Progressive taxation imposes higher tax rates on individuals with greater income, promoting income equality by redistributing wealth and funding social programs. Regressive taxation, often found in sales and excise taxes, disproportionately impacts lower-income earners by taking a larger percentage of their earnings. Understanding these tax structures is critical for policymakers aiming to balance fiscal responsibility with social equity.

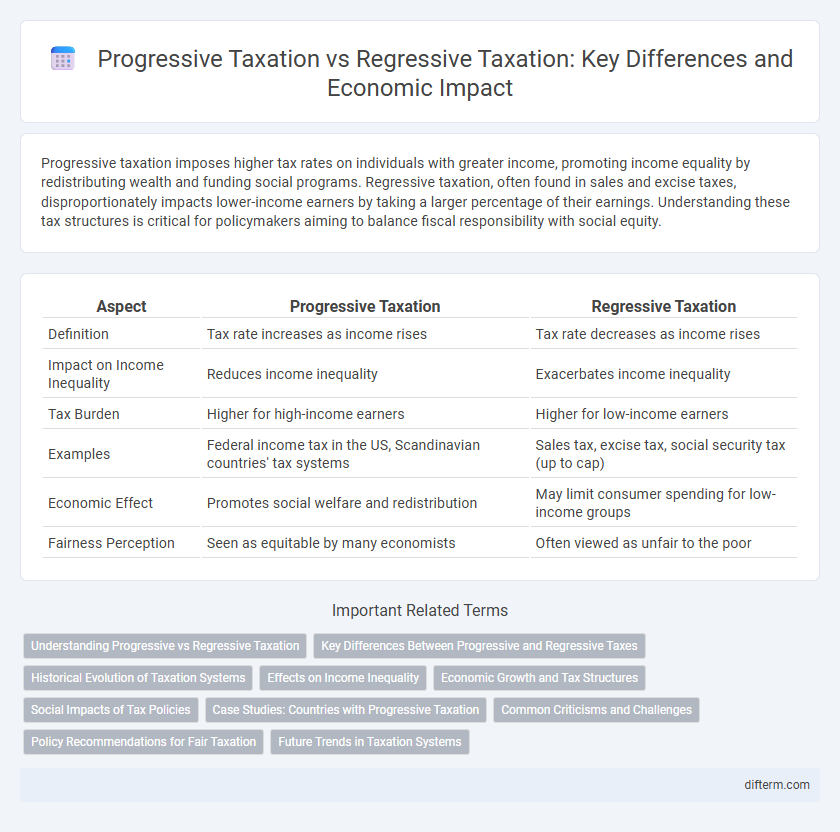

Table of Comparison

| Aspect | Progressive Taxation | Regressive Taxation |

|---|---|---|

| Definition | Tax rate increases as income rises | Tax rate decreases as income rises |

| Impact on Income Inequality | Reduces income inequality | Exacerbates income inequality |

| Tax Burden | Higher for high-income earners | Higher for low-income earners |

| Examples | Federal income tax in the US, Scandinavian countries' tax systems | Sales tax, excise tax, social security tax (up to cap) |

| Economic Effect | Promotes social welfare and redistribution | May limit consumer spending for low-income groups |

| Fairness Perception | Seen as equitable by many economists | Often viewed as unfair to the poor |

Understanding Progressive vs Regressive Taxation

Progressive taxation imposes higher tax rates on higher income brackets, aiming to reduce income inequality by taxing wealthier individuals more. Regressive taxation applies a higher relative tax burden on lower-income earners, often through flat taxes on goods and services, which disproportionately affects the financially vulnerable. Understanding these systems is crucial for policymakers to design equitable fiscal strategies that balance revenue generation with social justice.

Key Differences Between Progressive and Regressive Taxes

Progressive taxation imposes higher tax rates on individuals with greater income, promoting income redistribution and economic equity. Regressive taxation applies a higher relative tax burden on lower-income earners through fixed-rate taxes such as sales taxes, disproportionately affecting their purchasing power. The key difference lies in the tax incidence and equity impact, with progressive taxes enhancing progressivity and regressive taxes increasing inequality.

Historical Evolution of Taxation Systems

Progressive taxation evolved during the late 19th and early 20th centuries as industrial economies expanded, aiming to address income inequality by imposing higher rates on wealthier individuals. In contrast, regressive taxation, often rooted in consumption taxes like sales tax or excise duties, disproportionately affects lower-income groups and has been a characteristic of earlier, simpler tax systems focused on goods rather than income. The shift from regressive to progressive taxation reflects broader socio-economic changes, including increased government intervention and the development of welfare states.

Effects on Income Inequality

Progressive taxation reduces income inequality by imposing higher tax rates on higher income brackets, thereby redistributing wealth toward lower-income groups. Regressive taxation, characterized by a higher relative tax burden on low-income earners, often exacerbates income inequality by limiting disposable income for those in lower economic strata. Empirical studies demonstrate that countries with progressive tax systems tend to have lower Gini coefficients, indicating more equitable income distribution.

Economic Growth and Tax Structures

Progressive taxation, where tax rates increase with income, promotes economic growth by generating higher government revenues to fund essential public services and infrastructure, fostering a more equitable wealth distribution. In contrast, regressive taxation imposes a heavier burden on lower-income households, potentially stifling consumer spending and limiting economic expansion. Effective tax structures balance progressivity to incentivize investment and innovation while ensuring fairness and sufficient revenue for sustainable growth.

Social Impacts of Tax Policies

Progressive taxation reduces income inequality by imposing higher tax rates on wealthier individuals, enabling increased funding for social services like education and healthcare that benefit lower-income groups. Regressive taxation disproportionately affects low-income earners through higher effective tax rates on necessities, exacerbating poverty and limiting social mobility. These contrasting tax policies significantly influence social equity and economic opportunity across different demographics.

Case Studies: Countries with Progressive Taxation

Sweden's progressive tax system features a top marginal income tax rate of around 57%, effectively reducing income inequality and funding extensive social welfare programs. Canada implements a federal progressive tax system where the highest income bracket reaches 33%, supporting public services and promoting economic equity. Australia's tiered tax structure, with a top rate of 45%, balances revenue generation with redistribution, contributing to lower poverty rates and sustainable social spending.

Common Criticisms and Challenges

Progressive taxation faces criticism for potentially discouraging high earners and investment, as escalating tax rates may reduce incentives to generate additional income. Regressive taxation is challenged for disproportionately burdening lower-income individuals, intensifying income inequality by requiring a higher percentage of their earnings for tax payments. Both systems grapple with balancing fairness, economic growth, and administrative efficiency in implementing equitable fiscal policies.

Policy Recommendations for Fair Taxation

Progressive taxation ensures higher income earners contribute a larger share, promoting equity and reducing income inequality, while regressive taxation disproportionately burdens low-income households, exacerbating financial disparities. Policy recommendations for fair taxation include implementing graduated tax brackets, enhancing tax credits for low-income families, and closing loopholes that allow high earners to minimize tax liabilities. Strengthening enforcement and increasing transparency can improve compliance and create a more balanced fiscal system.

Future Trends in Taxation Systems

Future trends in taxation systems emphasize progressive taxation due to its potential to reduce income inequality and fund social welfare programs effectively. Technological advancements enable more precise income measurement, facilitating fairer progressive tax rates while minimizing evasion. Meanwhile, regressive taxation faces increasing criticism for disproportionately burdening lower-income groups, prompting calls for reform toward more equitable fiscal policies.

Progressive Taxation vs Regressive Taxation Infographic

difterm.com

difterm.com