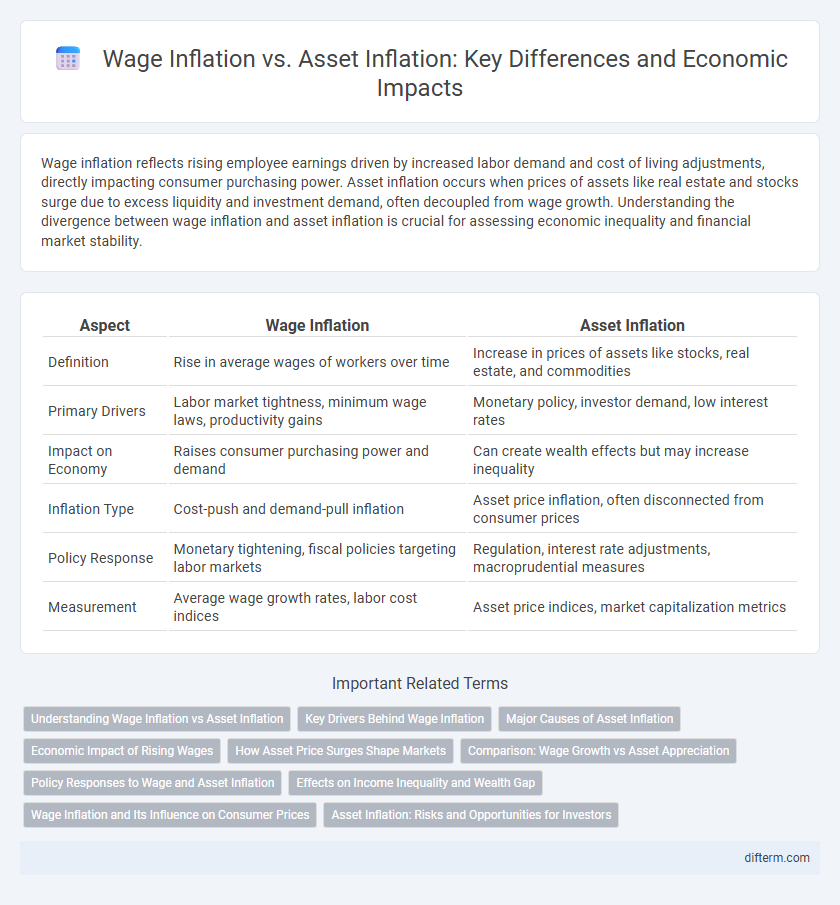

Wage inflation reflects rising employee earnings driven by increased labor demand and cost of living adjustments, directly impacting consumer purchasing power. Asset inflation occurs when prices of assets like real estate and stocks surge due to excess liquidity and investment demand, often decoupled from wage growth. Understanding the divergence between wage inflation and asset inflation is crucial for assessing economic inequality and financial market stability.

Table of Comparison

| Aspect | Wage Inflation | Asset Inflation |

|---|---|---|

| Definition | Rise in average wages of workers over time | Increase in prices of assets like stocks, real estate, and commodities |

| Primary Drivers | Labor market tightness, minimum wage laws, productivity gains | Monetary policy, investor demand, low interest rates |

| Impact on Economy | Raises consumer purchasing power and demand | Can create wealth effects but may increase inequality |

| Inflation Type | Cost-push and demand-pull inflation | Asset price inflation, often disconnected from consumer prices |

| Policy Response | Monetary tightening, fiscal policies targeting labor markets | Regulation, interest rate adjustments, macroprudential measures |

| Measurement | Average wage growth rates, labor cost indices | Asset price indices, market capitalization metrics |

Understanding Wage Inflation vs Asset Inflation

Wage inflation refers to the rise in average wages paid to employees over time, driven by labor market demand and productivity changes. Asset inflation occurs when prices of assets like real estate, stocks, and commodities increase due to factors such as monetary policy, investor demand, and liquidity conditions. Understanding the interplay between wage inflation and asset inflation is crucial for analyzing economic stability, purchasing power, and wealth distribution.

Key Drivers Behind Wage Inflation

Key drivers behind wage inflation include tight labor markets, where low unemployment rates increase employer competition for workers, pushing wages higher. Productivity gains or labor shortages in specific sectors, such as technology and healthcare, also contribute to rising wage demands. Inflation expectations and collective bargaining agreements further intensify wage pressures, impacting overall economic stability.

Major Causes of Asset Inflation

Asset inflation is primarily driven by excessive liquidity in financial markets, fueled by prolonged low-interest rates and expansive monetary policies implemented by central banks. Increased demand for real estate, stocks, and commodities due to speculative behavior and limited supply also significantly contributes to rising asset prices. Furthermore, global capital flows seeking higher returns in stable economies intensify asset inflation, creating disparities between wage growth and asset price increases.

Economic Impact of Rising Wages

Rising wages drive increased consumer spending, boosting demand for goods and services and potentially sparking broad economic growth. However, excessive wage inflation without corresponding productivity gains can raise production costs, leading to higher prices and contributing to overall inflationary pressures. In contrast to asset inflation, which predominantly inflates asset prices like real estate and stocks, wage inflation directly affects household incomes and purchasing power, influencing consumption patterns more immediately.

How Asset Price Surges Shape Markets

Surging asset prices significantly influence market dynamics by increasing wealth for asset holders, leading to higher consumer spending and investment. This asset inflation often outpaces wage inflation, causing disparities in wealth distribution and altering consumption patterns. Consequently, markets reflect a skewed economic growth driven primarily by capital gains rather than wage-driven purchasing power.

Comparison: Wage Growth vs Asset Appreciation

Wage growth typically reflects increases in labor compensation due to productivity gains and labor market conditions, often lagging behind the pace of asset appreciation driven by monetary policy and investor demand. Asset inflation, characterized by rising prices in real estate, stocks, and commodities, tends to outpace wage inflation, leading to wealth disparities and reduced purchasing power for workers. Measuring the divergence between wage growth and asset appreciation is crucial for understanding economic inequality and informing monetary and fiscal policy decisions.

Policy Responses to Wage and Asset Inflation

Policy responses to wage inflation often include tightening monetary policy through interest rate hikes to curb excessive wage growth and control labor costs. In contrast, addressing asset inflation typically involves regulatory measures such as tightening credit standards and increasing capital requirements for banks to reduce speculative investment in real estate and financial markets. Coordinated fiscal policies targeting income distribution and housing supply also play a critical role in balancing wage growth and containing asset price bubbles.

Effects on Income Inequality and Wealth Gap

Wage inflation primarily benefits low- and middle-income workers by increasing earnings and reducing income inequality, while asset inflation disproportionately advantages wealthy individuals who hold significant investments, thereby expanding the wealth gap. Rising asset prices in markets like real estate and stocks amplify wealth concentration at the top, intensifying economic disparities. This divergence between wage and asset inflation contributes to persistent inequality by limiting upward mobility for those reliant on labor income alone.

Wage Inflation and Its Influence on Consumer Prices

Wage inflation directly increases consumer purchasing power, leading to higher demand for goods and services, which often drives up consumer prices. Rising wages can prompt businesses to raise prices to maintain profit margins, contributing to overall inflationary pressure in the economy. Persistent wage inflation tends to create a feedback loop, where increased consumer prices further push wages higher as workers seek to maintain real income levels.

Asset Inflation: Risks and Opportunities for Investors

Asset inflation, marked by rising prices in equities, real estate, and commodities, poses risks such as increased market volatility and potential bubbles that can lead to significant financial losses for investors. However, it also offers opportunities for portfolio diversification and capital appreciation, especially in sectors benefiting from strong demand and limited supply. Strategic asset allocation and continuous market analysis are crucial for investors to navigate asset inflation effectively and optimize returns.

Wage inflation vs asset inflation Infographic

difterm.com

difterm.com