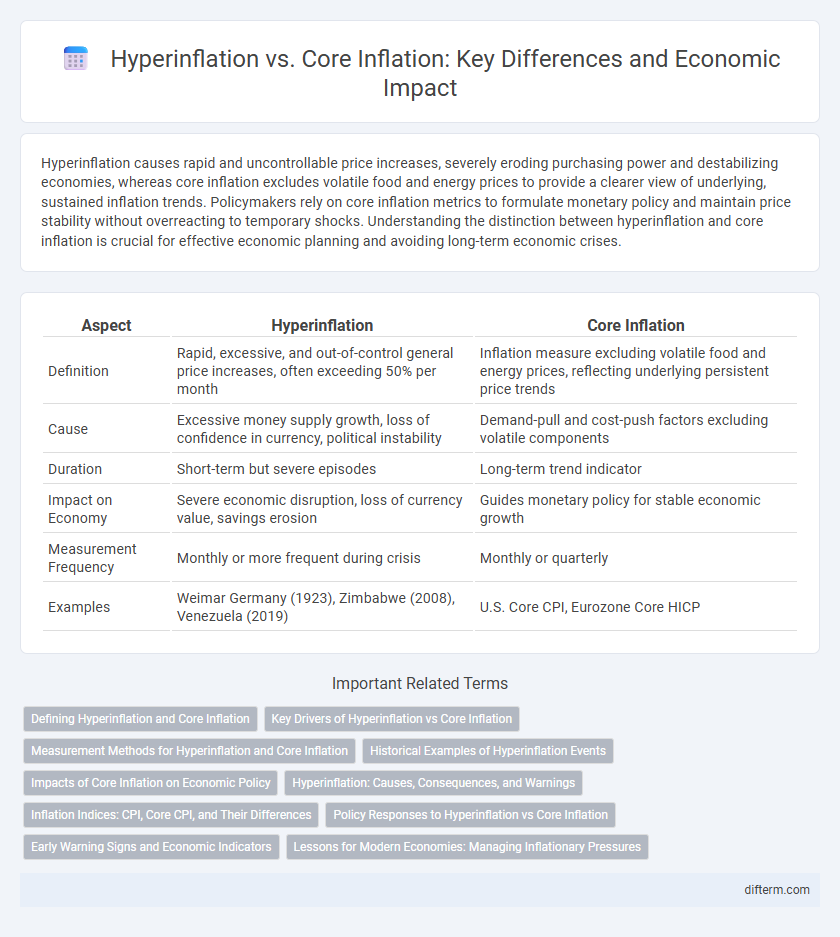

Hyperinflation causes rapid and uncontrollable price increases, severely eroding purchasing power and destabilizing economies, whereas core inflation excludes volatile food and energy prices to provide a clearer view of underlying, sustained inflation trends. Policymakers rely on core inflation metrics to formulate monetary policy and maintain price stability without overreacting to temporary shocks. Understanding the distinction between hyperinflation and core inflation is crucial for effective economic planning and avoiding long-term economic crises.

Table of Comparison

| Aspect | Hyperinflation | Core Inflation |

|---|---|---|

| Definition | Rapid, excessive, and out-of-control general price increases, often exceeding 50% per month | Inflation measure excluding volatile food and energy prices, reflecting underlying persistent price trends |

| Cause | Excessive money supply growth, loss of confidence in currency, political instability | Demand-pull and cost-push factors excluding volatile components |

| Duration | Short-term but severe episodes | Long-term trend indicator |

| Impact on Economy | Severe economic disruption, loss of currency value, savings erosion | Guides monetary policy for stable economic growth |

| Measurement Frequency | Monthly or more frequent during crisis | Monthly or quarterly |

| Examples | Weimar Germany (1923), Zimbabwe (2008), Venezuela (2019) | U.S. Core CPI, Eurozone Core HICP |

Defining Hyperinflation and Core Inflation

Hyperinflation is defined as an extremely rapid and out-of-control rise in prices, often exceeding 50% per month, causing a severe decline in a currency's purchasing power. Core inflation, on the other hand, measures the long-term trend in price levels by excluding volatile food and energy prices to provide a more stable indicator of underlying inflationary pressures. Understanding the distinction between hyperinflation and core inflation is crucial for policymakers to design effective monetary policies and stabilize the economy.

Key Drivers of Hyperinflation vs Core Inflation

Hyperinflation is primarily driven by excessive money supply growth, often due to massive government deficits financed by printing currency, leading to rapid loss of currency value. Core inflation, excluding volatile items like food and energy, is influenced mainly by underlying factors such as wage growth, production costs, and changes in demand and supply conditions. While hyperinflation reflects a monetary phenomenon with severe currency devaluation, core inflation captures persistent inflationary trends driven by real economic activity and structural factors.

Measurement Methods for Hyperinflation and Core Inflation

Measurement methods for hyperinflation involve tracking rapid and excessive price increases, often using monthly or even weekly Consumer Price Index (CPI) changes to capture extreme volatility. Core inflation measurement excludes volatile food and energy prices to provide a clearer view of underlying inflation trends, typically calculated through the CPI or Personal Consumption Expenditures (PCE) index adjusted for these components. Statistical techniques such as trimmed means or weighted median approaches enhance the accuracy of core inflation by mitigating the impact of outliers and temporary price shocks.

Historical Examples of Hyperinflation Events

Historical examples of hyperinflation events include the Weimar Republic in Germany during the early 1920s, Zimbabwe in the late 2000s, and Venezuela in the 2010s, where monthly inflation rates exceeded thousands to millions of percent. Hyperinflation drastically erodes the real value of currency, leading to severe economic instability and loss of consumer purchasing power, unlike core inflation which excludes volatile food and energy prices and typically remains within target ranges set by central banks. Understanding these episodes highlights the dangers of uncontrolled money supply growth and fiscal deficits in triggering hyperinflation, as opposed to the more stable and predictable trends observed in core inflation metrics.

Impacts of Core Inflation on Economic Policy

Core inflation, which excludes volatile food and energy prices, provides a clearer measure of underlying inflation trends, enabling policymakers to make more informed decisions regarding interest rates and monetary policy. Persistent core inflation signals sustained demand pressure, prompting central banks to adopt tighter monetary policies to prevent runaway inflation and maintain economic stability. Ignoring core inflation risks misinterpreting temporary price shocks, potentially leading to inappropriate policy responses that could destabilize economic growth.

Hyperinflation: Causes, Consequences, and Warnings

Hyperinflation occurs when a country experiences an extremely rapid and uncontrollable rise in prices, often exceeding 50% per month, primarily caused by excessive money printing, loss of confidence in the currency, and severe supply shocks. Its consequences include eroded purchasing power, collapsed savings, distored economic decision-making, and widespread social unrest, severely destabilizing the economy. Early warnings of hyperinflation involve skyrocketing inflation rates, collapsing fiscal discipline, currency devaluation, and runaway public debt, signaling urgent need for fiscal and monetary reforms.

Inflation Indices: CPI, Core CPI, and Their Differences

The Consumer Price Index (CPI) measures overall inflation by tracking changes in the prices of a broad basket of goods and services, while Core CPI excludes volatile food and energy prices to provide a clearer view of long-term inflation trends. Hyperinflation occurs when CPI rises uncontrollably, often exceeding 50% per month, eroding the real value of currency rapidly. Core inflation, represented by Core CPI, helps policymakers differentiate temporary shocks from persistent inflationary pressures, crucial for setting monetary policy during both stable and volatile economic periods.

Policy Responses to Hyperinflation vs Core Inflation

Policy responses to hyperinflation prioritize aggressive monetary tightening, currency stabilization measures, and fiscal discipline to restore trust and control runaway price increases. In contrast, managing core inflation often involves moderate interest rate adjustments and targeted supply-side reforms to address inflation drivers excluding volatile food and energy prices. Central banks deploy distinct strategies recognizing hyperinflation's systemic risk versus core inflation's gradual economic adjustments.

Early Warning Signs and Economic Indicators

Hyperinflation is signaled by rapid, exponential price increases and a collapse in currency value, often detected through skyrocketing money supply growth and steep rises in consumer prices. Core inflation measures sustained price changes excluding volatile food and energy sectors, serving as a stable indicator of underlying inflation trends. Early warning signs include surges in wage growth, commodity prices, and producer price indices, which collectively help policymakers differentiate between temporary inflation shocks and emerging hyperinflation risks.

Lessons for Modern Economies: Managing Inflationary Pressures

Hyperinflation, characterized by monthly inflation rates exceeding 50%, devastates economies by eroding purchasing power and destabilizing markets, while core inflation excludes volatile food and energy prices, offering a clearer picture of underlying inflation trends crucial for policy decisions. Modern economies must implement credible monetary policies, such as inflation targeting and central bank independence, to anchor inflation expectations and prevent hyperinflationary spirals. Effective inflation management relies on timely data analysis, fiscal discipline, and communication strategies that enhance transparency and maintain public confidence in economic stability.

Hyperinflation vs Core inflation Infographic

difterm.com

difterm.com