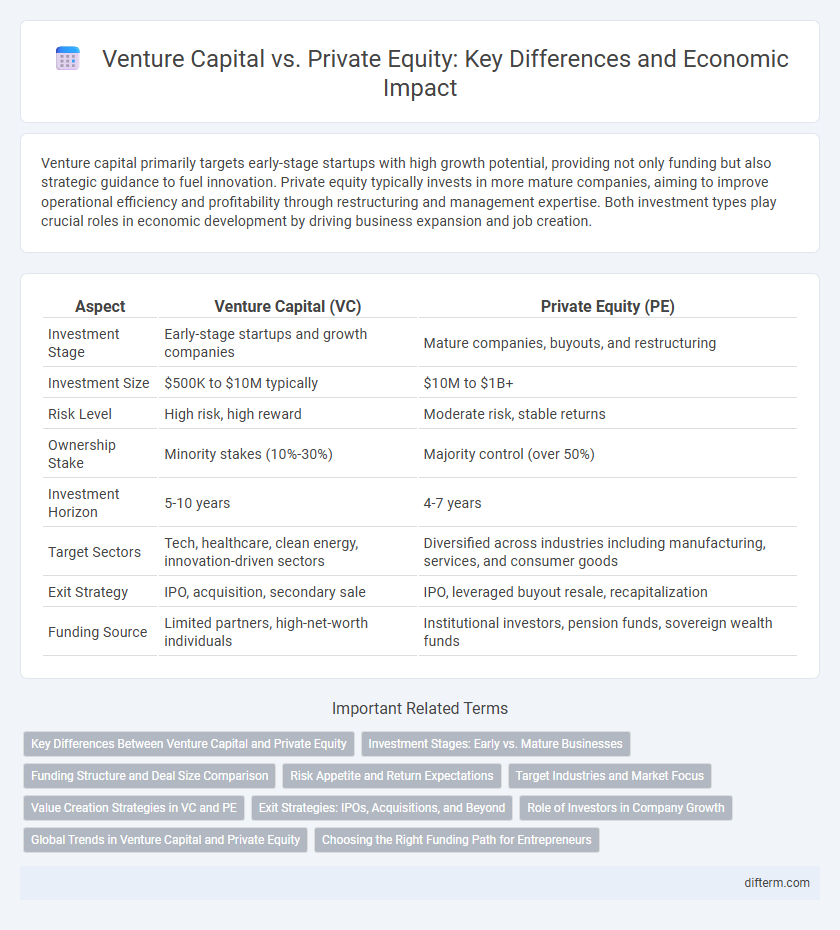

Venture capital primarily targets early-stage startups with high growth potential, providing not only funding but also strategic guidance to fuel innovation. Private equity typically invests in more mature companies, aiming to improve operational efficiency and profitability through restructuring and management expertise. Both investment types play crucial roles in economic development by driving business expansion and job creation.

Table of Comparison

| Aspect | Venture Capital (VC) | Private Equity (PE) |

|---|---|---|

| Investment Stage | Early-stage startups and growth companies | Mature companies, buyouts, and restructuring |

| Investment Size | $500K to $10M typically | $10M to $1B+ |

| Risk Level | High risk, high reward | Moderate risk, stable returns |

| Ownership Stake | Minority stakes (10%-30%) | Majority control (over 50%) |

| Investment Horizon | 5-10 years | 4-7 years |

| Target Sectors | Tech, healthcare, clean energy, innovation-driven sectors | Diversified across industries including manufacturing, services, and consumer goods |

| Exit Strategy | IPO, acquisition, secondary sale | IPO, leveraged buyout resale, recapitalization |

| Funding Source | Limited partners, high-net-worth individuals | Institutional investors, pension funds, sovereign wealth funds |

Key Differences Between Venture Capital and Private Equity

Venture capital primarily invests in early-stage startups with high growth potential, while private equity focuses on acquiring established companies to improve operations and profitability. Venture capital investments involve higher risk and smaller ownership stakes, whereas private equity deals generally consist of larger stakes in mature businesses with stable cash flows. The time horizon for venture capital is typically longer due to the developmental phase of startups, contrasting with private equity's strategy of quicker value creation and exit.

Investment Stages: Early vs. Mature Businesses

Venture capital primarily targets early-stage businesses with high growth potential, providing essential funding during initial development phases. Private equity focuses on mature companies, investing in established firms to optimize operations and drive expansion or consolidation. Investment in venture capital often involves higher risks and rewards compared to the more stable, but substantial capital infusions typical of private equity deals.

Funding Structure and Deal Size Comparison

Venture capital predominantly targets early-stage startups with smaller funding rounds typically ranging from $1 million to $10 million, emphasizing equity stakes to support rapid growth and innovation. Private equity deals involve significantly larger sums, often exceeding $100 million, focusing on established companies through leveraged buyouts and majority ownership for operational restructuring and value enhancement. Funding structures in venture capital prioritize multiple funding rounds with dilution, while private equity relies heavily on debt financing combined with equity to optimize capital efficiency and returns.

Risk Appetite and Return Expectations

Venture capital investments typically exhibit a higher risk appetite due to their focus on early-stage startups with unpredictable growth trajectories, but they also offer the potential for substantial returns through equity stakes in rapidly scaling companies. Private equity firms generally pursue lower-risk profiles by acquiring more mature companies with stable cash flows, aiming for steady, moderate returns achieved through operational improvements and strategic management. The contrasting risk tolerances reflect divergent return expectations, where venture capital targets exponential gains while private equity prioritizes consistent value creation.

Target Industries and Market Focus

Venture capital primarily targets early-stage technology startups in high-growth sectors such as software, biotechnology, and fintech, emphasizing innovation and rapid scalability. Private equity focuses on mature companies across diverse industries including manufacturing, healthcare, and consumer goods, aiming for operational improvements and long-term value creation. Market focus for venture capital centers on emerging markets with high growth potential, whereas private equity often invests in established markets with stable cash flows.

Value Creation Strategies in VC and PE

Venture capital drives value creation by targeting early-stage startups with high growth potential, accelerating innovation through strategic guidance, network access, and scaling support. Private equity enhances value by acquiring mature companies, optimizing operations, improving financial structures, and implementing robust management practices to maximize profitability and exit valuations. Both approaches leverage distinct value creation levers tailored to their investment horizons and portfolio maturity.

Exit Strategies: IPOs, Acquisitions, and Beyond

Venture capital exit strategies primarily involve initial public offerings (IPOs) and acquisitions by larger corporations, enabling early investors to realize returns from high-growth startups. Private equity firms often pursue diversified exit approaches including secondary buyouts, recapitalizations, and strategic sales to optimize returns from mature portfolio companies. Both investment types emphasize timing and market conditions to maximize value upon exit, reflecting distinct risk profiles and liquidity preferences in the capital markets.

Role of Investors in Company Growth

Venture capital investors provide early-stage funding and strategic guidance to startups, fueling innovation and accelerating market entry. Private equity investors focus on mature companies, leveraging financial restructuring and operational improvements to enhance value and profitability. Both investor types drive company growth by aligning capital infusion with tailored management expertise and long-term strategic goals.

Global Trends in Venture Capital and Private Equity

Global trends in venture capital highlight a surge in investments targeting early-stage startups within technology, healthcare, and fintech sectors, driven by increased digital transformation and innovation demands. Private equity continues to focus on mature companies, leveraging buyouts and growth capital strategies to optimize operational efficiencies and expand market presence across emerging markets like Southeast Asia and Latin America. Both asset classes are adapting to evolving economic conditions by incorporating ESG criteria, digital due diligence, and cross-border deal-making to maximize returns and mitigate risks.

Choosing the Right Funding Path for Entrepreneurs

Venture capital targets early-stage startups with high growth potential by providing equity financing and strategic guidance, while private equity focuses on established companies needing restructuring or expansion through significant capital investment. Entrepreneurs should assess their company's development stage, funding needs, and control preferences to determine the optimal funding source. Selecting the right path enhances scalability, minimizes dilution, and aligns investor expertise with business goals.

Venture Capital vs Private Equity Infographic

difterm.com

difterm.com