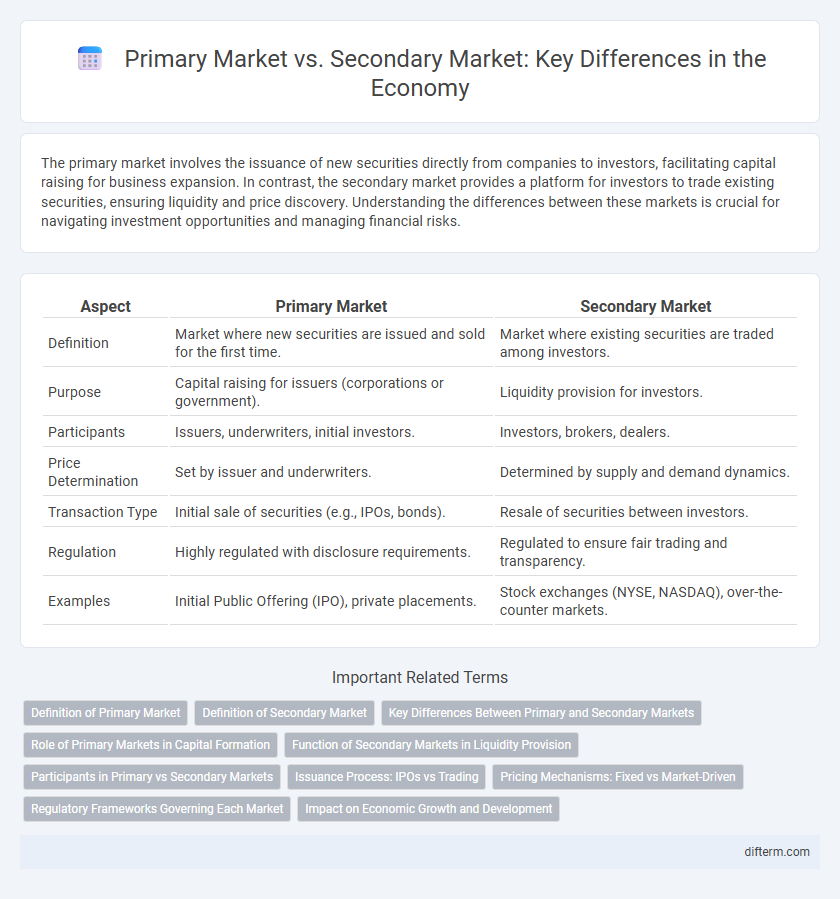

The primary market involves the issuance of new securities directly from companies to investors, facilitating capital raising for business expansion. In contrast, the secondary market provides a platform for investors to trade existing securities, ensuring liquidity and price discovery. Understanding the differences between these markets is crucial for navigating investment opportunities and managing financial risks.

Table of Comparison

| Aspect | Primary Market | Secondary Market |

|---|---|---|

| Definition | Market where new securities are issued and sold for the first time. | Market where existing securities are traded among investors. |

| Purpose | Capital raising for issuers (corporations or government). | Liquidity provision for investors. |

| Participants | Issuers, underwriters, initial investors. | Investors, brokers, dealers. |

| Price Determination | Set by issuer and underwriters. | Determined by supply and demand dynamics. |

| Transaction Type | Initial sale of securities (e.g., IPOs, bonds). | Resale of securities between investors. |

| Regulation | Highly regulated with disclosure requirements. | Regulated to ensure fair trading and transparency. |

| Examples | Initial Public Offering (IPO), private placements. | Stock exchanges (NYSE, NASDAQ), over-the-counter markets. |

Definition of Primary Market

The primary market is a financial marketplace where new securities are created and sold directly by issuers to investors, facilitating capital raising for businesses and governments. It enables the issuance of stocks, bonds, or other financial instruments for the first time, with proceeds flowing to the entity offering the securities. This market plays a crucial role in economic growth by providing the necessary funds for expansion, infrastructure development, and innovation.

Definition of Secondary Market

The secondary market is a financial market where previously issued securities such as stocks and bonds are bought and sold among investors. Unlike the primary market, which involves the issuance of new securities directly from companies, the secondary market facilitates liquidity and price discovery by enabling trading without company involvement. Major examples include stock exchanges like the New York Stock Exchange and NASDAQ, where investors transact existing shares.

Key Differences Between Primary and Secondary Markets

The primary market involves the issuance of new securities directly from issuers to investors, facilitating capital raising for companies and governments. The secondary market enables the trading of existing securities among investors, providing liquidity and price discovery for financial assets. Key differences include the initial sale of securities in the primary market versus subsequent transactions in the secondary market, as well as varying impacts on capital flow and investor participation.

Role of Primary Markets in Capital Formation

Primary markets play a crucial role in capital formation by facilitating the issuance of new securities directly from companies to investors, enabling businesses to raise fresh capital for expansion and development. This process enhances economic growth by channeling savings into productive investments and increasing the overall capital base. Unlike secondary markets, where securities are traded among investors, primary markets inject new funds into the economy, supporting innovation and job creation.

Function of Secondary Markets in Liquidity Provision

Secondary markets facilitate liquidity by enabling investors to buy and sell securities without impacting the issuing company directly. These markets allow efficient price discovery and continuous trading, enhancing the attractiveness of primary market offerings. By providing a platform for quick transaction execution, secondary markets reduce investment risk and improve capital allocation in the economy.

Participants in Primary vs Secondary Markets

Primary markets involve issuers such as corporations and governments directly selling securities to investors including institutional buyers and retail investors. Secondary markets facilitate trading of previously issued securities among investors, with market makers, brokers, and traders playing crucial roles. The primary market's key participants emphasize capital raising, while secondary market participants focus on liquidity and price discovery.

Issuance Process: IPOs vs Trading

The primary market involves the issuance of new securities through Initial Public Offerings (IPOs), where companies raise capital directly from investors. In contrast, the secondary market facilitates the trading of already issued securities among investors, providing liquidity and price discovery without raising new capital for the issuing companies. IPOs represent the first sale of stock to the public, while secondary market transactions occur on exchanges such as the NYSE or NASDAQ.

Pricing Mechanisms: Fixed vs Market-Driven

Primary markets use fixed pricing mechanisms where securities are issued at a predetermined price during initial public offerings or new bond issuances. In contrast, secondary markets rely on market-driven pricing, where supply and demand dynamics continuously adjust security prices through trading on stock exchanges. The efficiency of secondary market pricing provides real-time valuation, while fixed pricing in primary markets helps issuers secure capital at stable prices.

Regulatory Frameworks Governing Each Market

The primary market operates under stringent regulatory frameworks established by securities commissions to ensure transparency during initial public offerings (IPOs), mandating full disclosure of financial information. The secondary market is regulated to maintain fair trading practices, prevent market manipulation, and protect investors, with oversight bodies enforcing rules on insider trading and market conduct. Regulatory agencies such as the SEC in the United States and ESMA in Europe implement continuous monitoring and compliance requirements tailored to each market's unique functions.

Impact on Economic Growth and Development

The primary market drives economic growth by enabling corporations and governments to raise capital through new securities issuance, fueling investment in infrastructure, innovation, and job creation. The secondary market enhances economic development by providing liquidity and price discovery, allowing investors to trade securities easily and allocate resources efficiently. Together, these markets support capital formation and financial stability, essential for sustainable economic expansion.

Primary market vs Secondary market Infographic

difterm.com

difterm.com