Crowding out occurs when increased government spending leads to higher interest rates, reducing private investment and slowing economic growth. Crowding in happens when government expenditure stimulates demand, encouraging businesses to invest and boosting the overall economy. Understanding the balance between these effects is crucial for designing fiscal policies that maximize economic expansion without hindering private sector activity.

Table of Comparison

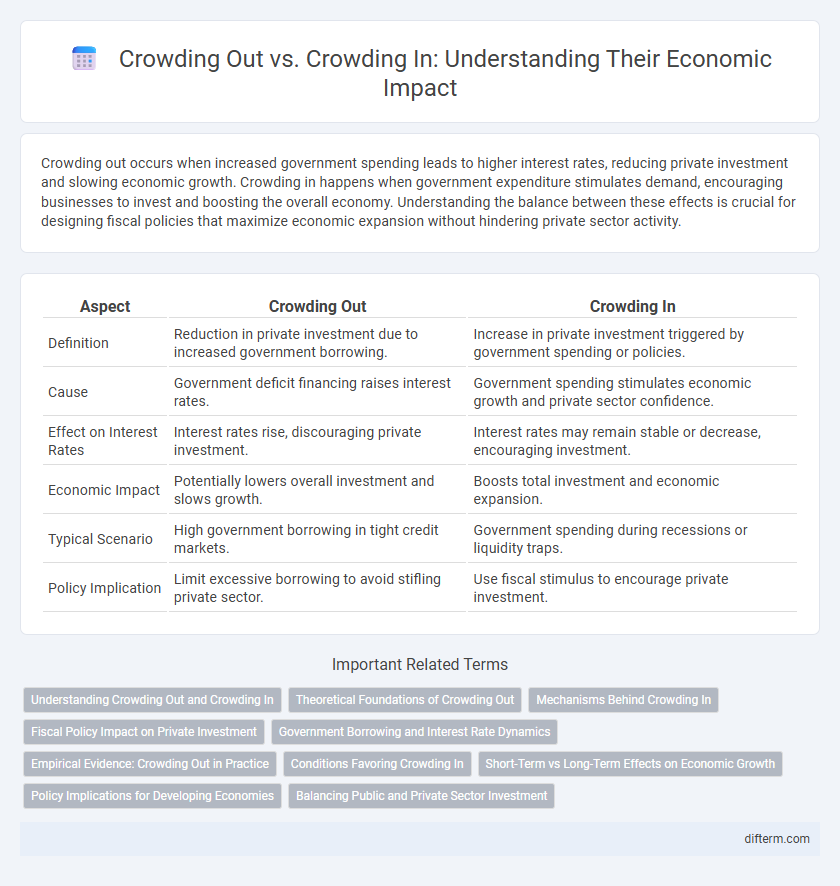

| Aspect | Crowding Out | Crowding In |

|---|---|---|

| Definition | Reduction in private investment due to increased government borrowing. | Increase in private investment triggered by government spending or policies. |

| Cause | Government deficit financing raises interest rates. | Government spending stimulates economic growth and private sector confidence. |

| Effect on Interest Rates | Interest rates rise, discouraging private investment. | Interest rates may remain stable or decrease, encouraging investment. |

| Economic Impact | Potentially lowers overall investment and slows growth. | Boosts total investment and economic expansion. |

| Typical Scenario | High government borrowing in tight credit markets. | Government spending during recessions or liquidity traps. |

| Policy Implication | Limit excessive borrowing to avoid stifling private sector. | Use fiscal stimulus to encourage private investment. |

Understanding Crowding Out and Crowding In

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment and slowing economic growth. Crowding in happens when government spending stimulates demand, encouraging businesses to invest and expand. Understanding these mechanisms is essential for policymakers to balance fiscal stimulus and sustainable economic development.

Theoretical Foundations of Crowding Out

The theoretical foundations of crowding out center on the government's increased borrowing, which raises interest rates and reduces private sector investment. Classical economic models highlight that higher public debt limits available capital, causing private businesses to scale back expenditures. Empirical studies emphasize that the magnitude of crowding out depends on factors such as economic slack, monetary policy responses, and the elasticity of private investment to interest rate fluctuations.

Mechanisms Behind Crowding In

Crowding in occurs when increased government spending stimulates private sector investment by improving infrastructure, raising aggregate demand, or reducing economic uncertainty, which boosts business confidence. Mechanisms behind crowding in include lowered interest rates through increased liquidity, enhanced productivity from public investments, and positive expectations about future economic growth. Empirical studies highlight how targeted fiscal policies, especially in underperforming economies, can trigger significant private sector expansion, counteracting the traditional crowding out effect.

Fiscal Policy Impact on Private Investment

Crowding out occurs when increased government spending raises interest rates, reducing private investment by making borrowing more expensive. Conversely, crowding in happens when fiscal policy boosts economic demand and business confidence, encouraging higher private sector investment. The net effect of fiscal policy on private investment depends on factors such as the state of the economy, interest rate sensitivity, and the presence of unused resources.

Government Borrowing and Interest Rate Dynamics

Government borrowing often leads to crowding out by raising interest rates, which reduces private investment as firms face higher capital costs. Conversely, when government spending stimulates economic growth, it can cause crowding in by increasing private sector confidence and investment despite higher borrowing levels. The dynamic interplay between interest rates and fiscal policy ultimately determines whether government borrowing suppresses or encourages private sector activity.

Empirical Evidence: Crowding Out in Practice

Empirical evidence demonstrates that crowding out occurs when increased government borrowing raises interest rates, reducing private investment. Studies in advanced economies reveal that substantial fiscal deficits often lead to higher bond yields, constraining business capital expenditures. However, the magnitude of crowding out varies depending on monetary policy accommodation and economic conditions.

Conditions Favoring Crowding In

Conditions favoring crowding in include low interest rates and economic slack, where government spending stimulates private investment by boosting demand and business confidence. When monetary policy supports fiscal expansion, increased government expenditure can lead to higher private sector activity instead of displacement. Empirical evidence shows crowding in is prevalent during recessions or periods of underutilized resources, enhancing overall economic growth.

Short-Term vs Long-Term Effects on Economic Growth

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment in the short term, thereby dampening economic growth. In contrast, crowding in happens when government spending stimulates demand, encouraging private sector investment and boosting growth especially in the long term. The balance between these effects depends on fiscal policy effectiveness, interest rate sensitivity, and the economy's productive capacity over time.

Policy Implications for Developing Economies

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment, whereas crowding in happens when public investment stimulates additional private sector activity. In developing economies, carefully designed fiscal policies that prioritize infrastructure and human capital investments can encourage crowding in by improving productivity and private sector confidence. Effective monetary coordination and targeted fiscal stimulus are essential to balance these effects and foster sustainable economic growth.

Balancing Public and Private Sector Investment

Balancing public and private sector investment requires managing the effects of crowding out and crowding in, where increased government spending can either displace or stimulate private investment. Government projects targeting infrastructure and innovation often generate positive externalities that encourage private firms to invest alongside public funds. Strategic fiscal policies and efficient allocation of resources are essential to harness crowding in while minimizing the risk of crowding out private capital.

Crowding out vs Crowding in Infographic

difterm.com

difterm.com