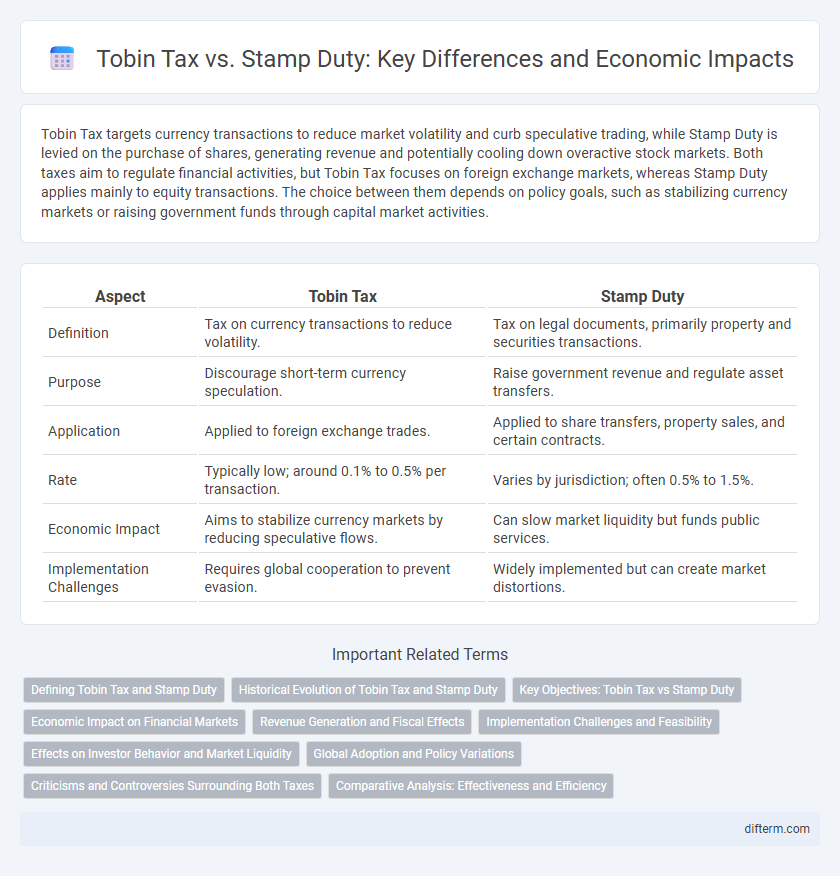

Tobin Tax targets currency transactions to reduce market volatility and curb speculative trading, while Stamp Duty is levied on the purchase of shares, generating revenue and potentially cooling down overactive stock markets. Both taxes aim to regulate financial activities, but Tobin Tax focuses on foreign exchange markets, whereas Stamp Duty applies mainly to equity transactions. The choice between them depends on policy goals, such as stabilizing currency markets or raising government funds through capital market activities.

Table of Comparison

| Aspect | Tobin Tax | Stamp Duty |

|---|---|---|

| Definition | Tax on currency transactions to reduce volatility. | Tax on legal documents, primarily property and securities transactions. |

| Purpose | Discourage short-term currency speculation. | Raise government revenue and regulate asset transfers. |

| Application | Applied to foreign exchange trades. | Applied to share transfers, property sales, and certain contracts. |

| Rate | Typically low; around 0.1% to 0.5% per transaction. | Varies by jurisdiction; often 0.5% to 1.5%. |

| Economic Impact | Aims to stabilize currency markets by reducing speculative flows. | Can slow market liquidity but funds public services. |

| Implementation Challenges | Requires global cooperation to prevent evasion. | Widely implemented but can create market distortions. |

Defining Tobin Tax and Stamp Duty

Tobin Tax is a financial transaction tax aimed at curbing short-term currency speculation by imposing a small levy on currency conversions, enhancing market stability. Stamp Duty is a tax charged on legal documents involving the transfer of assets, particularly on the purchase of shares and property, generating significant revenue for governments. Both taxes serve different regulatory functions: Tobin Tax targets cross-border currency flows, while Stamp Duty applies to asset ownership transfers.

Historical Evolution of Tobin Tax and Stamp Duty

The Tobin Tax, proposed by economist James Tobin in the 1970s, aimed to reduce currency speculation by imposing a small levy on foreign exchange transactions, sparking debates on financial market stability since its inception. In contrast, Stamp Duty dates back to the 17th century, originally introduced in England to tax legal documents and has since evolved into a government revenue tool on financial transactions, especially equity trading. Both taxes reflect different historical responses to economic challenges: Tobin Tax addressing global currency volatility and Stamp Duty serving as a longstanding fiscal instrument tied to asset transfers.

Key Objectives: Tobin Tax vs Stamp Duty

The Tobin Tax aims to reduce excessive currency speculation and stabilize foreign exchange markets by imposing a small levy on currency transactions, thereby discouraging short-term volatility. Stamp Duty primarily targets the transfer of ownership in financial assets like stocks, intending to generate government revenue and regulate trading activity without directly addressing market stability. Both taxes seek to influence financial market behavior, but the Tobin Tax emphasizes curbing speculative capital flows, while Stamp Duty focuses on transaction-based revenue and market regulation.

Economic Impact on Financial Markets

Tobin Tax targets currency transactions to reduce exchange rate volatility, potentially enhancing market stability but risking decreased liquidity in foreign exchange markets. Stamp Duty, applied mainly on stock transactions, can lead to lower trading volumes and increased transaction costs, which may reduce market efficiency and corporate financing options. Both taxes aim to curb speculative trading but have nuanced effects on liquidity, volatility, and overall market dynamics.

Revenue Generation and Fiscal Effects

The Tobin Tax targets international currency transactions and aims to reduce market volatility while generating revenue through small levies on currency trades, potentially stabilizing financial markets without significantly hindering liquidity. Stamp Duty applies primarily to the transfer of securities and real estate, producing substantial and predictable fiscal revenue for governments by taxing transactions directly tied to asset ownership changes. Both taxes influence economic behavior differently: the Tobin Tax may curb speculative trading, whereas Stamp Duty affects investment decisions, with each impacting government revenue streams and broader fiscal policies in unique ways.

Implementation Challenges and Feasibility

Implementing a Tobin Tax faces significant challenges due to the need for broad international coordination to prevent market distortions and capital flight, which complicates its feasibility. Stamp Duty, typically easier to implement as it targets specific transactions like stock trades within national borders, can still encounter issues related to market liquidity reduction and evasion strategies. Both taxes require robust administrative frameworks and clear regulatory guidelines to ensure compliance and minimize unintended economic impacts.

Effects on Investor Behavior and Market Liquidity

Tobin Tax, a levy on currency transactions, discourages short-term speculative trading by increasing transaction costs, leading to reduced market volatility but potentially lower liquidity. Stamp Duty, typically applied on stock transactions, can deter frequent stock trading, thereby decreasing market turnover and investor activity but providing steady government revenue. Both taxes influence investor behavior by discouraging rapid trades, yet Tobin Tax primarily targets foreign exchange markets, whereas Stamp Duty affects equity markets, impacting liquidity differently across these asset classes.

Global Adoption and Policy Variations

The Tobin Tax, proposed as a global financial transaction tax to curb currency speculation, has seen limited adoption mainly in European countries, while Stamp Duty remains widely implemented across various markets, particularly in the UK, Hong Kong, and India, targeting equity transactions. Policy variations reflect differences in scope, rate, and targeted financial instruments; Tobin Tax often aims at a broad range of foreign exchange transactions, whereas Stamp Duty commonly applies to stock purchases, with rates adjusted to balance revenue generation and market liquidity. Global adoption trends reveal a cautious approach to Tobin Tax due to concerns over market impact and enforcement complexity, whereas Stamp Duty's established framework benefits from clarity and administrative ease, influencing sovereign choices and regulatory designs.

Criticisms and Controversies Surrounding Both Taxes

The Tobin Tax faces criticism for potentially reducing market liquidity and harming short-term traders without significantly curbing speculative behavior, while Stamp Duty is often contested for its deterrent effect on property investment and market fluidity. Both taxes generate controversy over their actual effectiveness in raising government revenue versus causing unintended economic distortions. Critics argue that the Tobin Tax may drive transactions to untaxed markets, whereas Stamp Duty can inflate housing prices and limit market accessibility for first-time buyers.

Comparative Analysis: Effectiveness and Efficiency

Tobin Tax targets short-term currency speculation to stabilize foreign exchange markets, while Stamp Duty primarily taxes stock transactions, affecting equity liquidity and trading volume. Tobin Tax demonstrates higher effectiveness in curbing volatile capital flows, whereas Stamp Duty's efficiency varies across markets, often leading to reduced market efficiency and increased costs for investors. Comparative analysis reveals Tobin Tax's potential to enhance financial stability contrasts with Stamp Duty's trade-off between revenue generation and market distortions.

Tobin Tax vs Stamp Duty Infographic

difterm.com

difterm.com