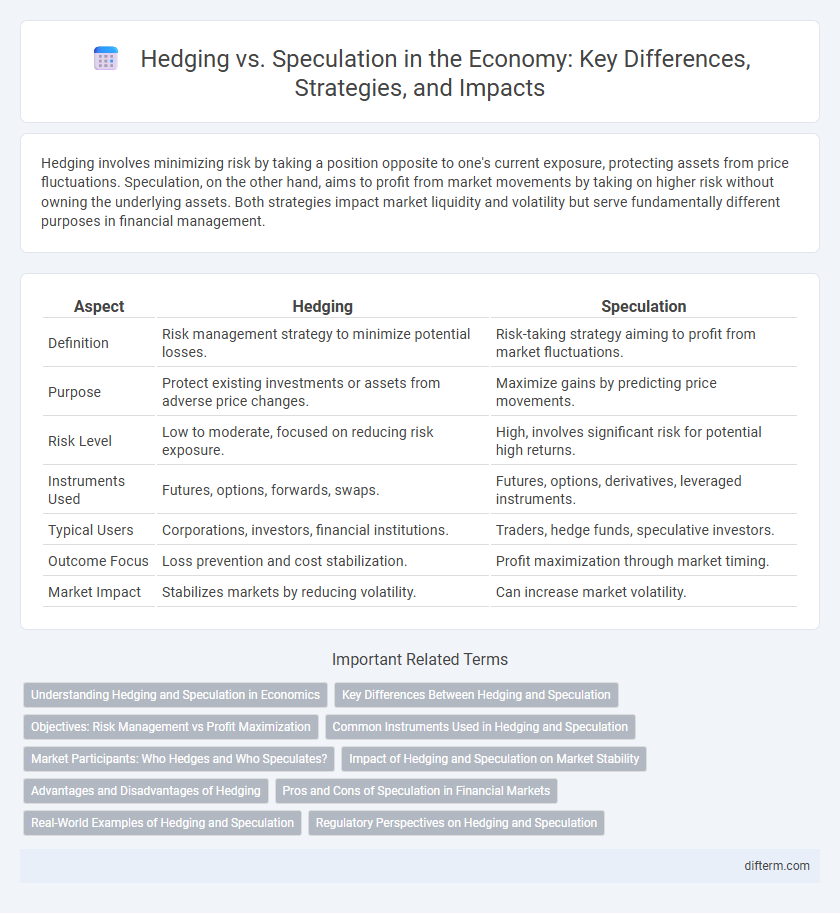

Hedging involves minimizing risk by taking a position opposite to one's current exposure, protecting assets from price fluctuations. Speculation, on the other hand, aims to profit from market movements by taking on higher risk without owning the underlying assets. Both strategies impact market liquidity and volatility but serve fundamentally different purposes in financial management.

Table of Comparison

| Aspect | Hedging | Speculation |

|---|---|---|

| Definition | Risk management strategy to minimize potential losses. | Risk-taking strategy aiming to profit from market fluctuations. |

| Purpose | Protect existing investments or assets from adverse price changes. | Maximize gains by predicting price movements. |

| Risk Level | Low to moderate, focused on reducing risk exposure. | High, involves significant risk for potential high returns. |

| Instruments Used | Futures, options, forwards, swaps. | Futures, options, derivatives, leveraged instruments. |

| Typical Users | Corporations, investors, financial institutions. | Traders, hedge funds, speculative investors. |

| Outcome Focus | Loss prevention and cost stabilization. | Profit maximization through market timing. |

| Market Impact | Stabilizes markets by reducing volatility. | Can increase market volatility. |

Understanding Hedging and Speculation in Economics

Hedging in economics involves using financial instruments like futures, options, or swaps to minimize or offset potential losses from price fluctuations in assets, commodities, or investments. Speculation, in contrast, entails taking on higher risks by trading assets with the aim of profiting from anticipated market movements, often without underlying exposure to the assets themselves. Understanding the distinction between hedging and speculation is crucial for risk management and financial strategy optimization in markets.

Key Differences Between Hedging and Speculation

Hedging involves reducing financial risk by taking an offsetting position in a related asset, primarily to protect against price fluctuations. Speculation aims to profit from price changes by taking on higher risk without the intention of risk reduction. Key differences include hedging's focus on risk management and stability, while speculation emphasizes potential high returns driven by market volatility.

Objectives: Risk Management vs Profit Maximization

Hedging aims to minimize exposure to price volatility and financial risk by using instruments such as futures, options, and swaps to protect assets and cash flows. Speculation focuses on maximizing profits by taking on higher risks through market betting and leveraging price movements in commodities, currencies, or securities. Risk management through hedging stabilizes business operations, while speculation seeks significant gains from market fluctuations.

Common Instruments Used in Hedging and Speculation

Futures contracts, options, and swaps are common instruments used in both hedging and speculation to manage or capitalize on price volatility in markets. Hedgers primarily use these derivatives to offset potential losses in underlying assets, ensuring price stability and risk mitigation. Speculators leverage the same instruments to profit from market fluctuations by assuming risk positions based on price forecasts.

Market Participants: Who Hedges and Who Speculates?

Market participants who hedge typically include producers, consumers, and investors seeking to reduce risk exposure to price fluctuations in commodities, currencies, or securities. Speculators, on the other hand, are traders and financial institutions aiming to profit from price movements by taking on higher risk without an underlying exposure. Hedgers prioritize stability and risk management, while speculators focus on market timing and potential gains.

Impact of Hedging and Speculation on Market Stability

Hedging enhances market stability by reducing price volatility through risk mitigation, allowing businesses to protect against adverse price movements in commodities, currencies, or interest rates. Speculation, while increasing liquidity, can amplify market fluctuations and lead to price bubbles or crashes when speculative positions are excessively leveraged. The balance between hedging and speculation plays a crucial role in maintaining efficient and resilient financial markets.

Advantages and Disadvantages of Hedging

Hedging offers the advantage of risk reduction by protecting businesses and investors against price fluctuations in commodities, currencies, or securities, thereby stabilizing cash flows and financial planning. However, the disadvantage lies in the potential cost of hedging strategies, such as premiums or basis risk, which may reduce profit margins and limit upside gains. Unlike speculation, hedging prioritizes minimizing losses over generating high returns, making it essential for risk-averse market participants.

Pros and Cons of Speculation in Financial Markets

Speculation in financial markets offers the potential for significant profits by capitalizing on price fluctuations and market trends, providing liquidity and price discovery benefits. However, it carries high risks including substantial financial losses and increased market volatility that can distort asset prices. Speculative activities may also lead to market bubbles and heightened systemic risk, impacting overall economic stability.

Real-World Examples of Hedging and Speculation

Companies like airlines hedge fuel costs through futures contracts to stabilize expenses against volatile oil prices, mitigating financial risk. Investors speculate on stock prices by buying shares of emerging tech firms anticipating rapid appreciation, accepting higher risk for potential gains. Commodity producers hedge crop yields via options to secure stable revenue, contrasting with traders who speculate on price swings to profit from market volatility.

Regulatory Perspectives on Hedging and Speculation

Regulatory perspectives on hedging and speculation emphasize distinguishing activities to mitigate systemic risk and ensure market stability. Hedging is generally supported by regulators as a risk management tool that protects businesses from price volatility, while speculation often faces stricter oversight due to its potential to create market distortions and amplify financial instability. Key frameworks include position limits, reporting requirements, and market conduct rules enforced by bodies such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Hedging vs Speculation Infographic

difterm.com

difterm.com