A trade deficit occurs when a country imports more goods and services than it exports, leading to a negative balance of trade that can impact currency value and economic growth. Conversely, a trade surplus happens when exports exceed imports, contributing to higher national income and stronger foreign exchange reserves. Managing the balance between trade deficit and surplus is crucial for maintaining economic stability and fostering sustainable development.

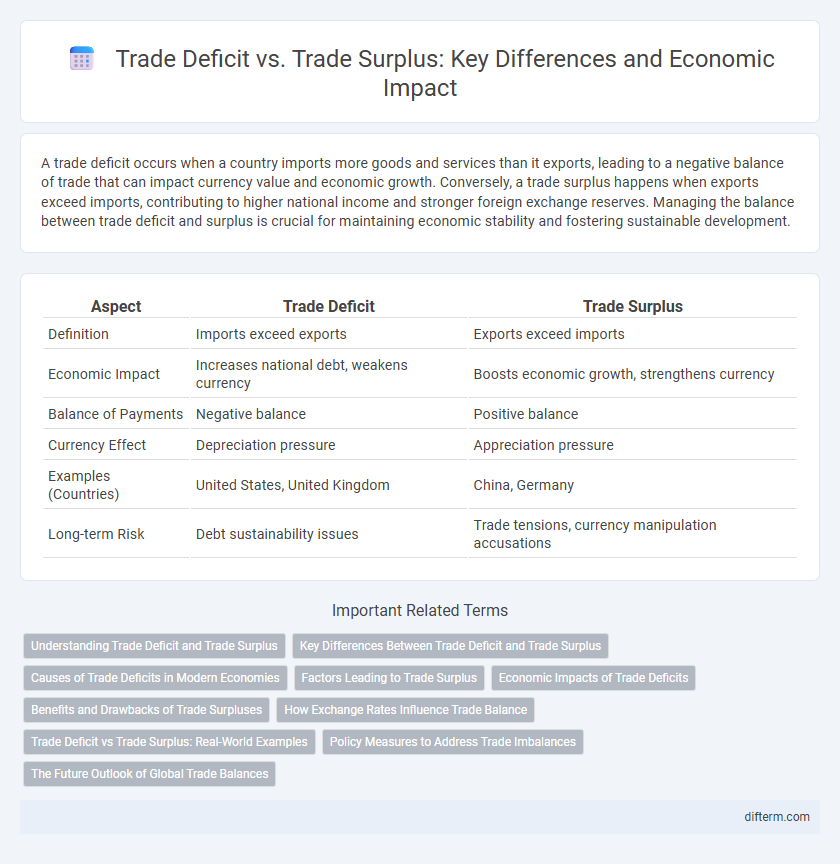

Table of Comparison

| Aspect | Trade Deficit | Trade Surplus |

|---|---|---|

| Definition | Imports exceed exports | Exports exceed imports |

| Economic Impact | Increases national debt, weakens currency | Boosts economic growth, strengthens currency |

| Balance of Payments | Negative balance | Positive balance |

| Currency Effect | Depreciation pressure | Appreciation pressure |

| Examples (Countries) | United States, United Kingdom | China, Germany |

| Long-term Risk | Debt sustainability issues | Trade tensions, currency manipulation accusations |

Understanding Trade Deficit and Trade Surplus

A trade deficit occurs when a country's imports exceed its exports, leading to a negative balance of trade that can impact currency value and foreign debt levels. Conversely, a trade surplus happens when exports surpass imports, generating a positive trade balance that often strengthens the national economy and increases foreign exchange reserves. Monitoring trade deficits and surpluses provides crucial insights into economic health, international competitiveness, and policy effectiveness.

Key Differences Between Trade Deficit and Trade Surplus

A trade deficit occurs when a country's imports exceed its exports, leading to a negative balance of trade, whereas a trade surplus arises when exports surpass imports, resulting in a positive trade balance. Key differences include the impact on a nation's currency value and economic growth; trade deficits can weaken currency and increase debt, while trade surpluses often strengthen currency and boost domestic industries. The causes vary, with deficits commonly driven by high consumer demand for foreign goods, and surpluses linked to strong export sectors and competitive manufacturing.

Causes of Trade Deficits in Modern Economies

Trade deficits in modern economies often result from higher domestic consumption compared to production, leading to increased imports over exports. Factors like currency valuation, lower export competitiveness, and reliance on foreign capital can exacerbate persistent deficits. Structural issues such as outsourcing and lack of investment in key industries also contribute significantly to ongoing trade imbalances.

Factors Leading to Trade Surplus

A trade surplus occurs when a country's exports exceed its imports, often driven by competitive advantages such as abundant natural resources, advanced technology, or a strong manufacturing sector. Exchange rate policies that keep the domestic currency undervalued can enhance export competitiveness, contributing to a sustained trade surplus. Additionally, government incentives, trade agreements favoring export markets, and high global demand for a nation's goods and services play critical roles in generating a trade surplus.

Economic Impacts of Trade Deficits

Trade deficits occur when a country imports more goods and services than it exports, which can lead to increased borrowing from foreign lenders and higher national debt. Persistent trade deficits may weaken domestic industries by exposing them to intense international competition, potentially resulting in job losses and reduced economic growth. However, they can also reflect strong consumer demand and investment in advanced technology, which might support long-term economic development despite short-term imbalances.

Benefits and Drawbacks of Trade Surpluses

Trade surpluses enhance a country's foreign exchange reserves and strengthen its currency value, fostering economic stability and increased global investment confidence. However, persistent surpluses may lead to trade tensions and retaliatory tariffs from deficit countries, disrupting international trade relationships. Overreliance on exports can also create vulnerabilities to external demand shocks and limit domestic market development.

How Exchange Rates Influence Trade Balance

Fluctuations in exchange rates directly affect a nation's trade balance by altering the relative prices of exports and imports, thereby influencing demand levels. A depreciating currency makes exports cheaper and more competitive internationally, potentially reducing a trade deficit or creating a trade surplus, while appreciation has the opposite effect by making imports less expensive and exports pricier. Central banks and policymakers closely monitor exchange rate movements to manage trade imbalances and support economic stability.

Trade Deficit vs Trade Surplus: Real-World Examples

The United States frequently experiences a trade deficit due to high consumer demand for imported goods exceeding exports, reflecting its role as a global consumption hub. In contrast, countries like Germany and China often maintain trade surpluses by exporting large volumes of manufactured products and technology, bolstering their economic growth. These real-world examples highlight how trade balances influence currency strength, employment rates, and national economic policies.

Policy Measures to Address Trade Imbalances

Policy measures to address trade imbalances include implementing tariffs and import restrictions to reduce trade deficits while promoting export incentives and subsidies to encourage trade surpluses. Exchange rate adjustments and currency devaluation are also used to make exports more competitive and imports more expensive. Structural reforms, such as improving domestic productivity and diversifying the economy, help achieve sustainable trade balance over the long term.

The Future Outlook of Global Trade Balances

Trade deficits and trade surpluses will significantly influence future global trade balances as emerging markets expand their export capacities while advanced economies adjust consumption patterns. Technological advancements and shifting geopolitical alliances are expected to reshape supply chains, potentially reducing persistent imbalances. Sustainable trade policies and digital trade integration will drive more balanced and resilient economic growth worldwide.

Trade deficit vs Trade surplus Infographic

difterm.com

difterm.com