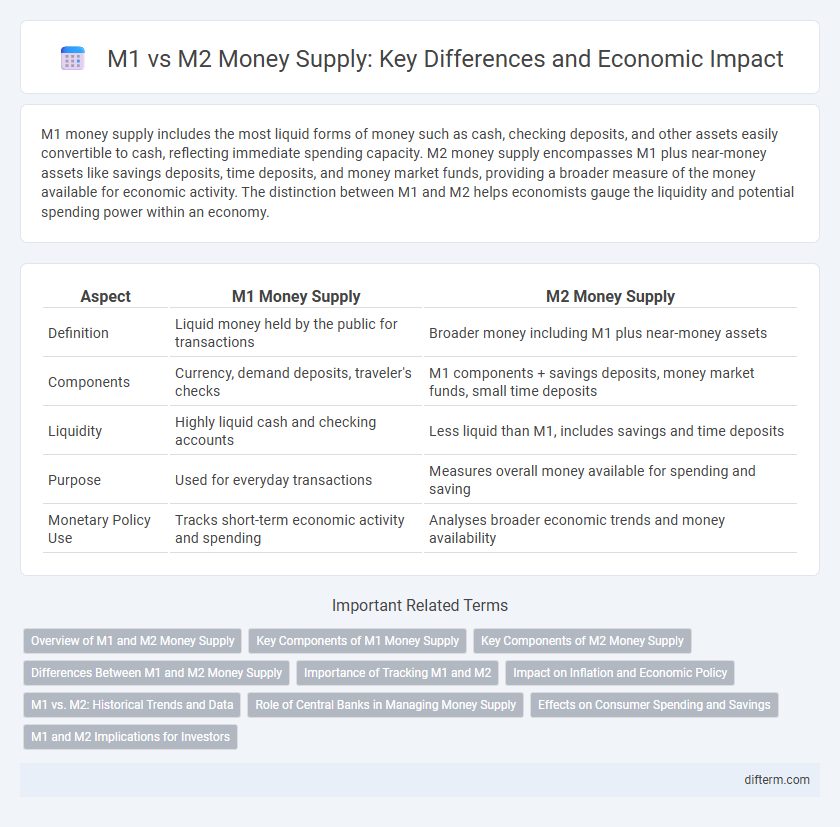

M1 money supply includes the most liquid forms of money such as cash, checking deposits, and other assets easily convertible to cash, reflecting immediate spending capacity. M2 money supply encompasses M1 plus near-money assets like savings deposits, time deposits, and money market funds, providing a broader measure of the money available for economic activity. The distinction between M1 and M2 helps economists gauge the liquidity and potential spending power within an economy.

Table of Comparison

| Aspect | M1 Money Supply | M2 Money Supply |

|---|---|---|

| Definition | Liquid money held by the public for transactions | Broader money including M1 plus near-money assets |

| Components | Currency, demand deposits, traveler's checks | M1 components + savings deposits, money market funds, small time deposits |

| Liquidity | Highly liquid cash and checking accounts | Less liquid than M1, includes savings and time deposits |

| Purpose | Used for everyday transactions | Measures overall money available for spending and saving |

| Monetary Policy Use | Tracks short-term economic activity and spending | Analyses broader economic trends and money availability |

Overview of M1 and M2 Money Supply

M1 money supply includes the most liquid forms of money, such as physical currency, demand deposits, and other checkable deposits, which are readily available for spending. M2 money supply encompasses all components of M1 along with near-money assets like savings accounts, money market mutual funds, and time deposits under $100,000, reflecting a broader measure of money in the economy. Monitoring the difference between M1 and M2 helps economists assess liquidity levels and the potential for consumer spending and investment growth.

Key Components of M1 Money Supply

M1 money supply primarily includes the most liquid forms of money such as physical currency, demand deposits, and other checkable deposits held by the public. These components facilitate immediate spending and are critical indicators of the economy's transactional capacity. Unlike M2, which encompasses savings accounts and time deposits, M1 reflects the money readily available for everyday transactions.

Key Components of M2 Money Supply

M2 money supply includes all components of M1, such as physical currency and checking deposits, plus savings accounts, time deposits under $100,000, and non-institutional money market funds, making it a broader measure of money in the economy. Key components like savings deposits and small-denomination time deposits reflect liquidity that is not immediately accessible but can influence consumer spending and investment. Tracking M2 provides critical insights into overall money availability and potential inflationary pressures.

Differences Between M1 and M2 Money Supply

M1 money supply includes the most liquid forms of money such as physical currency, demand deposits, and other checkable deposits, facilitating immediate spending power. M2 encompasses all M1 components plus near-money assets like savings deposits, money market mutual funds, and small time deposits, reflecting a broader measure of money readily accessible for spending or investment. The main difference lies in liquidity, with M1 representing cash and assets directly usable for transactions, while M2 includes slightly less liquid assets that can be converted into cash relatively quickly.

Importance of Tracking M1 and M2

Tracking M1 money supply, which includes cash and checking deposits, provides critical insights into the immediate liquidity available for consumer spending and short-term economic activity. M2 money supply expands this view by encompassing savings deposits, money market funds, and other near-money assets, reflecting broader financial stability and future spending potential. Monitoring both M1 and M2 enables policymakers and economists to assess inflationary pressures, guide monetary policy decisions, and gauge overall economic health accurately.

Impact on Inflation and Economic Policy

M1 money supply, comprising physical currency and demand deposits, directly influences short-term liquidity and can rapidly affect inflation when expanded quickly. M2 money supply includes M1 plus savings accounts and time deposits, representing broader money available for spending and investment, thereby having a more sustained impact on inflation trends and economic growth. Central banks adjust M1 and M2 to fine-tune monetary policy, balancing inflation control with stimulating economic activity.

M1 vs. M2: Historical Trends and Data

M1 money supply primarily includes physical currency and demand deposits, while M2 encompasses M1 plus savings deposits, money market funds, and other near-money assets. Historically, M2 grows at a faster rate than M1, reflecting increased savings and investment activity beyond immediate cash transactions. Data from the Federal Reserve shows that during economic expansions, M2 often expands significantly as consumers and businesses seek higher-yielding assets, contrasting with M1's relatively stable cash holdings.

Role of Central Banks in Managing Money Supply

Central banks play a crucial role in managing M1 and M2 money supply to influence economic stability and growth. M1, consisting of currency and demand deposits, represents the most liquid forms of money, while M2 includes M1 plus savings accounts and small time deposits, reflecting broader money availability. Central banks adjust interest rates, conduct open market operations, and set reserve requirements to control both M1 and M2, aiming to regulate inflation, support employment, and guide overall economic policy.

Effects on Consumer Spending and Savings

M1 money supply, consisting mainly of cash and checking deposits, directly influences consumer spending by providing immediate liquidity for daily transactions. M2 money supply, which includes M1 plus savings deposits and money market funds, reflects broader savings capacity that can affect long-term consumer behavior and investment decisions. Changes in M1 typically lead to quicker shifts in spending patterns, while variations in M2 indicate shifts in overall savings and financial stability impacting economic growth.

M1 and M2 Implications for Investors

M1 money supply, consisting of cash, checking deposits, and other liquid assets, directly reflects immediate spending power and liquidity in the economy, making it crucial for investors assessing short-term market movements. M2 money supply includes M1 plus savings deposits, money market securities, and other near-money assets, providing a broader perspective on overall money availability and potential inflationary pressures. Investors monitor changes in M1 and M2 to gauge economic momentum and adjust portfolios for liquidity risk, interest rate fluctuations, and inflation expectations.

M1 money supply vs M2 money supply Infographic

difterm.com

difterm.com