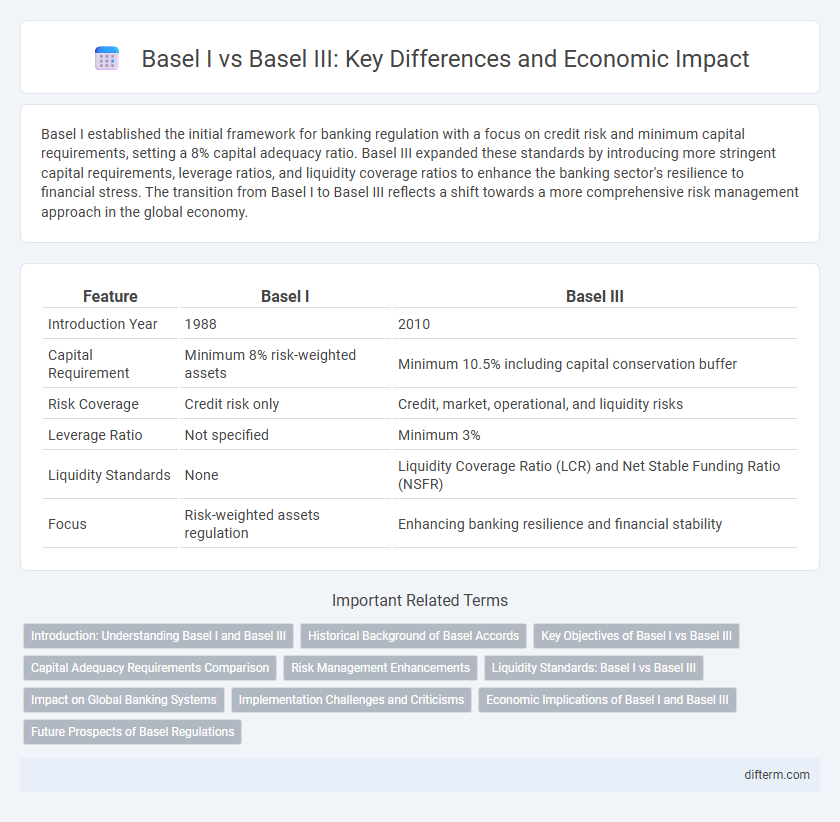

Basel I established the initial framework for banking regulation with a focus on credit risk and minimum capital requirements, setting a 8% capital adequacy ratio. Basel III expanded these standards by introducing more stringent capital requirements, leverage ratios, and liquidity coverage ratios to enhance the banking sector's resilience to financial stress. The transition from Basel I to Basel III reflects a shift towards a more comprehensive risk management approach in the global economy.

Table of Comparison

| Feature | Basel I | Basel III |

|---|---|---|

| Introduction Year | 1988 | 2010 |

| Capital Requirement | Minimum 8% risk-weighted assets | Minimum 10.5% including capital conservation buffer |

| Risk Coverage | Credit risk only | Credit, market, operational, and liquidity risks |

| Leverage Ratio | Not specified | Minimum 3% |

| Liquidity Standards | None | Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) |

| Focus | Risk-weighted assets regulation | Enhancing banking resilience and financial stability |

Introduction: Understanding Basel I and Basel III

Basel I, introduced in 1988 by the Basel Committee on Banking Supervision, established minimum capital requirements for banks to mitigate credit risk and promote financial stability globally. Basel III, developed in response to the 2008 financial crisis, enhances these regulations with stricter capital adequacy ratios, leverage ratios, and liquidity requirements to strengthen bank resilience. Both frameworks aim to safeguard the banking sector but differ significantly in scope and regulatory rigor.

Historical Background of Basel Accords

The Basel Accords emerged from the need to establish international banking regulatory standards, with Basel I introduced in 1988 focusing primarily on credit risk and setting minimum capital requirements. Basel III, developed in response to the 2008 financial crisis, expanded these regulations by incorporating liquidity, leverage ratios, and enhanced risk management practices to strengthen the banking sector's resilience. Both frameworks are pillars of the Basel Committee on Banking Supervision's efforts to promote financial stability and reduce systemic risk worldwide.

Key Objectives of Basel I vs Basel III

Basel I primarily focused on establishing minimum capital requirements to enhance bank stability and reduce credit risk by setting a fixed risk-weight framework. Basel III introduced more comprehensive regulations targeting capital adequacy, leverage ratios, and liquidity buffers to address systemic risks exposed by the 2008 financial crisis. Enhanced measures under Basel III aim to improve bank resilience, promote transparent risk management, and reduce the likelihood of future financial crises.

Capital Adequacy Requirements Comparison

Basel I established a minimum capital adequacy requirement of 8% risk-weighted assets, primarily focusing on credit risk with standardized risk weights. Basel III enhanced these requirements by introducing stricter capital standards, including higher quality capital (Common Equity Tier 1) and increased minimum capital ratios to improve bank resilience. Furthermore, Basel III incorporates additional buffers such as the capital conservation buffer and countercyclical buffer to better address systemic risks and financial stability.

Risk Management Enhancements

Basel III significantly enhances risk management frameworks by introducing stricter capital requirements and leverage ratios compared to Basel I, aimed at improving banks' resilience to financial stress. It also incorporates comprehensive liquidity standards such as the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), which were absent in Basel I, to ensure banks maintain adequate short- and long-term liquidity buffers. Enhanced risk assessment methodologies in Basel III address credit, market, and operational risks more effectively, promoting a stronger and more stable global banking system.

Liquidity Standards: Basel I vs Basel III

Basel I primarily focused on credit risk and capital adequacy without specific liquidity standards, lacking measures to address short-term funding risks. Basel III introduced comprehensive liquidity standards, including the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), to ensure banks maintain sufficient high-quality liquid assets and stable funding profiles. These enhancements in Basel III are designed to improve resilience against liquidity shocks and systemic financial stress compared to Basel I.

Impact on Global Banking Systems

Basel I established the first international minimum capital requirements, significantly improving risk management transparency in global banking systems. Basel III expanded these standards by introducing stricter capital adequacy ratios, leverage ratios, and liquidity requirements, enhancing banks' resilience to financial shocks worldwide. This evolution has led to stronger balance sheets and reduced systemic risks across international financial markets.

Implementation Challenges and Criticisms

Basel I faced criticism for its simplistic risk-weighting system that inadequately captured credit risk, leading to implementation challenges in diverse banking environments. Basel III introduced more complex liquidity and capital requirements, which, while enhancing financial stability, posed significant compliance costs and operational difficulties for banks worldwide. Regulatory arbitrage and inconsistent adoption across jurisdictions further complicated the effective implementation of Basel III standards.

Economic Implications of Basel I and Basel III

Basel I established minimum capital requirements primarily targeting credit risk, which led to limited risk sensitivity and encouraged banks to hold standardized capital buffers, affecting lending practices and economic stability. Basel III introduced more stringent capital and liquidity standards, including countercyclical buffers and leverage ratios, enhancing banks' resilience to financial shocks and promoting long-term economic growth. The transition from Basel I to Basel III shifted economic implications by emphasizing risk management, reducing systemic risk, and improving overall financial sector robustness.

Future Prospects of Basel Regulations

Basel III introduces enhanced capital requirements and liquidity standards that significantly improve banking sector resilience compared to Basel I. Future prospects of Basel regulations emphasize integrating advanced risk assessment tools and greater emphasis on systemic risk containment to address evolving economic challenges. Continued regulatory evolution aims to strengthen global financial stability through dynamic and adaptive supervisory frameworks.

Basel I vs Basel III Infographic

difterm.com

difterm.com