Fiat currency derives its value from government regulation and public trust rather than physical backing by a commodity like gold or silver. Commodity currency holds intrinsic value because it is made from precious materials that can be traded independently of its use as money. The flexibility of fiat currency allows for easier monetary policy adjustments, while commodity currency provides inherent stability due to its tangible value.

Table of Comparison

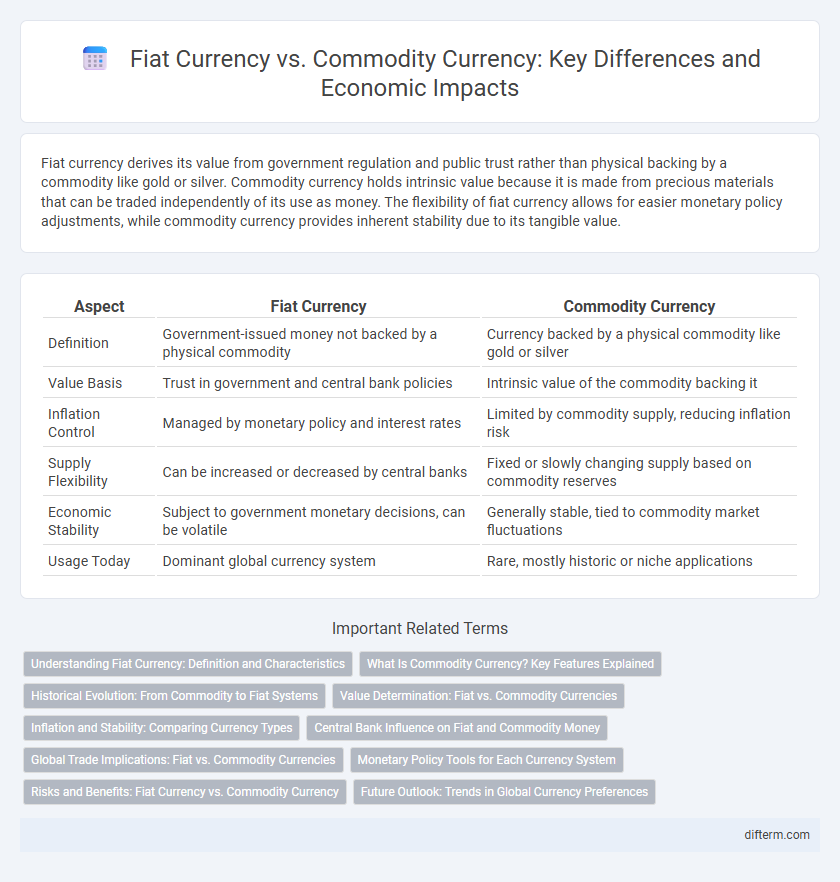

| Aspect | Fiat Currency | Commodity Currency |

|---|---|---|

| Definition | Government-issued money not backed by a physical commodity | Currency backed by a physical commodity like gold or silver |

| Value Basis | Trust in government and central bank policies | Intrinsic value of the commodity backing it |

| Inflation Control | Managed by monetary policy and interest rates | Limited by commodity supply, reducing inflation risk |

| Supply Flexibility | Can be increased or decreased by central banks | Fixed or slowly changing supply based on commodity reserves |

| Economic Stability | Subject to government monetary decisions, can be volatile | Generally stable, tied to commodity market fluctuations |

| Usage Today | Dominant global currency system | Rare, mostly historic or niche applications |

Understanding Fiat Currency: Definition and Characteristics

Fiat currency is government-issued money that is not backed by a physical commodity like gold or silver but derives its value from government regulation and public trust. Its flexibility allows central banks to implement monetary policy effectively by controlling money supply and interest rates. Unlike commodity currencies, fiat money can be produced in unlimited quantities, which can lead to inflation if not managed properly.

What Is Commodity Currency? Key Features Explained

Commodity currency is money backed by a physical good such as gold, silver, or oil, providing intrinsic value rooted in tangible resources. Key features include high stability during inflation, direct correlation with the commodity's market price, and limited issuance influenced by commodity supply constraints. Unlike fiat currency, commodity currency holds value independent of government decree, making it a hedge against currency devaluation.

Historical Evolution: From Commodity to Fiat Systems

The historical evolution of currency demonstrates a shift from commodity-based systems, where money held intrinsic value through materials like gold and silver, to fiat currency systems backed solely by government decree. This transition enabled greater flexibility in monetary policy and economic expansion by decoupling currency supply from physical reserves. Key milestones include the abandonment of the gold standard during the 20th century and the global adoption of fiat currencies as dominant mediums of exchange.

Value Determination: Fiat vs. Commodity Currencies

Fiat currency derives its value primarily from government regulation and trust in the issuing authority, lacking intrinsic value but widely accepted for transactions and reserves. Commodity currency, by contrast, has intrinsic value based on the physical goods it represents, such as gold or silver, which historically influenced its purchasing power. The value determination of fiat currency depends on monetary policy and economic stability, whereas commodity currency's value fluctuates with the supply and demand of the underlying commodity.

Inflation and Stability: Comparing Currency Types

Fiat currency, backed by government regulation rather than physical commodities, often experiences higher inflation rates due to unlimited issuance potential, undermining long-term price stability. Commodity currencies, such as those pegged to gold or silver, inherently limit money supply growth, offering greater resistance to inflation and more stable value retention over time. Inflation control and monetary stability remain critical factors influencing the preference between fiat and commodity-based currency systems in global economic policy.

Central Bank Influence on Fiat and Commodity Money

Central banks hold significant influence over fiat currency by controlling money supply and setting interest rates, which stabilizes economies and manages inflation. In contrast, commodity currencies, backed by physical assets like gold or silver, limit central bank intervention as their value depends on market supply and demand of the commodities. This distinction often leads to greater flexibility in economic policy under fiat systems but also introduces risks of inflation and currency devaluation.

Global Trade Implications: Fiat vs. Commodity Currencies

Fiat currencies dominate global trade due to their flexibility, ease of exchange, and widespread acceptance, enabling governments to implement monetary policies that stabilize economies. Commodity currencies, backed by tangible assets like gold or silver, offer intrinsic value and protection against inflation but face limitations in liquidity and scalability for international transactions. The reliance on fiat currency supports large-scale trade networks, while commodity currencies contribute to economic stability in resource-rich nations with export-driven markets.

Monetary Policy Tools for Each Currency System

Fiat currency systems rely heavily on central bank monetary policy tools such as open market operations, reserve requirements, and interest rate adjustments to control money supply and inflation. Commodity currency systems, backed by tangible assets like gold or silver, limit the effectiveness of these tools due to fixed supply constraints and reduced flexibility in adjusting money supply. The reliance on fiat currencies enables more dynamic and responsive monetary policy management, while commodity currencies often result in more stable but less adaptable economic conditions.

Risks and Benefits: Fiat Currency vs. Commodity Currency

Fiat currency offers flexibility in monetary policy, enabling governments to control inflation and stimulate economic growth, but it carries the risk of devaluation and inflation if mismanaged. Commodity currency, backed by physical assets like gold or silver, provides intrinsic value and stability, reducing inflation risk but limiting monetary policy flexibility and economic responsiveness. The choice between fiat and commodity currencies impacts inflation control, economic stability, and the ability to respond to financial crises.

Future Outlook: Trends in Global Currency Preferences

Global currency preferences are increasingly shifting from commodity-based currencies toward fiat currencies due to enhanced flexibility in monetary policy and digital currency integration. Central banks worldwide are exploring Central Bank Digital Currencies (CBDCs), which promise greater transaction efficiency and financial inclusion, impacting the future dominance of fiat currencies. However, commodity currencies like gold and oil remain valuable as hedge assets against inflation and geopolitical risks, sustaining their niche role in diversified portfolios.

fiat currency vs commodity currency Infographic

difterm.com

difterm.com