Depreciation refers to the gradual decrease in the value of a currency due to market forces such as supply and demand, while devaluation is a deliberate downward adjustment of a country's currency value by the government or central bank. Depreciation typically occurs in floating exchange rate systems, reflecting economic trends and investor sentiment, whereas devaluation is used as a policy tool to boost exports and reduce trade deficits. Both processes affect inflation, import costs, and competitiveness but differ in their causes and implementation.

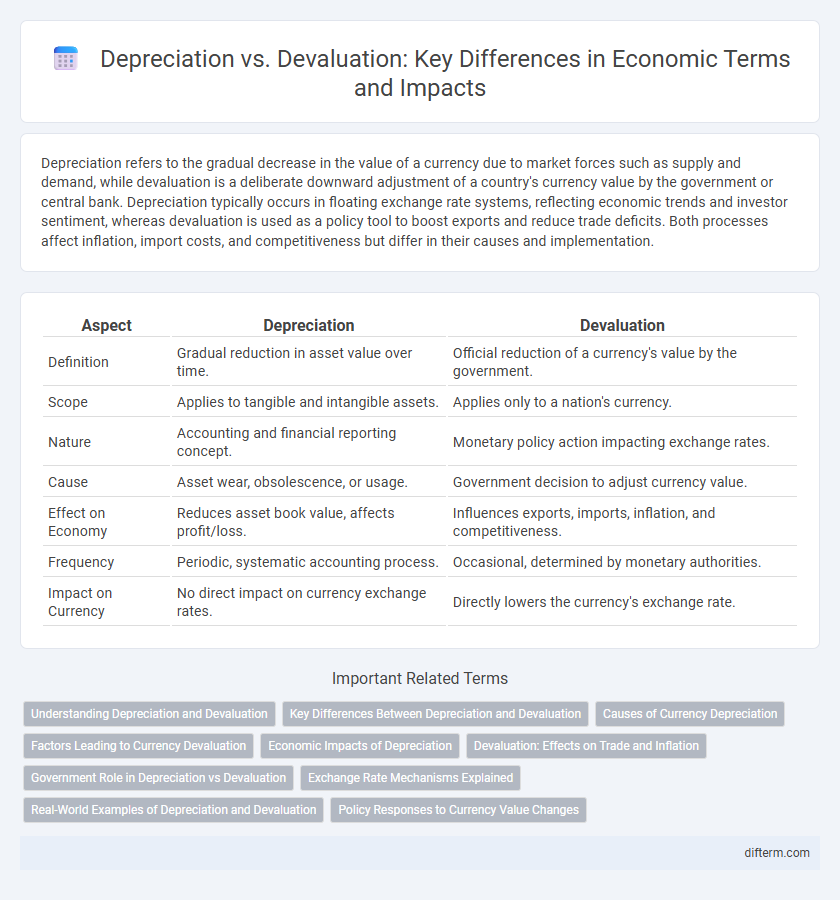

Table of Comparison

| Aspect | Depreciation | Devaluation |

|---|---|---|

| Definition | Gradual reduction in asset value over time. | Official reduction of a currency's value by the government. |

| Scope | Applies to tangible and intangible assets. | Applies only to a nation's currency. |

| Nature | Accounting and financial reporting concept. | Monetary policy action impacting exchange rates. |

| Cause | Asset wear, obsolescence, or usage. | Government decision to adjust currency value. |

| Effect on Economy | Reduces asset book value, affects profit/loss. | Influences exports, imports, inflation, and competitiveness. |

| Frequency | Periodic, systematic accounting process. | Occasional, determined by monetary authorities. |

| Impact on Currency | No direct impact on currency exchange rates. | Directly lowers the currency's exchange rate. |

Understanding Depreciation and Devaluation

Depreciation refers to the gradual decline in the value of a country's currency in the foreign exchange market due to market forces such as supply and demand, without direct government intervention. Devaluation occurs when a government or monetary authority deliberately lowers the official value of its currency relative to foreign currencies, often to boost exports. Understanding the distinction between depreciation and devaluation is crucial for analyzing currency fluctuations and their impact on trade balances and inflation.

Key Differences Between Depreciation and Devaluation

Depreciation refers to the gradual decline in the value of a currency due to market forces such as inflation, interest rates, and economic performance, whereas devaluation is a deliberate downward adjustment of a currency's value by a country's government or central bank. Depreciation occurs in a floating exchange rate system, while devaluation happens in a fixed or pegged exchange rate regime. Key differences also include the causes and policy intent, with depreciation being market-driven and devaluation being a policy tool to improve trade balance or competitiveness.

Causes of Currency Depreciation

Currency depreciation occurs due to factors such as rising inflation rates, which diminish purchasing power, and widening trade deficits that increase demand for foreign currencies. Political instability and declining investor confidence can trigger capital flight, exerting downward pressure on the domestic currency. Central bank policies, including rising interest rates or excessive money supply, also influence the currency's value by altering investor perceptions and capital flows.

Factors Leading to Currency Devaluation

Currency devaluation occurs when a nation's government or central bank intentionally lowers the value of its currency relative to foreign currencies, driven by factors such as persistent trade deficits, high inflation rates, and significant fiscal imbalances. External shocks, like a sudden drop in export demand or a sharp increase in global commodity prices, also pressure currency devaluation to maintain competitive export pricing. Moreover, political instability and loss of investor confidence can trigger capital flight, prompting authorities to devalue the currency to stabilize the economy.

Economic Impacts of Depreciation

Depreciation in currency valuation leads to higher export competitiveness by making goods cheaper for foreign buyers, which can stimulate economic growth and reduce trade deficits. However, it also increases the cost of imported goods and inflationary pressures, affecting consumer purchasing power and operational costs for businesses reliant on imports. Persistent depreciation may undermine investor confidence, potentially causing capital flight and higher borrowing costs for the economy.

Devaluation: Effects on Trade and Inflation

Devaluation lowers a country's currency value relative to foreign currencies, making exports cheaper and imports more expensive, which can improve the trade balance by boosting export volumes. However, this often leads to imported inflation as the increased cost of foreign goods and raw materials raises domestic prices. The resulting inflationary pressure can erode purchasing power and increase production costs, impacting overall economic stability.

Government Role in Depreciation vs Devaluation

Governments influence depreciation by setting monetary policies that affect inflation and interest rates, which indirectly cause the currency's value to decline over time. In contrast, devaluation is a deliberate government action to reduce the official exchange rate of its currency against foreign currencies, typically to boost exports or correct trade imbalances. Central banks and finance ministries play critical roles in managing these processes through regulatory measures and interventions in foreign exchange markets.

Exchange Rate Mechanisms Explained

Depreciation refers to a gradual decline in a currency's value due to market forces in a floating exchange rate system, affecting international trade competitiveness by making exports cheaper and imports more expensive. Devaluation occurs when a country's government or central bank deliberately lowers the official exchange rate of its currency under a fixed or pegged exchange rate regime to boost export activity and correct trade imbalances. Understanding the difference between depreciation and devaluation is crucial for policymakers managing exchange rate mechanisms and their impact on inflation, foreign investment, and economic growth.

Real-World Examples of Depreciation and Devaluation

Depreciation occurs gradually in floating exchange rate systems, as seen with the US dollar weakening against the euro from 2014 to 2017, reflecting market dynamics and economic fundamentals. Devaluation happens when a government intentionally lowers its fixed currency value, like China's 2015 decision to devalue the yuan to boost exports amid slowing growth. Both mechanisms affect trade balances, inflation, and foreign investment, but depreciation signals market-driven adjustments while devaluation represents policy intervention.

Policy Responses to Currency Value Changes

Depreciation refers to a gradual decrease in a currency's value due to market forces, prompting central banks to adjust interest rates or intervene in foreign exchange markets to stabilize the economy. Devaluation is a deliberate policy decision by a government to lower the currency's nominal value, often aimed at boosting exports by making them cheaper internationally. Policy responses to these currency value changes involve fiscal adjustments, monetary easing or tightening, and strategic international negotiations to mitigate inflation and maintain economic competitiveness.

Depreciation vs Devaluation Infographic

difterm.com

difterm.com